Redfin (NASDAQ:RDFN) shareholders have endured a 88% loss from investing in the stock a year ago

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So spare a thought for the long term shareholders of Redfin Corporation (NASDAQ:RDFN); the share price is down a whopping 88% in the last twelve months. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. We note that it has not been easy for shareholders over three years, either; the share price is down 62% in that time. The falls have accelerated recently, with the share price down 40% in the last three months. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Redfin

Redfin wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Redfin saw its revenue grow by 96%. That's well above most other pre-profit companies. So the hefty 88% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

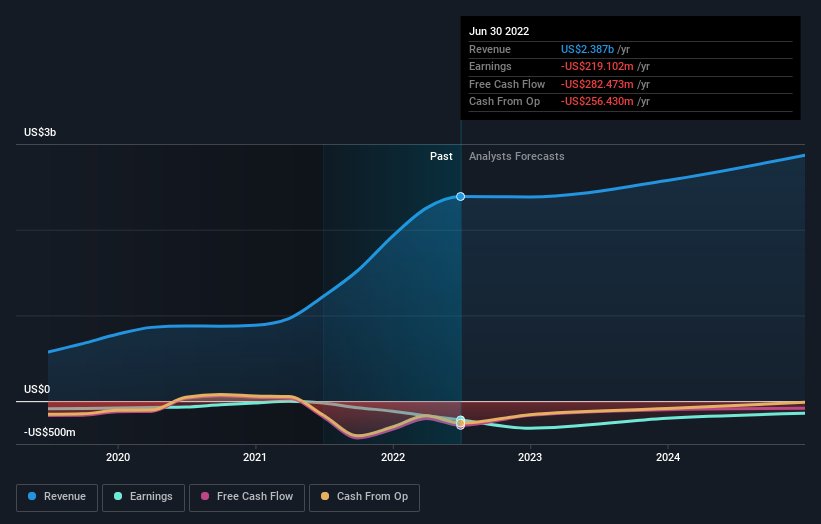

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market lost about 18% in the twelve months, Redfin shareholders did even worse, losing 88%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Redfin is showing 3 warning signs in our investment analysis , you should know about...

Redfin is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies