I Ran A Stock Scan For Earnings Growth And Norfolk Southern (NYSE:NSC) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Norfolk Southern (NYSE:NSC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Norfolk Southern

How Fast Is Norfolk Southern Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years Norfolk Southern grew its EPS by 7.7% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Norfolk Southern is growing revenues, and EBIT margins improved by 4.4 percentage points to 41%, over the last year. That's great to see, on both counts.

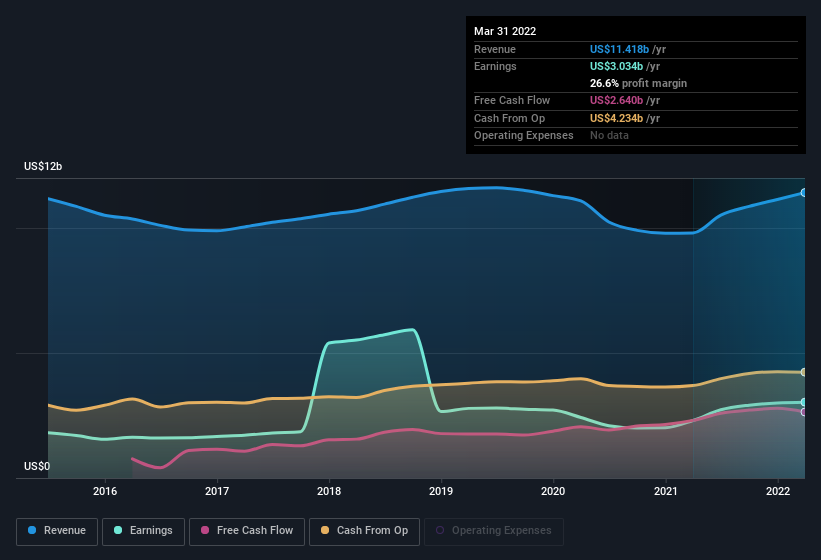

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Norfolk Southern's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Norfolk Southern Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While we did see insider selling of Norfolk Southern stock in the last year, one single insider spent plenty more buying. Specifically the Independent Director, Claude Mongeau, spent US$664k, paying about US$283 per share. That certainly pricks my ears up.

The good news, alongside the insider buying, for Norfolk Southern bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping US$69m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Alan Shaw is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations over US$8.0b, like Norfolk Southern, the median CEO pay is around US$13m.

The Norfolk Southern CEO received total compensation of just US$4.4m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Norfolk Southern Deserve A Spot On Your Watchlist?

As I already mentioned, Norfolk Southern is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Before you take the next step you should know about the 2 warning signs for Norfolk Southern that we have uncovered.

As a growth investor I do like to see insider buying. But Norfolk Southern isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies