UK economy on track for worst slump in 300 years

Watch: UK economy to shrink 11.3% this year

Official figures from the government’s independent spending watchdog show the UK economy is on track for its worst year in three centuries.

The Office for Budget Responsibility (OBR) on Wednesday forecast that UK GDP would shrink by 11.3% this year, its worst annual performance since “the Great Frost of 1709”.

“The coronavirus pandemic has delivered the largest peacetime shock to the global economy on record and the UK economy has been hit relatively hard by it,” the OBR said.

While activity is expected to pick up next year as restrictions ease, the UK is not expected to return to pre-pandemic levels until the end of 2022. Permanent “scarring” means the UK economy is forecast to be 3% smaller by 2025 than economists had previously expected.

Unemployment is likely to hit 2.6 million next year as the furlough scheme ends, the OBR said. Jobless numbers will remain above pre-pandemic levels until at least 2025.

The OBR’s forecasts came in response to the UK chancellor’s spending review, which was published on Wednesday.

READ MORE: Minimum wage hike for two million workers as public sector pay freeze confirmed

“The economic damage is likely to be lasting,” chancellor Rishi Sunak said in parliament, warning that the “economic emergency” caused by the pandemic was only just beginning.

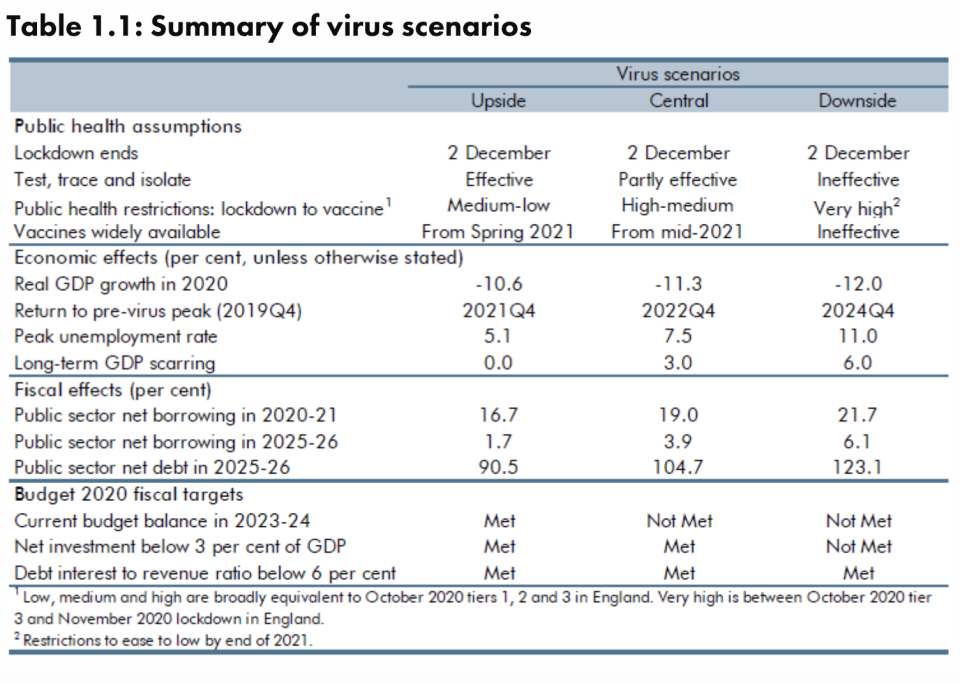

The OBR’s figures form part of its “central scenario.” The watchdog warned that the outlook was “highly uncertain” and presented three possible scenarios for the economy morning forward.

In the best case scenario, GDP still declines by over 10% this year and the economy takes until the end of next year to recover. This timeline requires current lockdowns to effectively control the second wave of COVID-19 infections and assumes a quick and effective rollout of vaccines next year.

In the worst case scenario, the UK economy shrinks by 12% this year and does not recover until the end of 2024. The downside scenario assumes lockdowns must be extended and vaccines prove ineffective.

All three scenarios assume the UK reaches a trade deal with the EU. Failure to strike a deal would would provide an immediate 2% shock to GDP and reduce longer term GDP by 1.5%.

