Surgery for a child, car loan, electric bills: We asked Americans how they’d spend $1,400 stimulus checks. This is what they said.

It was supposed to be a two-week quarantine. Instead, it was a year of indescribable loss.

Lost family. Lost jobs. Lost hope.

COVID-19 ripped the country apart, killing more than 500,000 people and erasing years of economic gains. Months later, 10 million people remain unemployed. Nearly 40 million are being threatened with eviction as they brave the biggest housing crisis since the Great Depression. More than 79 million Americans say they can’t pay for electricity, water or heat.

And 50 million people are going hungry – up from 35 million before the outbreak. Families across the country, especially those of color, report a devastating reality: there isn’t enough food on the table.

The House of Representatives could vote as soon as Friday on President Joe Biden's proposed $1.9 trillion relief package, which would include $1,400 stimulus checks. If the bill passes, it would go to the Senate, where many Republicans, who argue that assistance dissuades people from looking for work, are looking to cut out some of the provisions. Nearly 80% of adults said they need another economic assistance package, according to the Pew Research Center.

USA TODAY asked people around the country how they would spend $1,400.

For them, a stimulus check is more than cash.

Fourteen hundred dollars can stave off eviction or a utility shutoff. It can nurse a teenager back to health, provide seed money for a business, pay for an education and, in some cases, provide a new sense of freedom.

This is what they told us.

‘I don’t know how much more pain Isabell can take’

Stacy Rodriguez, 36, wipes down her daughter's hospital bed with disinfectant wipes. She then makes sure to squirt a glob of antibacterial gel in both hands before fixing her face mask.

This is her routine every time a staff member enters the room.

Rodriguez has been on a three-year journey to get medical care for her teenage daughter. Isabell suffers from pilonidal disease, a chronic skin infection that causes cysts to form in the crease between the buttocks. The painful cysts can create abscesses and sinus cavities, requiring surgery.

Her 14th operation should have been a one-day outpatient procedure in January. But complications have kept Isabell at the Cleveland Clinic in Ohio for five weeks, requiring biweekly dressing changes of the softball-sized open wound that must be done in an operation room while she is under sedation.

Isabell is in excruciating pain. Her mother hears her squall while she's lying on her side. Rodriguez, who was hospitalized last year with COVID-19 and lost her stepfather to the virus in October, sobs uncontrollably every night, wondering if Isabell will get better soon or whether the virus will get to her first.

Each dressing change costs $800.

Rodriguez, the family's sole breadwinner, hasn't worked in more than a month because she has had to relocate to Ohio for the surgery, but the utilities and mortgage bills back in Indiana haven't stopped coming in. And now her insurance provider is threatening to not pay because the hospital isn't part of the network, leaving Rodriguez to settle the $5,000-and-counting bill out of pocket.

Rodriguez scrambled to set up a GoFundMe page to cover the medical bills. But a stimulus check would be the only certainty in the middle of chaos, her only means to chip away at the spiraling costs for Isabell's medical expenses and other bills.

"COVID has ruined my life," Rodriguez says. "I just don't know how much more pain Isabell can take."

'I've had to climb out of poverty, and now the pandemic is shoving me back in'

Misty Mcdade swore she would never put her three kids back in a trailer. But COVID-19 blew everything she worked so hard to achieve to smithereens.

In March, the 40-year-old was laid off from her six-figure accountant job at a top Fortune company in Morgantown, West Virginia. Mcdade didn't receive unemployment for seven months because of processing delays. She cashed out her 401(k) and savings to keep up with her $1,600 rent payment and the rest of the bills. She lost the health insurance coverage provided through her employer, which she depended on to care for her eldest son, who is on the autism spectrum and has bipolar disorder.

When her savings ran out, she moved the family from a 2,500-square-foot townhouse in a great public school district to a mobile home in the country. She got a job at a local nonprofit that pays $40,000 a year. She says she has done everything she can think of but is desperate.

Mcdade owes more than $1,100 in back utilities and two months on her car loan. She fears it could be repossessed any minute, leaving her without a reliable way to get to work.

"It feels like I failed, even though it wasn't me," she says.

She hopes to use the stimulus to pay what is owed on the car and utilities.

Mcdade has already rebuilt her life once before. Against a backdrop of abuse by her former husband, Mcdade says, she put herself through college, holding jobs in fast food while on public assistance. After the divorce, the children's father was stripped of all parental rights in 2012.

