Shareholders May Not Be So Generous With HomeStreet, Inc.'s (NASDAQ:HMST) CEO Compensation And Here's Why

CEO Mark Mason has done a decent job of delivering relatively good performance at HomeStreet, Inc. (NASDAQ:HMST) recently. As shareholders go into the upcoming AGM on 27 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for HomeStreet

How Does Total Compensation For Mark Mason Compare With Other Companies In The Industry?

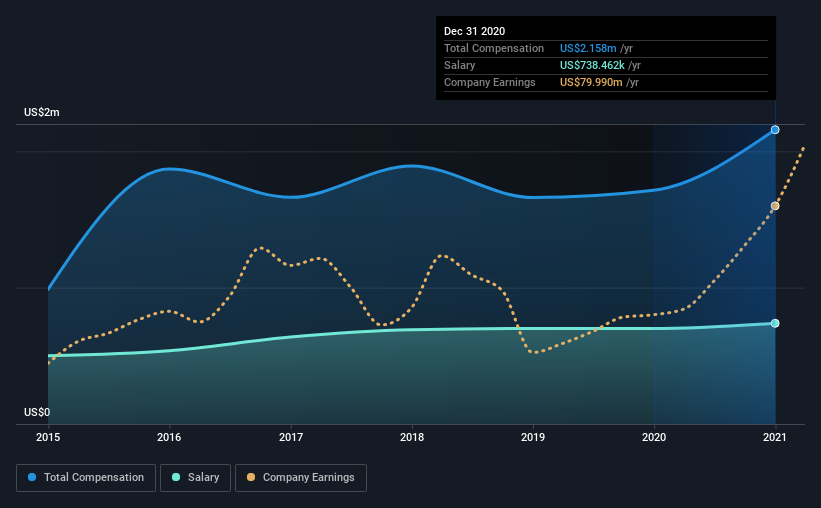

According to our data, HomeStreet, Inc. has a market capitalization of US$949m, and paid its CEO total annual compensation worth US$2.2m over the year to December 2020. Notably, that's an increase of 26% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$738k.

For comparison, other companies in the same industry with market capitalizations ranging between US$400m and US$1.6b had a median total CEO compensation of US$1.5m. This suggests that Mark Mason is paid more than the median for the industry. Moreover, Mark Mason also holds US$7.1m worth of HomeStreet stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$738k | US$700k | 34% |

Other | US$1.4m | US$1.0m | 66% |

Total Compensation | US$2.2m | US$1.7m | 100% |

Talking in terms of the broader industry, salary and other compensation roughly make up 50% each, of the total compensation. HomeStreet sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at HomeStreet, Inc.'s Growth Numbers

HomeStreet, Inc. has seen its earnings per share (EPS) increase by 26% a year over the past three years. In the last year, its revenue is up 34%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has HomeStreet, Inc. Been A Good Investment?

We think that the total shareholder return of 66%, over three years, would leave most HomeStreet, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for HomeStreet (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from HomeStreet, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies