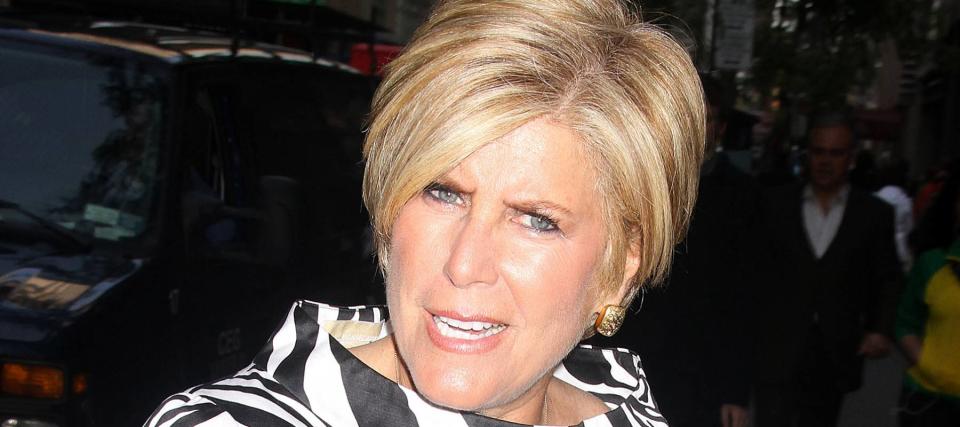

Suze Orman thinks a market crash could be imminent — here's what to do

The stock market has been breaking records over the last year while the real economy has struggled in the face of the pandemic.

And that discrepancy is starting to make experts a little nervous.

One expert, Suze Orman, would go so far as to say she’s now preparing for an inevitable crash.

And a famous measurement popularized by Warren Buffett — known as the Buffet Indicator — shows Orman might be onto something.

Here’s an explanation of where the concern is coming from and some techniques you can use to keep your investment portfolio growing even if the market goes south.

What does Suze Orman think?

Suze Orman has been avidly watching the market for decades now. She knows ups and downs are to be expected, but what she’s seeing happen with investment fads like GameStop has her concerned.

“I don’t like what I see happening in the market right now,” Orman said in a video for CNBC. “The economy has been horrible, but the stock market has been going.”

While investing is as easy now as using a smartphone app, Orman is concerned about where we can go from these record highs.

And even with stimulus checks, which are still going out, and the real estate market breaking its own records last year, Orman worries about what will come with the coronavirus — especially as new variants continue to pop up.

And given how long the market has been surging, she feels it’s just been too long since the last crash to stay this high much longer.

“This reminds me of 2000 all over again,” Orman says.

The Buffett Indicator

One metric Warren Buffett uses to assess the market so regularly that it’s been named after him has been flashing red for long enough that market watchers are starting to wonder if it’s an outdated tool.

But the Buffett Indicator, which is a measurement of the ratio of the stock market’s total value against U.S. economic output, continues to climb to previously unseen levels.

And those in the know are wondering if it's a sign that we’re about to see a hard fall.

Even Tesla boss Elon Musk is starting to feel anxious. Musk recently asked investing bigwig Cathie Wood, CEO of Ark Invest, if we should be expecting a crash.

While Wood initially brushed off any concerns, she did tell Musk she would have her team take a closer look.

HHw to prepare for a rainy day

Orman has three recommendations for setting up a simple investment strategy to help you successfully navigate any sharp turns in the market.

1. Buy low

Part of what upsets Orman so much about the furor over meme stocks like GameStop is it goes completely against the average investor’s interests.

“All of you have your heads screwed on backwards,” she says. “All you want is for these markets to go up and up and up. What good is that going to do you?”

She points out that, the only extra money most people have goes toward investing for retirement in their 401(k) or IRA.

Because you probably don’t plan to touch that money for decades, the best long-term strategy is to buy low. That way, your dollar will go much further now, leaving plenty of room for growth over the next 20, 30 or 40 years.

2. Invest on a schedule

While she prefers to buy low, Orman doesn’t recommend you stop investing completely when the market goes up.

Again, she wants casual investors not to get too caught up in the daily ups and downs of the market.

In fact, cheering for downturns now may be your best bet at getting a larger piece of very profitable investments — like some lucky investors were able to do back in 2007 and 2008.

“When the market went down, down, down you could buy things at nothing,” says Orman. “And now look at them 15 years later.”

She suggests you set up a dollar-cost averaging strategy, which means you invest your money in equal portions at regular intervals, regardless of the market’s fluctuations.

This kind of approach is easy to implement with any of the many investing apps currently available to DIY investors.

There are even apps that will automatically invest your spare change by rounding up your debit and credit card purchases to the nearest dollar.

3. Diversify with fractional shares

To help weather dips in specific corners of the market, Orman suggests you diversify your investments — balance your portfolio with investments in many different types of assets and sectors of the economy.

Orman particularly recommends fractional-share investing. This approach allows you to buy a slice of a share for a big-name company that you otherwise wouldn’t be able to afford.

With the help of a popular stock-trading tool, anyone at any budget can afford the fractional share strategy.

“The sooner you begin, the more money you will have,” says Orman. “Just don’t stop, and when these markets go down, you should be so happy because your dollars find more shares.”

“And the more shares you have, the more money you’ll have 20, 40, 50 years from now.”

What else you can do

Whether or not a big crash is around the corner, investors who are still decades out from retirement can make that work for them, Orman said in the CNBC video.

First, prepare for the worst and hope for the best. Since the onset of the pandemic, Orman now recommends everyone have an emergency fund that can cover their expenses for a full year.

Then, to set yourself up for a comfortable retirement, she suggests you opt for a Roth account, whether that’s a 401(k) or IRA.

That will help you avoid paying tax when you take money out of your retirement account because your contributions to a Roth account are made after tax. Traditional IRAs, on the other hand, aren’t taxed when you make contributions, so you’ll end up paying later.

If you find you need a little more guidance, working with a professional financial adviser, can help point you in the right direction so you can confidently ride out any market volatility.

While everyone else is veering off course or overcorrecting, you’ll be firmly in the driver’s seat with your sunset years planned for.

Yahoo Movies

Yahoo Movies