ONEOK's (OKE) Expansion Efforts, Fee-Based Earnings Bode Well

ONEOK, Inc. OKE is well-poised to gain from its strategic buyout of ONEOK Partners, improved fee-based earnings and midstream assets located in the higher productive regions.

The Zacks Consensus Estimate for the company’s 2021 earnings is pegged at $3.33 per share, suggesting growth of 134.51% from the year-ago reported figure. The consensus mark for revenues stands at $14.11 billion, indicating an increase of 65.19% from the prior-year reported number. The long-term (three to five years) earnings growth rate of ONEOK is 6%.

What’s Aiding the Stock?

ONEOK is well-placed to benefit from long-term fee-based commitments to its Natural Gas Gathering and Processing, and Natural Gas Liquids segments. The company reported more than 90% of its 2020 earnings as fee-based.

It continues to invest in organic growth projects for expansion in the existing operating regions and also provides a broad range of services to crude oil and natural gas producers as well as the end-use markets. Besides, ONEOK Partners is the primary growth vehicle of ONEOK and the completion of its acquisition is likely to be accretive to its distributable cash flow from 2017 through 2021.

Also, no single customer contributes more than 10% to ONEOK’s total revenues. In a way, this gives stability to its top line and in fact, the loss of one customer is not going to affect the company’s performance.

Headwinds

However, stringent government regulations and intense competition in the company’s pipeline business are potential growth deterrents. Also, it does not own all the land on which its pipelines are located, which maximizes its risks of incurring elevated expenses to maintain necessary land use.

Zacks Rank & Price Performance

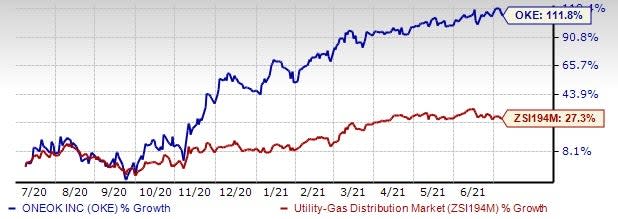

The stock currently carries a Zacks Rank #3 (Hold). In the past year, shares of the company have surged 111.8% compared with the industry’s 27.3% rise.

One Year Price Performance

Image Source: Zacks Investment Research

Stocks to Consider

A few better-ranked utilities are NewJersey Resources Corporation NJR, Hawaiian Electric Industries, Inc. HE and UGI Corporation UGI, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NewJersey Resources’ long-term (three to five years) earnings growth rate is pegged at 7.1%. The Zacks Consensus Estimate for fiscal 2021 earnings has been revised 12.8% upward in the past 60 days.

The Zacks Consensus Estimate for Hawaiian Electric Industries’ 2021 earnings has been revised 8.8% upward in the past 60 days. The company’s long-term earnings growth rate is pegged at 7.1%.

UGI Corporation’s long-term earnings growth rate stands at 8%. The company delivered a trailing four-quarter earnings surprise of 58.23%, on average.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Hawaiian Electric Industries, Inc. (HE) : Free Stock Analysis Report

UGI Corporation (UGI) : Free Stock Analysis Report

NewJersey Resources Corporation (NJR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Movies

Yahoo Movies