Those who invested in Empire Energy Group (ASX:EEG) five years ago are up 150%

Empire Energy Group Limited (ASX:EEG) shareholders might understandably be very concerned that the share price has dropped 38% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. Indeed, the share price is up an impressive 150% in that time. We think it's more important to dwell on the long term returns than the short term returns. Ultimately business performance will determine whether the stock price continues the positive long term trend.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Empire Energy Group

Empire Energy Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

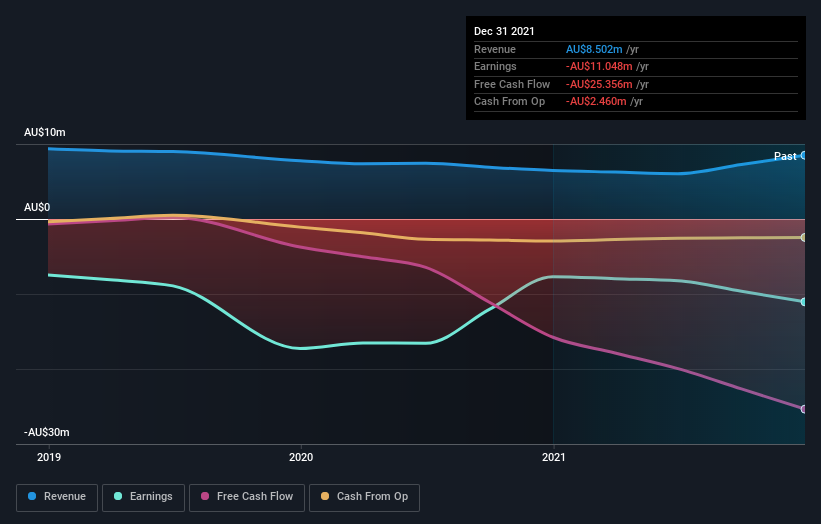

Over the last half decade Empire Energy Group's revenue has actually been trending down at about 26% per year. On the other hand, the share price done the opposite, gaining 20%, compound, each year. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Empire Energy Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 6.0% in the twelve months, Empire Energy Group shareholders did even worse, losing 38%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Empire Energy Group you should be aware of, and 2 of them are concerning.

Of course Empire Energy Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies