Workers earning £50,000 a year will enjoy biggest tax breaks under Truss

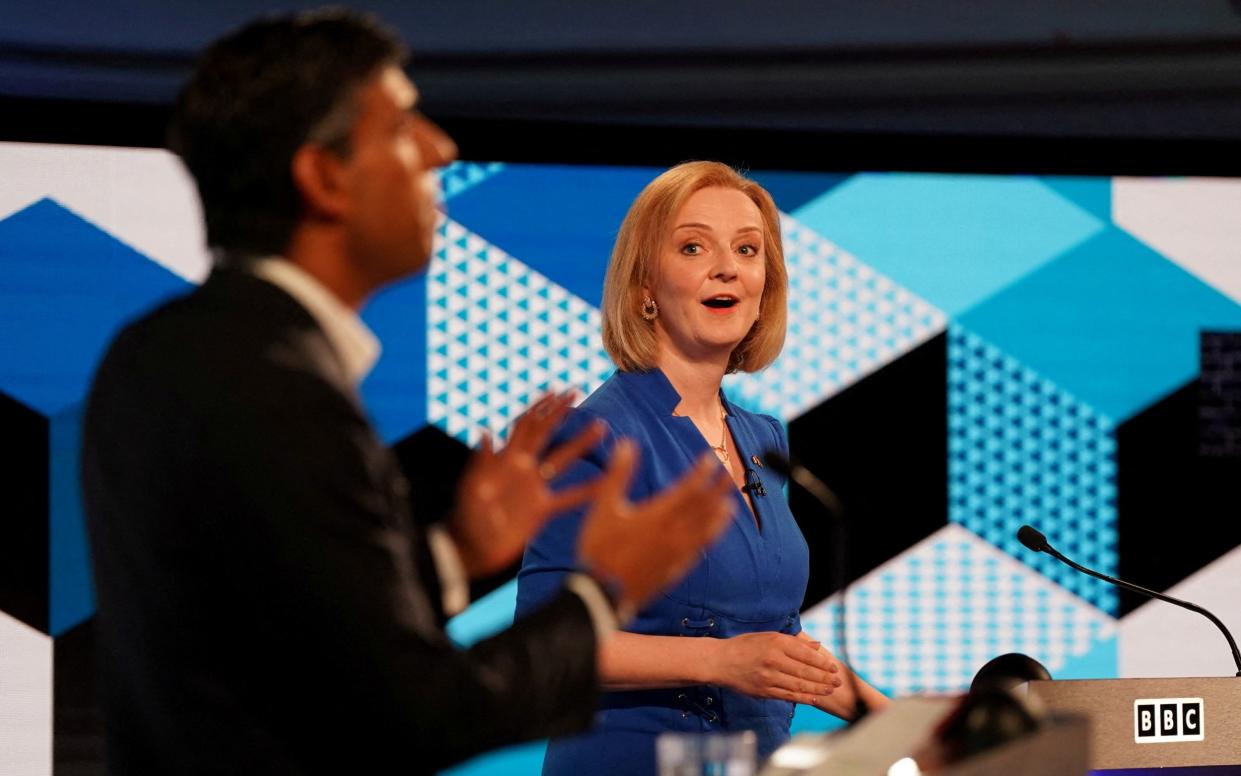

Tax has been at the heart of the Conservative leadership race. But will Liz Truss or Rishi Sunak leave more in your pocket once the taxman has taken his share? Telegraph Money commissioned accountancy firm Blick Rothenberg to crunch the numbers, whether you are earning £20,000 a year or £120,000.

While Ms Truss’s campaign has been defined by its radical plan to slash taxes almost immediately, the analysis revealed that people earning between £60,000 and £100,000 would actually be better off under Mr Sunak – but not for another seven years, when the full extent of his tax policy is expected to take effect.

Overall, Ms Truss is the clear winner in terms of tax cuts. Blick found the Foreign Secretary’s £40bn in proposed tax cuts would leave both lower and higher earners with a higher net income. The biggest tax breaks will be received by those earning £50,000 a year. These taxpayers would get a £2,979 increase to their annual pay packet under Ms Truss compared with what they are paying in the current 2022-23 tax year.

In contrast to what Mr Sunak is offering, this works out at £1,532 extra a year. Higher earners also get a good deal under Ms Truss.

Reaping the benefits of her plan to reverse the 1.25pc health and social care levy – a new charge introduced by Mr Sunak himself – someone on an annual salary of £120,000 would get a windfall of £1,720 while a £200,000-a-year earner would take home £2,720 more. For the latter group, this is £1,212 more than Mr Sunak’s pledges would give them.

However, it is lower income workers who see the most dramatic differences between a Truss-led and Sunak-led government – worth £1,882 for those on £30,000 a year. Nimesh Shah, chief executive of Blick Rothenberg, said this windfall was largely driven by Ms Truss’s “enhanced transferable marriage allowance” – which amounts to a tax break worth up to £2,644 a year for basic-rate taxpayers.

For middle earners on £60,000 to £100,000, the picture is slightly different. People in this income bracket will ultimately be better off under Mr Sunak – but only once his changes to the basic rate of income tax kick in. Whereas Ms Truss has promised to slash taxes from “day one”, Mr Sunak’s reduction of the basic rate, from 20pc to 16pc, will not come into play until 2029.

So while higher-rate taxpayers will take home £1,508 more compared with the 2020-21 tax year, when Mr Sunak became chancellor, that is only once they have waited a full seven years. Before then, they will first get a £377 boost when Mr Sunak starts lowering the basic rate in 2024, to 19pc initially.

Even then, Mr Shah said the benefits are “marginal” compared with those offered by Ms Truss. For someone earning £100,000, a Sunak government will result in a measly £39 more a year than under Ms Truss. “Someone earning £80,000 will only be £289 better off – hardly worth the wait,” said Mr Shah.

The tax break is more generous for someone on £60,000, who would see a £539 uplift – but again this is assuming they are patient enough to wait until 2029. With consumer prices soaring, this may be too little too late.

John O’Connell, chief executive of the TaxPayers’ Alliance, said: “Double-digit inflation is hitting households hard. A 70-year-high tax burden and record-busting price rises are placing an unbearable toll on firms and families. The new Tory leader should remember that the best way to help taxpayers is by putting money back into people’s pockets through targeted tax cuts.”

But some argue the impact of tax cuts could be undermined if they stoke inflation, causing even tighter monetary policy from the Bank of England. Laith Khalaf, of investment firm AJ Bell, said this could mean the extra cash that people get from tax cuts is quickly eaten up by higher mortgages and loan payments. “The combined effect could be a bit like robbing Peter simply to pay Peter,” he said.

For Mr Shah, a major issue remains overlooked by both candidates – the freezing until 2026 of the personal tax allowance and income tax thresholds. So-called “fiscal drag” means more workers will find themselves swept up in Mr Sunak’s stealth tax raid. “If the candidates want to do the right thing, they should be leading with a promise to reset the allowances and thresholds to increase with inflation and cancel Sunak’s big freeze,” said Mr Shah.

Yahoo Movies

Yahoo Movies