Q2 Holdings (NYSE:QTWO) adds US$72m to market cap in the past 7 days, though investors from three years ago are still down 67%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Q2 Holdings, Inc. (NYSE:QTWO) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 67% in that time. And over the last year the share price fell 65%, so we doubt many shareholders are delighted. Furthermore, it's down 30% in about a quarter. That's not much fun for holders.

While the stock has risen 5.0% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Q2 Holdings

Given that Q2 Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Q2 Holdings grew revenue at 21% per year. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 19% over that time, a bad result. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

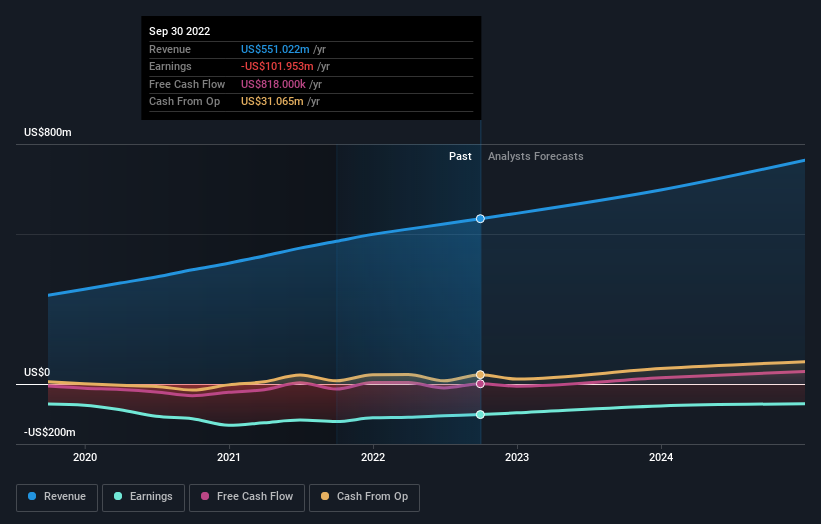

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Q2 Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Q2 Holdings stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market lost about 16% in the twelve months, Q2 Holdings shareholders did even worse, losing 65%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Q2 Holdings better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Q2 Holdings .

We will like Q2 Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies