A Piece Of The Puzzle Missing From Cardinal Energy Ltd.'s (TSE:CJ) 26% Share Price Climb

Cardinal Energy Ltd. (TSE:CJ) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 205% following the latest surge, making investors sit up and take notice.

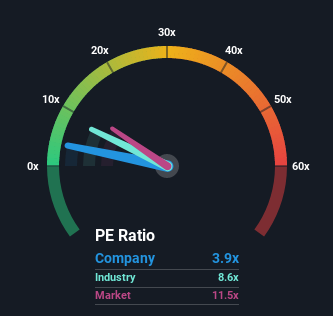

In spite of the firm bounce in price, Cardinal Energy's price-to-earnings (or "P/E") ratio of 3.9x might still make it look like a strong buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 12x and even P/E's above 27x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Cardinal Energy certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Cardinal Energy

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Cardinal Energy's earnings, revenue and cash flow.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Cardinal Energy's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 371% gain to the company's bottom line. Pleasingly, EPS has also lifted 388% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Cardinal Energy is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Shares in Cardinal Energy are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Cardinal Energy currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Cardinal Energy (2 are a bit unpleasant!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Cardinal Energy. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies