How the TikTok Generation fell in love with cash

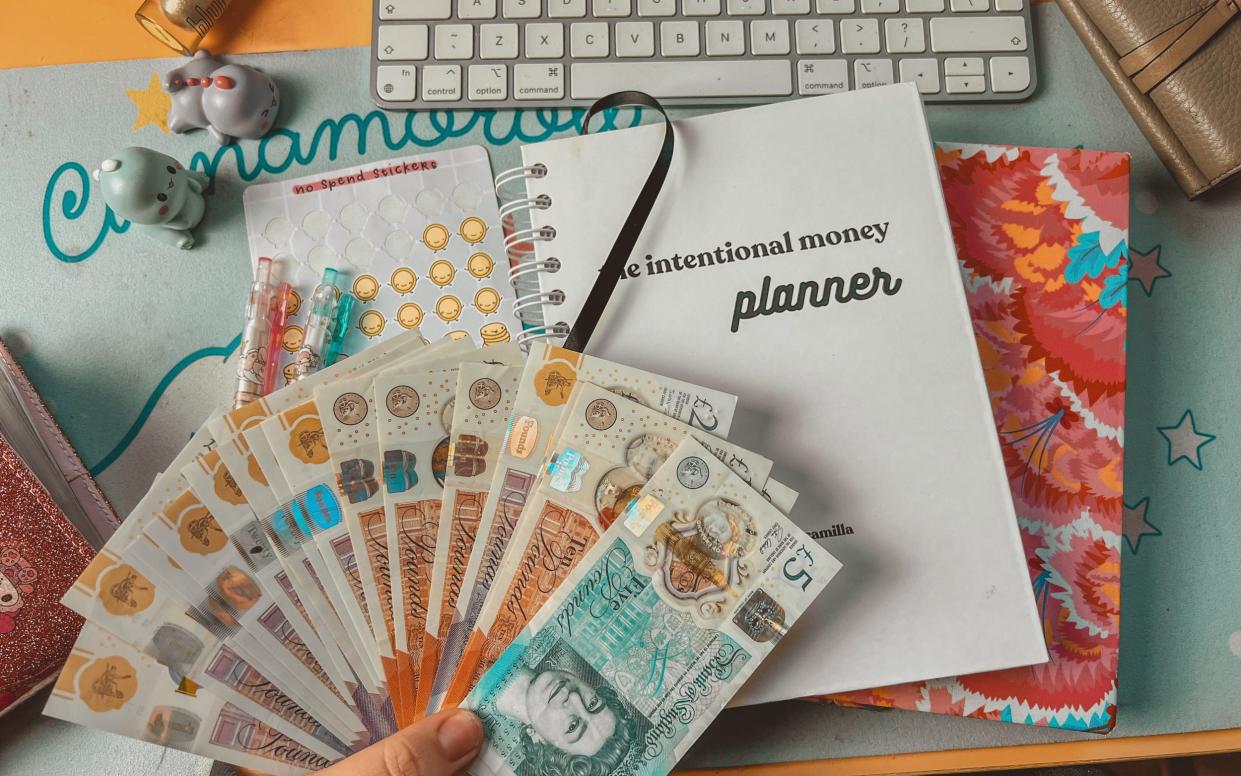

Every week, 37-year-old Yasmine Camilla sits down with a wad of cash.

She empties her bank account of her earnings, except the amount for direct debits and transport, and sorts her money into different envelopes labelled ‘groceries’ or ‘travel’ inside attractive pastel binders. She films the process for her followers on TikTok, and uploads it with the hashtag ‘cash stuffing’ – which has more than 800 million views.

The ‘cash stuffing’ budgeting method has given the age-old system of coins and notes an upgrade for the social media generation. Rather than keeping all of their funds in the bank, cash-stuffing converts say having their earnings in physical money has transformed their attitude to saving.

Camilla began budgeting with cash 18 months ago, when she was in £38,000 worth of credit card debt. She says: “Using cards, and having cards in my Apple Pay and all that kind of thing, just made it really easy for me to spend. So I switched to using cash as much as I could, which is when I then found the cash stuffing method.”

The London-based content creator is now debt-free, and has begun being able to save for longer term goals.

Her videos documenting her method regularly attract over ten thousand views, with an audience typically aged between 25 and 35. Part of the appeal for the Millennial viewer, according to Camilla, is what she calls the “gamification” aspect of this method of saving.

“A lot of people in this country are very used to shopping as a hobby and actually putting money into the envelopes can become really addictive and fun. It's almost like a gamification of saving.”

Camilla believes that a passion for cash stuffing is growing at both ends of the income spectrum. “I'd say [the demographic] is really, really mixed because I hear that people who have less money are finding it helps them manage what they do have, and people who have more are realising how much they were wasting.”

The mother of a 17-year-old viewer told the content creator that her videos had inspired her daughter to save more then £1,000 from her part-time job, rather than spending the money on “trainers, fried chicken and going out with her mates”.

Dee Kaskonaite, 24, describes cash stuffing as “quite life-changing”. She says: “I was basically living paycheque to paycheque every single month, and cash stuffing has really helped me to budget my finances in a physical way, because when I have it out in front of me, I'm someone that tends to not spend as much.”

Kaskonaite, who started budgeting with cash last July, now owns a small business making and selling binders and other cash stuffing paraphernalia to those inspired to start the trend. She says that part of its success comes from its aesthetic appeal.

“I do think the aesthetics of it does help because it is a really therapeutic process to sit down and actually put the money away into each different envelope, and it is fun.”

Sarah Coles, a personal finance analyst at investment service Hargreaves Lansdown, says: “It can be a useful way to keep an eye on your spending, particularly those areas where you have a tendency to splurge.

“By splitting up your cash into envelopes marked with types of spending, and only putting in the cash you’ve actively chosen to spend in one specific area, it forces you to make spending decisions in advance. It also helps you see exactly where you stand, so you can change your plans if need be. And if you only ever carry this cash, once it’s gone, you have to stop spending.”

However, she warns: “This isn’t practical for the big payments you tend to make digitally – like bills and the rent or mortgage. Even for smaller amounts, if you leave your cards at home you could run into difficulties with payments, and if you carry those cards, you can be tempted to keep spending. There are security risks too – both when you’re carrying cash around, and when it’s sitting at home in envelopes.”

Although Kaskonaite says she has had little issue using cash in her local area, Camilla says that she keeps £100 on her card “as a buffer”, in case she goes out with friends to a venue which won’t accept notes.

For longer-term savings goals - where envelopes can fill up with hundreds of pounds’ worth of cash - she uses placeholder cards, and returns the funds to a “hidden-away pot” in her bank, for reasons of security.

For cash stuffers, physical money is the antidote to the "one-click" culture of consumerism, enabled by modern ways to pay. An ardent believer in the future of cash, Camilla has begun to teach her two children under ten how to pay with coins and notes, and its importance.

“As a parent I want to try and put as many barriers between their future money and buying stuff as I possibly can. I think that learning the value of cash by using cash is one of the biggest factors that will keep them out of debt in the future.”

Yahoo Movies

Yahoo Movies