A Shareholder Revolt Put Bob Iger in Power. Another One Could Strip Him of It

The showdown between Disney CEO Bob Iger and an activist investor group culminating at Wednesday’s annual meeting won’t be the first time the entertainment giant has stared down a shareholder revolt. In fact, the last time this happened, Iger emerged the big winner.

Two decades ago, Disney’s board stripped Iger’s predecessor Michael Eisner of his chairman title following the Save Disney campaign led by founder Walt Disney’s nephew Roy E. Disney and his investor partner Stanley Gold. As the smoke cleared, the Disney board handed the CEO reins to Iger, then Eisner’s No. 2, in 2005.

Disney has recently steeped itself in legacy sequels, returning to franchises decades after the fact. But nobody wanted to see another shareholder revolt. Especially not Iger, whose second chance at the CEO role was meant to solidify his place as one of the most successful and respected corporate leaders in history.

Now all that is in jeopardy.

“It is weird that 20 years later, we’re back in the same place,” said Jim Hill, a Disney historian whom Roy Disney recruited to help with Save Disney. “The only difference is that there’s no meeting in Philadelphia. This time it’s virtually.”

Disney’s board will reveal on Wednesday whether Trian Fund Management, whose co-founder Nelson Peltz has been decrying for months that Iger and Disney are not doing enough to improve the content and financial performance of the company, will be given a seat at the table. Peltz and Trian control 32.3 million Disney shares, 79% of which are owned by ex-Marvel Entertainment Chairman Ike Perlmutter.

Wednesday’s annual meeting is the crescendo to Peltz and Trian’s Restore the Magic campaign, which despite Disney acquiescing to many of their demands (like the firing of 7,000 employees), has only intensified in recent months.

One Disney insider told TheWrap that some Wall Street analysts expect that if Peltz takes control of even part of the board he would sell the company for parts, with divisions like theme parks and consumer products going to the highest bidder.

Peltz is seeking to replace current board members Maria Elena Lagomasino and Michael Froman with himself and former Disney Chief Financial Officer Jay Rasulo.

Separately, another activist investor, Blackwells Capital, has nominated former Warner Bros. and NBCUniversal executive Jessica Schell, Tribeca Film Festival co-founder Craig Hatkoff and TaskRabbit founder Leah Solivan. Blackwells, its affiliates and its chief investment officer Jason Aintabi, owned an aggregate of 288,050 Disney shares as of Jan. 31. While supportive of Disney’s current turnaround efforts, Blackwells wants the company to prioritize artificial intelligence and spatial computing and proposed a real estate and strategic asset review, including a potential split of the company. It’s also suing over the company’s information-sharing agreement with ValueAct Capital.

The annual meeting is scheduled to kick off Wednesday at 10 a.m. PST. Eligible shareholders will have until 11:59 p.m. ET on Tuesday to cast their vote.

Disney deja vu?

In 1984, Disney was in rough shape.

Nearly 20 years after Walt Disney’s death, the company had fallen into disarray. The animation division, once the crown jewel of the company, was releasing forgettable kiddie stuff. The theme parks, seen as a potential growth sector, had overspent on projects like Florida’s EPCOT Center. Almost every part of the company was chasing Walt’s shadow. And while there were some signs of life, like then-president and CEO Ron E. Miller’s development of Touchstone Pictures, which debuted in 1984, Disney was largely seen as a lame duck, especially by Wall Street.

There were several takeover attempts by corporate raiders Saul Steinberg and Irwin Jacobs, who looked to divvy up the company, essentially stripping it and selling it for parts. But a takeover gave way to a greenmail attempt, something that Disney actually engaged with.

The company successfully stopped Steinberg’s $1.4 billion bid to buy a 49% controlling stake by paying him nearly $300 million to buy back his 4.19 million shares, or 11% stake, in the company. Jacobs ended up selling his 7.7% Disney stake to the billionaire Bass family.

