South Africa Trails Emerging-Market Peers as Ramaphosa Faces Calls to Resign

(Bloomberg) -- Five years ago, Cyril Ramaphosa’s ascent to power fueled a euphoric rally in South Africa’s assets that coined a new word: Ramaphoria. On Thursday, a financial scandal threatened to end it all in a rout.

Most Read from Bloomberg

Musk’s Neuralink Hopes to Implant Computer in Human Brain in Six Months

Beverly Hills Cop Was California’s Highest-Paid Municipal Worker

An Arizona County’s Refusal to Certify Election Results Could Cost GOP a House Seat

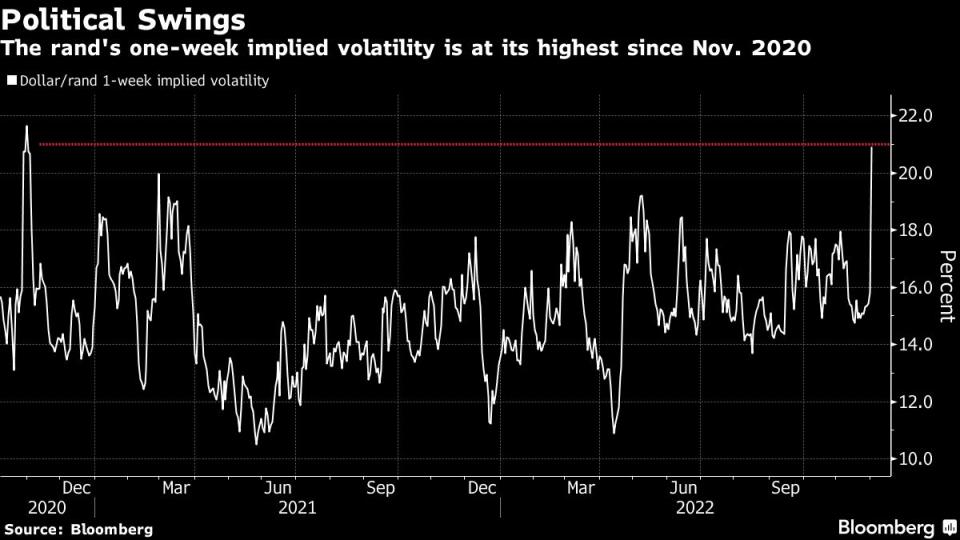

The nation’s currency posted its worst one-day loss since May while the government’s borrowing costs surged the most since 2015, as the president considers resigning over potential breaches of the constitution related to the theft of $580,000 stashed at a game farm he owns. Options traders bet on the wildest currency volatility in two years, and the cost to hedge against a sovereign default jumped the most in the same period.

Ramaphosa Weighs Resigning Over Panel’s Report on Farm Scandal

The reversal marks a stark contrast to the market reaction between November 2017 and February 2018 when Ramaphosa emerged as the replacement for the scandal-ridden tenure of Jacob Zuma. His reform agenda and clean image helped fuel a 27% rally in the rand in that period.

Money managers now say he failed to deliver the policy changes required to ignite growth in the country, considered a bellwether for emerging markets. Rampant unemployment at about 33% and a continued mess in the electricity sector have lowered markets’ confidence in him, with the latest political crisis pushing them over the edge.

“The market dreads political instability and often prefers to go with the devil they know than the devil they don’t,” said Cristian Maggio, the head of portfolio and ESG Strategy at TD Securities in London. “But Ramaphosa’s reform agenda has been underwhelming to say the least. Doubts will remain as to whether another candidate can kick-start that process, but we surely know that Ramaphosa is unlikely to deliver what is needed.”

The leadership crisis sent the rand as much as 4.2% lower to 17.9596 per dollar, at one point set for the biggest one-day loss since November 2016. The currency trimmed some of those losses to end the session down 2.6% to a three-week low at 17.6574.

The rand held losses as government spokesman Vincent Mgwenya said in a televised briefing a response by the president is “imminent” without giving timing details for the address.

Some more market reaction:

The 10-year sovereign rand-bond yield rose 74 basis points to 11.54%.

The yield on 10-year dollar bonds climbed about 36 basis points to 7.36%.

One-week implied volatility on the currency, based on options prices, soared 5 percentage points to more than 21%.

Credit default swaps, used to hedge against the risk of default by South Africa in the next five years, increased 30 basis points to 275.

An index of bank shares slumped as much as 8.2%, the most since March 2020 on a closing basis

“The probability of Ramaphosa lasting another full term looks very low to me now,” said Kieran Curtis, director of investment at abrdn in London.

South Africa’s currency is no stranger to routs triggered by political drama. It dropped as much as 5.2% on Dec. 9, 2015, when President Zuma fired the then Finance Minister Nhlanhla Nene and replaced him with a little-known lawmaker. The rand plunged 9.2% in five days through April 3, 2017, as Zuma dumped another finance minister, Pravin Gordhan.

Thursday’s losses in South Africa came amid gains in global stocks, bonds and currencies after Federal Reserve Chair Jerome Powell signaled the central bank may slow the pace of monetary tightening and a Chinese official in charge of pandemic controls indicated strict rules may be relaxed.

In South Africa, though, the latest scandal will likely continue to weigh on markets, with traders looking ahead to a meeting of the ANC’s top leaders expected on Friday.

“A reprieve, let alone a rebound, is unlikely until uncertainty about the future of Mr. Ramaphosa and the ANC’s leadership lifts,” Jason Tuvey, a senior EM economist at Capital Economics, wrote in a note.

--With assistance from Sydney Maki and Leda Alvim.

(Updates prices throughout.)

Most Read from Bloomberg Businessweek

11 Hours With Sam Bankman-Fried: Inside the Bahamian Penthouse After FTX’s Fall

TikTok’s Viral Challenges Keep Luring Young Kids to Their Deaths

Forget Zoom Calls, Remote Work Startups Want to Build a Virtual Office

The Avatar Sequel Is a Make-or-Break Moment for Disney’s $71 Billion Fox Deal

How a Ruling Family Tipped Sri Lanka Into Economic Free Fall

©2022 Bloomberg L.P.

Yahoo Movies

Yahoo Movies