"I've had to climb out of poverty, and now the pandemic is shoving me back in," she says.

Most days there isn't enough for anything – even food.

"I never wanted to have to tell them I don't have the money for that," Mcdade says with a cracked voice over the phone. "And I'm saying that about cereal."

More: Where Biden's COVID-19 plan, including stimulus checks, stands in Congress; House to vote Friday

'All I need to do is find a little extra'

Tiffany Velez, 38, plops herself on the bed to begin her nightly COVID-19 ritual.

She takes a sip of piping hot coffee from her favorite mug with a photo of 1990s teen idol Luke Perry. The coffee will keep her awake and help her feel full.

Velez begins scouring the internet for digital coupons, looking at the notes she has typed on her phone of what products are on sale at which discount grocers in town. She maps out her route, accounting for every gas mile.

Velez is trying to save money on food to pay off the $1,300 her family owes in gas and electricity.

"All I need to do is find a little extra," Velez says. "I keep thinking if we pay something every week they won't shut the power off."

A stimulus check would settle the balance, Velez says.

The family from Vineland, New Jersey, began struggling after Velez quit her Instacart shopper job when her 16-year-old twins and her daughter in college were sent home from school in March. They've been living off her husband's welding job.

The family now spends more than $1,000 a month on groceries. That's about $3 per meal per person. Velez has cut out almost all meat and makes a lot of pasta. The twins had free lunch at school.

The U.S. Department of Agriculture estimates that the average cost of groceries for a low-income family of four is $155 to $205 a week.

"I hate what this virus has done to me," Velez says. "My anxiety is through the roof, I'm on edge all the time. Thinking all the time. It never stops."

‘This is my little castle’

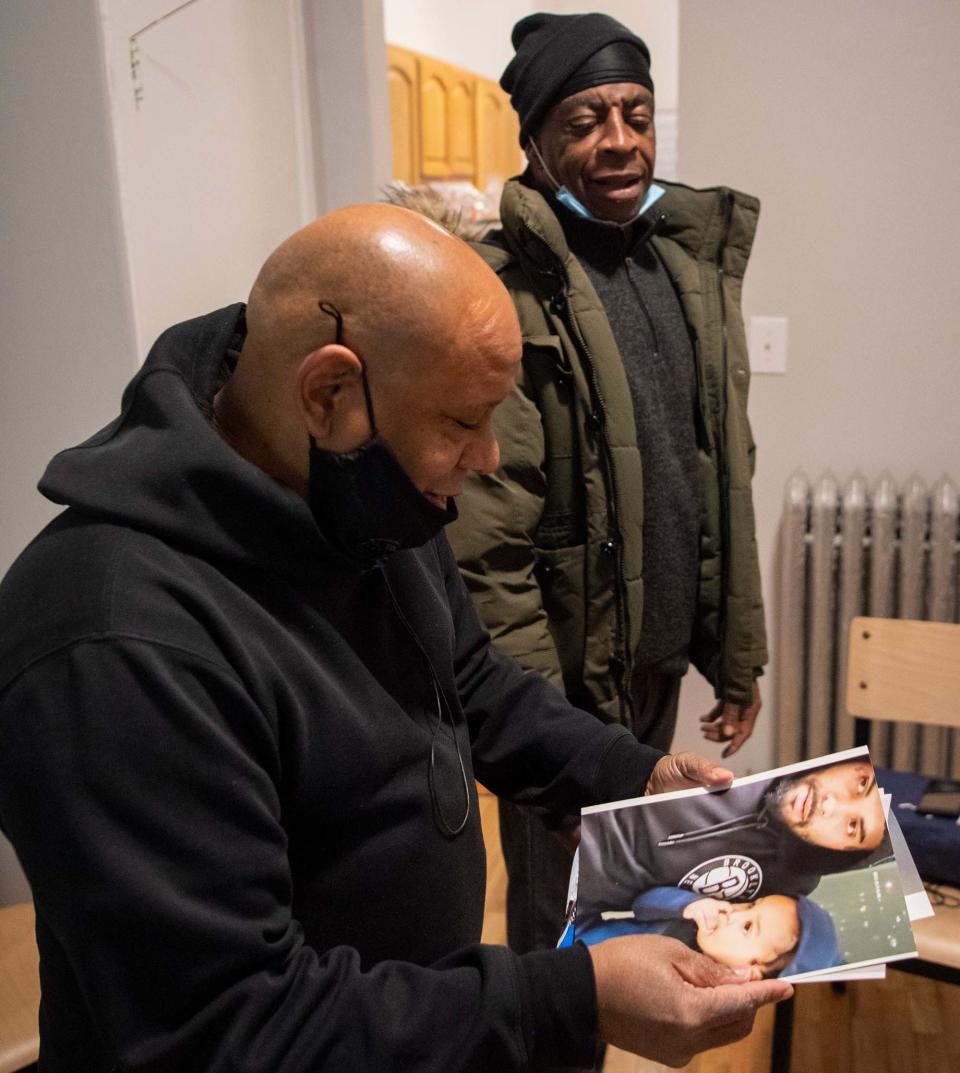

It took Larry Thomas half his life and a deadly plague to get the keys to his tiny Harlem apartment in New York City.

Thomas, 59, served 21 years in prison. By the time his sentence was up in 2017, he had no surviving family. Within the span of a few hours as a free man, Thomas was homeless.

Thomas spent more than two years on and off the streets; working many jobs, unable to afford rent. His belongings fit inside a backpack, on top of a milk crate or inside an assigned locker.

When the pandemic hit, officials moved people out of shelters and into hotel rooms. Thomas was assigned a private room that allowed him to quarantine, a job as part of an outdoor cleaning crew that allowed him to save money and help to secure a rent-controlled apartment. He moved in November and began studying to become a certified peer counselor to help others like him.

The apartment has a bed, sofa, small dining table and TV purchased with the help of a local nonprofit.

If he received the stimulus, Thomas says, he would put it toward the things in the apartment that show he isn't going anywhere: summer clothes to hang in the closet, picture frames for the photographs he takes of Central Park, and kitchenware.

"It's something as simple as a metal dish rack, you know," Thomas says.

"This is my home. This is my little castle."

‘A refuge from the world’

Even for Americans like Chelsea Ratterman, 28, who have their basic needs met, a stimulus check can help a dream come true and fuel the economy.

Ratterman recently made an offer to purchase an apartment in Oklahoma City. It's the first time she'll be living on her own.

She already imagines how she wants to decorate her own place – with a Pinterest board for every room, an Amazon wish list and a gray sectional picked out.

COVID-19 nearly stunted her dreams of becoming a homeowner.

Although she had saved up enough living with her parents to put a down payment on a house in March, she got nervous about moving in the middle of a pandemic.

The information about how the virus spread was scant, and she wasn't sure what the financial hit would be when everyone was ordered into quarantine – let alone if her job at the University of Central Oklahoma would be spared.

By the time Ratterman was ready to start looking again, prices for single-family homes had soared as low mortgage rates kicked off a buying spree across the country.

She settled for a condo.

"It's the dream of getting to build a home that reflects me for the first time," she says, "a refuge from the world."

‘We cannot traumatize our children anymore’

The Fergusons decided they weren't going to let a health crisis go to waste.

Together, Tia Ferguson, 40, and her husband, Thomas Ferguson III, hatched a plan to get ahead financially by saving to open their own businesses in Columbus, Ohio.

It's a team effort. The family's food budget is now $400 a month, consisting of a lot of plant-based meals and peanut butter. There are extra throw blankets around the house, and everyone doubles up on socks and sweaters. Use of appliances and screen time is limited. There's no cable. The kids play board games, use painting sets and do crafts.

Each $1,400 check would be used as seed funding: She would put it toward a certification for her literacy tutoring business and he would purchase a trailer he needs for his mobile mechanics shop.

Saving for her future hasn't come easy for Ferguson, a substitute teacher who was ordered by her doctor to stay away from in-person classrooms because she has diabetes, hypertension and asthma, which puts her at high risk if she contracts COVID-19.

But breaking the generational poverty cycle is a priority for her family – especially after being in the throes of a foreclosure, bankruptcy and a high-risk pregnancy that ended in their fourth child being stillborn in December 2019.

Tia and Thomas Ferguson were unable to shield their kids from what was happening. They swore to never be in such a financially precarious position again.

"This is why we are so staunch on living below our means to give our children the security and stability they need to grow," Tia Ferguson says. "We cannot traumatize our children anymore."

‘COVID took out my village’

For a single mom trying to put food on the table and pay bills on time while earning minimum wage, child care is everything. This is the case for Meghan Hullinger, 37, and her four kids in Marlinton, West Virginia.

