Riskified Discusses Retail’s $600 Billion Online Shopping Problem

Taking a risk in retail may not be advisable in a rocky, erratic market — but for Riskified, an e-commerce revenue protection platform, instantaneous trust and flexibility are precisely why the firm has waxed when many other aspects of retail have waned.

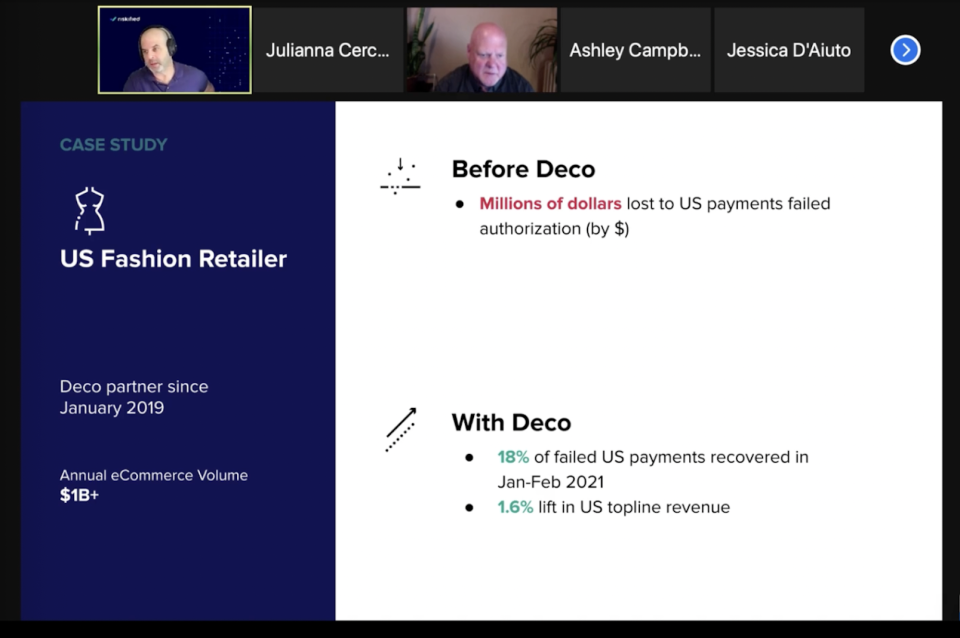

At the recent Fairchild Media Group Tech Forum, the workshop “E-Commerce Pain Points: Addressing a $600 Billion Online Shopping Problem,” presented by Riskified, discussed the massive losses due to e-commerce payment failures and how the company’s Deco solution helps merchants recoup lost revenues.

More from WWD

Payment failures cost merchants over $600 billion, as 40 percent of customers abandon a cart after their first payment declines. Deco diminishes this friction by combating payment failures at checkout — and as a result, it also reduces drop-off, and increases customer retention. A U.S. fashion retailer reported that with Deco, 18 percent of failed U.S. payments were recovered in January-February 2021, with a 1.6 percent lift in U.S. topline revenue.

Eyal Raab, vice president of sales and business development at Riskified, and Arthur Zackiewicz, executive editor at WWD, began the workshop by explaining the basics. Raab said that “Payment failure is when someone tries to pay online and they get declined, not by anything that the merchant is doing, but usually by the issuing bank or any part of the ecosystem.”

When a shopper tries to transact and sees messages spanning from “The transaction cannot be processed,” and “Authorization failed,” or “Card was declined,” and “Your payment details couldn’t be verified,” the customer often abandons the purchase instead of trying to address the issue. “Unfortunately, merchants are not really able to do anything about it, and they accept it as a ‘fight or flight’ scenario,” Raab said.

Zaczkiewicz asked what exactly is at stake from these lost sales, and Raab explained that it’s a very costly effort just to add a product to a shopping cart — and that’s only the beginning of the transaction.

“If you think about where this is happening in the e-commerce funnel, you’re spending money on marketing to get customers onto the site. You’re spending money on solutions to optimize the experience. Then, you’ve got to get customers to add items to the cart. They’ve pulled out their credit card, they want to pay — and after all of that effort, they get declined.”

Raab continued, “The problem stems from the fact that there’s a very complex payment ecosystem facilitating payments, and although we think about it as a very straightforward system that works, you pull out your credit card, you put in the number, the CVV, the expiration date, and you expect it to go — a lot of time it doesn’t go well.”

And that’s because when it comes to payment authorization, there are too many cooks in the kitchen, Raab said. “If we think about what’s really going on behind the scenes, the moment someone checks on your merchant’s site, it usually goes through a gateway, and then there’s an inquirer or processor at the end, and then it goes to the credit card network, then the issuing bank, and then hopefully gets an approval” — but about 5 to 15 percent of the time, it gets declined.

Reasons for declining a card includes the obvious, such as maxed-out credit cards or various types of fraud protections that may be in place — but in instances where other faulty glitches may be at play, Riskified’s solution will work for the merchant and customer to successfully process the transaction.

Its Deco solution “doesn’t compete with existing payment solutions in the market — it augments them,” Raab said. Deco enters the payment flow immediately after authorization failure, in real-time, and doesn’t kick the customer off the site. When a payment declines, its risk engine assesses the quality of the customer through its proprietary machine-learning models that check their legitimacy and past purchasing behavior, without a sign-up process or credit check, and begins to interact with the shopper through a branded widget.

When its widget pops up, it asks again for credit card details. Deco immediately allows the transaction, collects the money with no interest or debt, and at times will offer half a payment or smaller installments to process it on the spot.

“Someone not paying you is a losing proposition for the vendor,” Raab said — and it’s Deco’s real-time ability to quickly and accurately assess that truly differentiates it. “It’s about the accuracy of assessing in real-time whether the customer is a good customer, and that’s where the magic happens,” Raab said. “That’s the engine that makes Deco possible.”

FOR MORE BUSINESS NEWS FROM WWD, SEE:

Outerwear Brand Nobis Launches Upcycling Campaign

The Great Outdoors Is Having a Moment in Fashion

Field Notes: Textile Chemical Use Is Getting Greener

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.

Yahoo Movies

Yahoo Movies