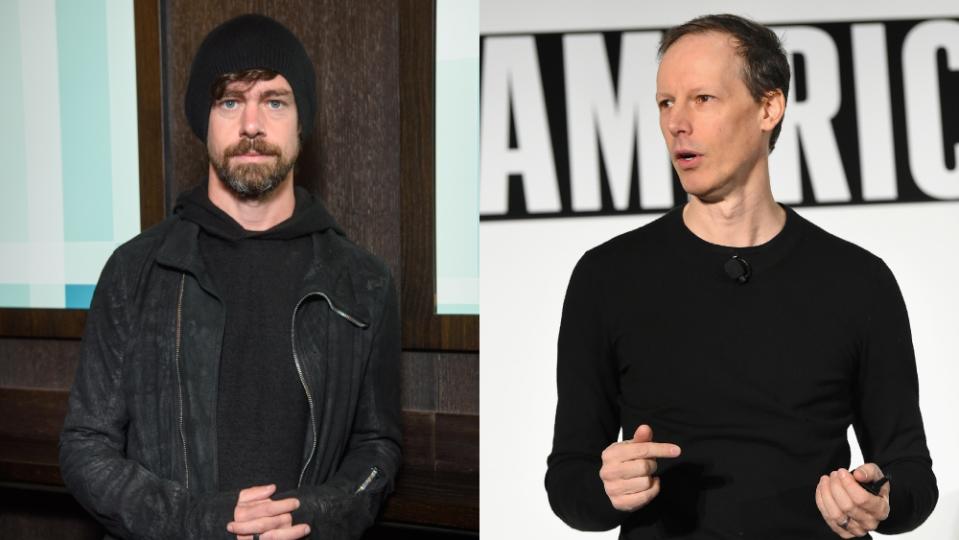

The Square and CashApp Reportedly Committed Wide-Scale Fraud, Earning Founders Jack Dorsey and Jim McKelvey Over $1 Billion

In 2009, billionaires Jack Dorsey and Jim McKelvey founded Square, Inc., a payment platform intended to help smaller businesses by allowing them to accept credit card payments. Now, a new report claims that the company engaged in wide-scale fraud that took advantage of its users—and netted founders Dorsey and McKelvey a seriously substantial profit.

The report, from investment research firm Hindenburg Research, took a deep dive into the company’s history over a two-year investigation, during which its team reviewed the company’s records and spoke with former employees, partners, and industry experts. Hindenburg disclosed as part of this report that they had taken a short position in shares of Block Inc., the company’s new name as of 2021. Block is best known as the company behind Square credit card payment devices and Cash App; it also became the majority owner of Jay-Z’s Tidal in 2021 and acquired pay-later service Afterpay in 2022.

More from Robb Report

The Hindenburg report alleges the business has engaged in predatory practices for those “underbanked” consumers it claimed to serve and further committed fraud to avoid regulation and mislead investors. Among other acts, Block has reportedly shared falsely high user counts and falsely low customer acquisition costs, two key metrics that have inspired confidence and excitement in the company’s future. The company claims to have 51 million monthly transacting users, but Hindenburg’s research alleges this figure included many fake and duplicate accounts, with a former employee corroborating how users engaged in fraud could be associated with up to “hundreds” of active accounts—which meant that “blacklisted” users were never actually banned from the platform, and which helped create inflated numbers of “transacting users” that didn’t represent real, unique customers.

In response to the Hindenburg report, Block said in a statement, “We intend to work with the SEC and explore legal action against Hindenburg Research for the factually inaccurate and misleading report they shared about our Cash App business today.” The company also stated that it has “reviewed the full report in the context of our own data and believe it’s designed to deceive and confuse investors.

A troubling aspect of the reported fraud is how Block’s financial products have allegedly been used in alleged criminal activity. The report showed that Cash App is regularly used to facilitate sex trafficking and even to hire contract killers: the latter has been rapped about in a song called “Cash App,” which the company promoted.

Per this report, Block committed numerous other types of fraud and dishonest activity—predatory fees for its users, maneuvers to avoid compliance, and further misleading metrics offered to investors—and all the while, it was able to grow stocks and profits in keeping with those reported figures. During the pandemic, Hindenburg alleges that Dorsey and McKelvey “collectively sold over $1 billion of stock” based on the company’s reported successes.

The firm’s research suggested that other investigations into Block’s practices are ongoing.

Sign up for Robb Report's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Movies

Yahoo Movies