As part of their attempt to right the ship, Roy Disney and his business partner Stanley Gold determined Disney needed to be more than a family company, and made a move to replace Miller, who was Walt’s son-in-law. To appease their new corporate partners the Bass Brothers, the board installed Eisner, who was coming off a hot streak at Paramount, and Frank Wells, who had been president and vice chairman of Warner Bros., as CEO/chairman and president, respectively. They brought in tenacious executive Jeffrey Katzenberg to run the film department.

A decade later, Wells died tragically in a helicopter accident. It was the first in a series of public trials for the company and Eisner, which included Katzenberg revolting after failing to secure Wells’ job, leading to his exit.

In 2003, Roy Disney resigned from Disney’s board and animation division due to “serious differences of opinion” with Eisner over “the direction and style of management” at the company. At the time, he accused Eisner of consistently refusing to establish a clear succession plan, “timidity” in investing in the theme park business and creating a “creative brain drain” at the company.

The company was becoming perceived as “rapacious, soulless, and always looking for the quick buck rather than long-term value,” Roy Disney said then.

Eisner, not Disney, should leave the company, said Disney, who called for the CEO to resign.

At Disney’s annual meeting in March 2004, Eisner lost with 48.5% of the vote. That September, he announced he would resign and named Iger his preferred successor. Ironically, without Eisner, Iger was unlikely to have been in Disney’s orbit. The former weatherman was president and COO of Capital Cities/ABC when Disney acquired the network. While generally viewed as less creative than Eisner and more focused on the bottom line, Iger quickly rose through the ranks.

Fast forward to 2024. Trian asserts that Disney has “woefully underperformed its peers and its potential,” citing tens of billions of dollars in lost shareholder value, a meaningful drop in consensus earnings-per-share estimates for fiscal years 2024 and 2025 and studio content that “continues to disappoint consumers, slowing the speed of the flywheel and threatening future earnings growth.”

The root cause of that underperformance, Trian argues, is “a board that is too closely connected to a long-tenured CEO and too disconnected from shareholders’ interests,” and that “lacks objectivity as well as focus, alignment, and accountability.”

The result, Trian added, “has been questionable strategic and capital allocation decisions, including the investment of $200 billion of capital without any discernible return, the demonstrable lack of alignment between executive compensation and shareholder value creation and financial results in the most recent year that pale in comparison to the results five years ago.”

Trian’s various proposals to “restore the magic” include a new “streaming margin” incentive for executives to target a Netflix-like 15-20% margin by 2027 and allocating more of its budget to lower-cost, easier-to-produce projects.

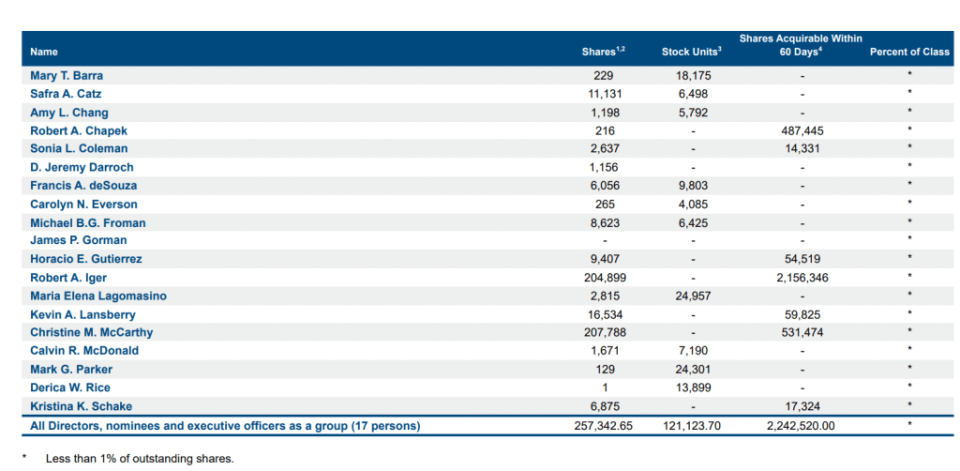

Collectively, Disney’s current board of directors, nominees and executive officers own less than 1% of the company’s 1.83 billion outstanding shares, according to Disney’s proxy filing.

Disney strikes back

Disney has told shareholders that Trian and Blackwells’ nominees are not up to the task and have slammed Peltz and Rasulo’s “track record of value destruction.”