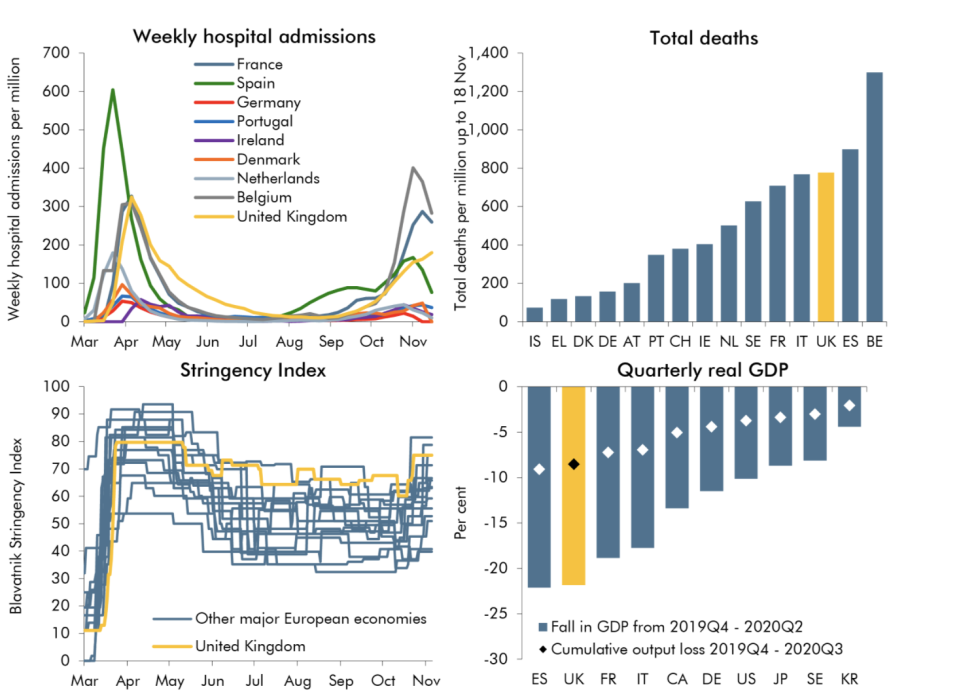

The UK has so far suffered a “deeper fall and slower recovery in economic activity” than its European neighbours due to the government’s decision to lockdown later than other nations and remain locked down for longer, the OBR said.

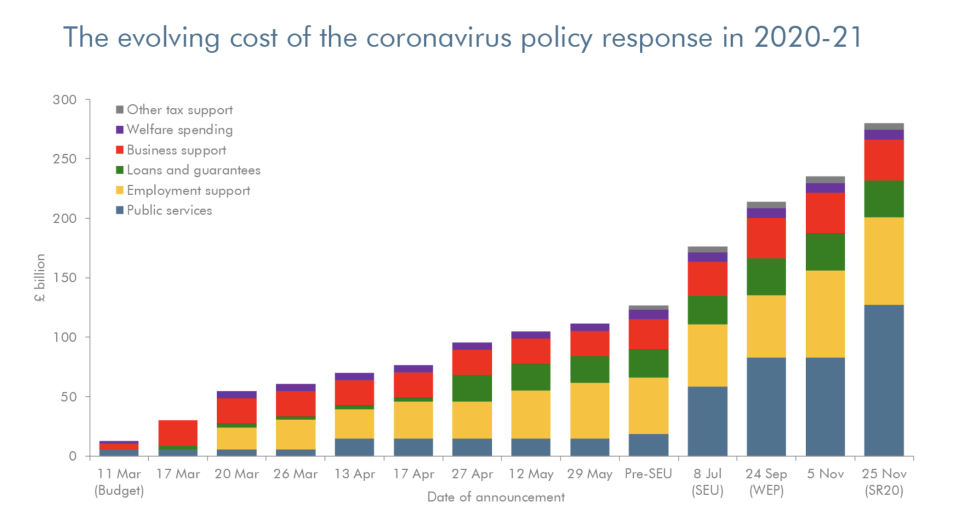

As well as hobbling the economy, the pandemic has “exacted a heavy and mounting toll on the public finances,” the OBR said.

The government deficit is forecast to be almost £400bn this year — equivalent to 19% of GDP. State borrowing is forecast to be over £100bn for the next five years.

The OBR said the large deficit and rise in borrowing was largely down to increased spending on the NHS and furlough, rather than the impact of a shrinking economy.

READ MORE: Chancellor Rishi Sunak warns 'economic emergency has only just begun'

However, the long-term economic impact from COVID-19 — coupled with elevated spending levels — leaves the government with a billion pound gap in its budget when it eventually seeks to balance the books.

“Even on the loosest conventional definition of balancing the books, a fiscal adjustment of £27bn (1 per cent of GDP) would be required to match day-to-day spending to receipts by the end of the five-year forecast period,” the OBR said.

The chancellor announced a partial pay freeze for public sector workers on Wednesday and cut foreign aid contributions. Speculation is mounting that the chancellor will launch a tax raid in the coming years to help pay for the cost of the pandemic response.

Watch: Bank of England warns long-term effects of no-deal Brexit worse than pandemic

Yahoo Movies

Yahoo Movies