When school was in session, Hullinger's kids attended daily. She relied on grandparents and older relatives to look after the toddlers. In the summers, the older kids would spend the summer with family in Florida.

But the public health emergency made it impossible to ask her relatives to watch the kids without putting them at higher risk of catching the virus.

"COVID took away my village," says Hullinger, who was volunteering at the High Rocks Academy for Girls as a member of AmeriCorps, a program funded by the federal government that pays participants' education in exchange for their service. As a full-time member, she received a monthly $1,100 stipend.

Without help, she had no choice but to stay home and put everything on hold to take care of her kids.

Hullinger is one of hundreds of thousands of women being driven out of the workforce. Female unemployment has reached double digits for the first time since 1948.

In May, she started a job at a nonprofit that allows her to work some days from home but pays only $10.30 an hour. She makes more money than before, but she doesn't have anyone to look after the kids for free.

Although Hullinger qualifies for subsidized child care, the wait lists for licensed facilities can take years for a spot to open. The waiting has only gotten worse with occupancy restrictions resulting from the pandemic.

Her 3-year-old was accepted at a nearby center two weeks ago. He had been waiting for a spot since he was 18 months old.

Hullinger has found a babysitter who would be willing to watch her children for $180 a week. A stimulus check of $1,400 would allow her to pay for 7½ weeks of care and allow her extra time to pick up a class online. Her goal is to complete her undergraduate degree.

Being a single parent is scary, Hullinger says, "but COVID has made it exceptionally so."

‘I’m having to create more debt for myself’

After school closed for the summer in June, Katie Krupp was told not to return in the fall. Her teaching position had been canceled.

Krupp, 42, struggled to get unemployment in Ohio, racking up credit card debt to pay for groceries and basic necessities.

She started having panic attacks and fell into depression. When the situation became even more untenable, she made the difficult decision to sell her home.

"My whole life I had to give up," she says.

Krupp found a new job as a teacher at a nearby charter school in Dayton, but it came with a 50% pay cut.

Seeing her employment prospects dwindle, Krupp enrolled at Miami University in Oxford, Ohio, to get an additional license that would allow her to teach special education.

She believes there will be a greater need for educators in the post-COVID-19 world. Parents from school districts across the country have said students nationwide are falling behind. By one estimate, the shift to remote school last spring set back children by up to five months, a trend projected to continue.

The certification costs about $7,000. A stimulus check would contribute to lowering the price tag – and Krupp’s anxiety.

Going into more debt is scary for Krupp.

She used to believe that if you did everything by the book, you could avoid certain pitfalls. COVID-19 broke any sense of security.

"I have this overwhelming sense, a gut-wrenching feeling that things are not going to be OK," she says. "They haven't been OK yet."

'It's the best gift you could give somebody'

Michael Patterson, 38, has been living with a bullet lodged in his back for two decades. He was shot at age 18 in Philadelphia, resulting in a lifelong spinal cord injury that left him unable to walk.

He is one of millions of Americans who long struggled before the arrival of COVID-19 and would benefit from a $1,400 check.

He moved to upstate New York in 2018 to work as an advocate at the University of Rochester. Patterson receives a small stipend in addition to his small income from the Social Security Administration, which brings his total earnings to $13,000 – barely over the 2021 poverty line of $12,880. He gets $19 in monthly Supplemental Nutrition Assistance Program benefits.

Patterson lives with his mother and a younger brother and contributes toward rent, leaving him with $700 for the rest of the month.

For more than 15 years, his insurance provider said it wouldn't cover the cost of essential physical therapy equipment, including a standing frame, which helps him stand up straight and provide better digestion and relief to aching muscles and joints.

Patterson's girlfriend found a used frame in excellent condition in Vermont for $800. His mom and brother also pitched in and purchased it at the end of January.

On Feb. 8, he stood up straight for the first time in more than a decade.

The standing frame has helped Patterson forge a path toward greater independence. If he receives a stimulus, he hopes to help his mom fix up their family home and invest in a set of hand controls for a car he would be able to drive himself.

The modifications cost about $1,500 and aren't covered by Medicaid.

"It's the best gift you could give somebody," Patterson says. "Freedom!"

Follow Romina Ruiz-Goiriena on Twitter: @RominaAdi

This article originally appeared on USA TODAY: Stimulus check: How Americans plan to spend $1,400 COVID payment

Yahoo Movies

Yahoo Movies