The company has advised shareholders on how to vote using one of its animated characters, the wizardly Professor Ludwig von Drake, who gave tips in the style of a classic episode of “The Wonderful World of Color.”

Disney strategy has included restoring the company’s cash dividend and boosting the payment by 50%, announcing a $3 billion share buyback program for fiscal year 2024 and investing $60 billion in its theme parks over the next decade. Disney says it is also on track to meet or exceed $7.5 billion in cost savings, reach streaming profitability for Disney+ and deliver $8 billion in free cash flow by the end of fiscal year 2024.

Disney is buying out Comcast’s minority stake in Hulu for at least $8.61 billion, officially launched a Hulu and Disney+ combined app offering, and inked an $8.5 billion deal with Mukesh Ambani’s Reliance Industries for a joint venture that will combine Viacom18 and Star India. The company also paid $1.5 billion for a stake in “Fortnite” creator Epic Games, obtained the streaming rights to Taylor Swift’s Eras Tour concert film, announced sequels to “Moana” and “Zootopia,” and plans to launch a fully direct-to-consumer version of ESPN in fall 2025, along with a sports streaming joint venture with Fox and Warner Bros. Discovery this fall.

Iger’s board is full of corporate operatives. The chairman hails from Nike, while other board members have been part of corporations like Oracle, Meta and Mastercard. In November, the board of directors appointed two new members: former Morgan Stanley chairman and CEO James Gorman and former Sky CEO Jeremy Darroch.

By contrast, Eisner’s board of directors included a teacher and postmodern architect Robert A.M. Stern.

Iger, who has extended his contract through the end of 2026, has previously said he will “definitely step down” at the end of that term. He’s said that before.

Disney’s strategy has played well with Wall Street, with multiple analysts raising their price targets on the stock, though Trian has argued pressure from its proxy campaign has been partially responsible for the recent momentum. Disney shares fell to a 52-week low of $78.73 in October but have rebounded to $121.53 as of Monday’s close, though they are off a recent 52-week high of $123.74 and all-time high of $201.91.

The company’s market capitalization currently sits at $222.92 billion, down nearly a third from its $328.02 billion market cap at the end of 2020.

“The biggest risk in our view is potential management change, were the activists to be successful in the bid for board seats,” UBS analyst John Hodulik wrote in a note to clients. “This could cause a downturn in the shares just as the benefits of Bob Iger’s latest tenure are starting to take hold.”

