Shareholders in Nerdy (NYSE:NRDY) have lost 81%, as stock drops 30% this past week

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. It must have been painful to be a Nerdy, Inc. (NYSE:NRDY) shareholder over the last year, since the stock price plummeted 81% in that time. A loss like this is a stark reminder that portfolio diversification is important. We wouldn't rush to judgement on Nerdy because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 59% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Since Nerdy has shed US$55m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Nerdy

Because Nerdy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Nerdy saw its revenue grow by 32%. That's definitely a respectable growth rate. Unfortunately, the market wanted something better, given it sent the share price 81% lower during the year. It could be that the losses are too much for investors to handle without losing their nerve. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

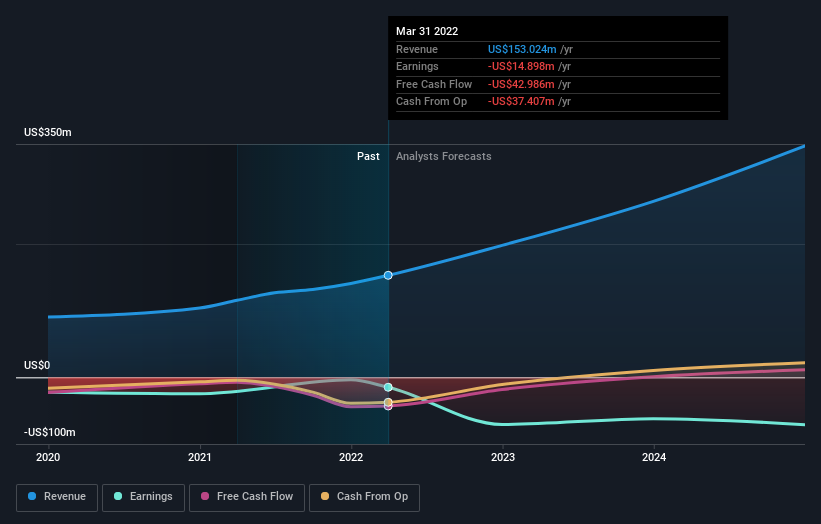

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Nerdy

A Different Perspective

Nerdy shareholders are down 81% for the year, even worse than the market loss of 6.6%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 59%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Nerdy (of which 1 is potentially serious!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies