Upcoming bank loan loss provisions won’t be ‘fireworks’, but will have a long-lasting impact

Analysts are expecting one of the most dramatic quarters in years. Bryden Teich, partner and portfolio manager at Avenue Investment Management, warns that the pandemic’s effects on banks’ loan loss provisions won’t come as a one-off hit to the financial sector, but will be much longer-lasting.

He told Yahoo Finance Canada he thinks many “are expecting a lot of fireworks with this quarter, because it’s the first quarter into the recession. I think this is going to have a really long tail.”

That long tail, Teich said, comes in part from the subsidies being rolled by the banks, mortgage deferrals being one of the most significant.

“You might not actually get the worst of it until three or six months in the future because people will try to hang on for as long as they can, and then a lot of it certainly comes down to how quickly the economy can come back together and get people back to work.”

According to Teich, accounting rules have also changed under IFRS 9’s expected loss impairment model, so that banks are required to report loan provision and credit losses more quickly now compared to a few years ago. “They used to be able to go 90 days or 120 days before they started posting for losses. Those credit numbers have to be reported much more quicker, so banks have to say much quicker whether or not they’re expecting delinquencies.”

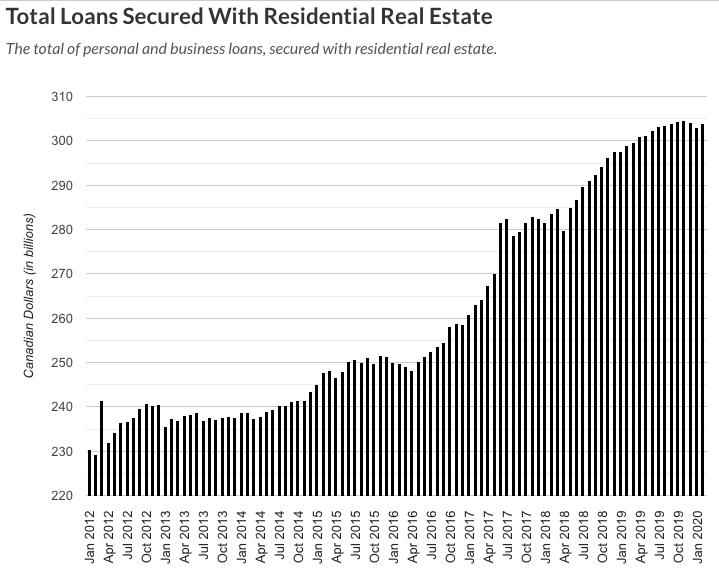

The magnitude of the loan losses will also likely come from years of Canadians relying on debt, fuelled by a run-up in real estate values, allowing people to borrow against the value of their home.

Loan amounts secured by residential real estate have soared since the early 2010’s, hitting a peak of $304.6 billion before levelling off heading into the pandemic. Teich said consumption fuelled by borrowing from home equity substituted for any real economic growth, describing years of stagnating GDP per capita and productivity.

“They feel wealthier, they take a home equity line of credit, they take the HELOC and they buy furniture or they go on trips or they go out for dinner,“ said Teich. “So with the rise in equity home prices, people will take from their home equity and start using that money to consume in other parts of the economy.”

The perceived wealth created by surging house prices is being challenged by the pandemic’s impact on the economy, like mass job losses bringing the unemployment rate up to 13 per cent, the second-highest on record. This left many Canadian households struggling to pay their mortgages, needing to rely on the banks’ mortgage deferrals during this downturn. When Evan Siddall, the CEO of the Canadian Mortgage Housing Corporation (CMHC) spoke to parliament last week, he said that the CMHC was presently estimating that 12 per cent of mortgage holders elected to defer their payments. The organization expects that by September, this figure will climb to 20 per cent.

Arrears rates are also a concern for these agencies: the CMHC expects that one-fifth of all mortgages could be in arrears if the economy does not recover sufficiently. In mid-May, the Bank of Canada published data showing that even with policy measures in place, the bank expects that mortgage arrears will triple from 0.27 per cent in Q3 2020 to as much as 0.79 per cent in in Q3 2021.

In 2009, these arrears rose as high as 0.45 per cent. All of these combined factors will create what Teich calls a ‘negative wealth’ effect and lead to lower consumption, with banks overexposed to residential mortgage lending (taking up a large segment of total loan amounts on all bank balance sheets, ranging from 28 per cent to 61 per cent in Q1 2020).

Along with mortgage lending, business loans also provide a risk to banks that hold most of their loans in either sector.

“It’s definitely a double-whammy, Teich said. “You’ll have the residential lending hurt really bad, but you’ll also have the commercial lending hurt really bad.”

A spike in delinquencies and defaults in both of these areas could hit their loan loss provisions more than the last recession. “I think the longer term tail effect would be magnitudes worse than ‘08/’09,” he added.

Teich expects to see some banks perform better than others during the next few quarters. The two banks that Teich holds at Avenue Investment Management are TD and RBC.

“Traditionally, they’ve both been really good on the lending side, they’ve been really good lenders, they have diversified businesses,” Teich said. “We’ve continued to like those banks because we like how they’ve done over the last few credit cycles.”

One bank that Teich sees as a risk in the current environment is CIBC. “CIBC’s kind of always had a reputation for not doing the best, high-quality lending and I think that’s been the nature of some of their past cycles.”

Despite the risks in the market, Teich doesn’t expect any dividend cuts.

“I think all of the banks will do absolutely anything possible to not have to cut [dividends], because they realize how negative it will be toward sentiment.”

Much of the impact of loan provisions will depend on the economic recovery. Teich said what sets this financial downturn apart is how all-encompassing it is. “It’s so broad-based. All of the banks are going to have a significantly hard time. I don’t think any of the banks are going to skate by or be spared in this.”

Yahoo Movies

Yahoo Movies