Picking sides

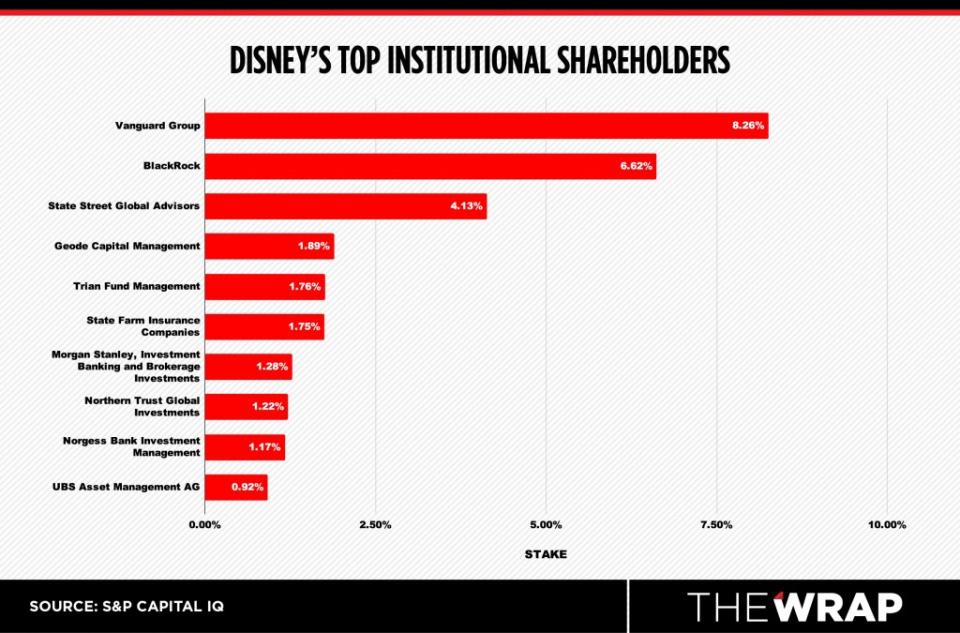

Ahead of Wednesday’s vote, both Iger and Peltz have secured key endorsements as they look to sway Disney’s larger institutional investors, who own over 50% of the company’s outstanding shares. The New York Times reports around 40% of Disney shares are held by individuals.

According to S&P Capital IQ, the largest institutional shareholders include Vanguard Group (8.26%), BlackRock Inc. (6.62%), State Street Global Advisors (4.13%), Geode Capital Management (1.89%), Trian (1.76%), State Farm (1.75%), Morgan Stanley (1.28%), Northern Trust (1.2%) and Norgess Bank Investment Management (1.17%).

Peltz has received endorsements from Neuberger Berman, Yacktman Asset Management, the California Public Employees Retirement System, activist investor Ancora Holdings, over a dozen current and former public company directors who worked with Trian and Peltz on their boards, and proxy advisory firms Egan Jones and the highly influential Institutional Shareholder Services.

ISS, whose recommendation was a key factor in Eisner’s loss back in 2004, notably recommended Peltz but not Rasulo due to a fear of creating “added friction” on the board. In its latest determination, ISS cited Disney’s botched succession attempt with Iger’s predecessor-turned-successor Bob Chapek as a key reason for its support of Peltz.

“Chapek’s sudden appointment at the onset of the pandemic was not a result of a rigorous process, by the board’s own admission during engagement with ISS,” the proxy firm wrote. “It appears that there was no structured board-mandated interview process, and that the board primarily relied on Iger’s judgment in making this decision.”

While acknowledging Iger is the “right CEO” for Disney at the moment, ISS argued there are “lingering questions” about the board’s ability to oversee the next CEO transition and strategic changes being undertaken. Iger has said that a search for his successor is underway. And while a number of potential replacements have been floated internally (including Josh D’Amaro, the head of the parks division, Asad Ayad, the newly appointed director of brands and Dana Walden, the co-chair of entertainment), a forerunner has yet to emerge.

“Given the major missteps and severe consequences of the failed 2020 succession, particularly for a company that already had a history of succession drama, it may be difficult for others to simply trust that the board, albeit refreshed, will get it right this time,” ISS wrote. “Dissident nominee Peltz, as a significant shareholder, could be additive to the succession process, providing assurance to other investors that the board is properly engaged this time around.”

Supporters in Iger’s corner include New York City Retirement Systems, activist investor ValueAct Capital, proxy advisory firm Glass Lewis, “Star Wars” creator George Lucas, Laurene Powell Jobs, J.P. Morgan CEO Jamie Dimon, former Walt Disney Imagineering president Bob Weis, “Frozen” star Josh Gad, Walt Disney and Roy O. Disney’s grandchildren and Eisner himself.

The grandchildren acknowledged that while they don’t agree with every decision the company has made, they know that Roy would be “especially proud of what Disney means to the world today” and “very concerned by the threat posed by self-anointed ‘activist investors’ who are really wolves in sheep’s clothing, just waiting to tear Disney apart if they can trick shareholders into opening the door for them.”

The Disney family members also recalled the “bitter episode” when Steinberg launched his hostile takeover attempt, noting that he was “good friends” with Peltz.

Eisner, too, referenced the 1983 “attack by corporate raiders” that would have “ended the Disney Company as we know it, for the studio, theme parks, and hotels were suggested to be sold off.”

He urged shareholders to “remember the lessons from 40 years ago” and that “bringing in someone who doesn’t have experience in the company or the industry to disrupt Bob and his eventual successor is playing not only with fire but earthquakes and hurricanes as well.”

The post A Shareholder Revolt Put Bob Iger in Power. Another One Could Strip Him of It appeared first on TheWrap.

Yahoo Movies

Yahoo Movies