Reflecting on Dogness (International)'s (NASDAQ:DOGZ) Share Price Returns Over The Last Three Years

Dogness (International) Corporation (NASDAQ:DOGZ) shareholders should be happy to see the share price up 24% in the last month. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 60%. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Check out our latest analysis for Dogness (International)

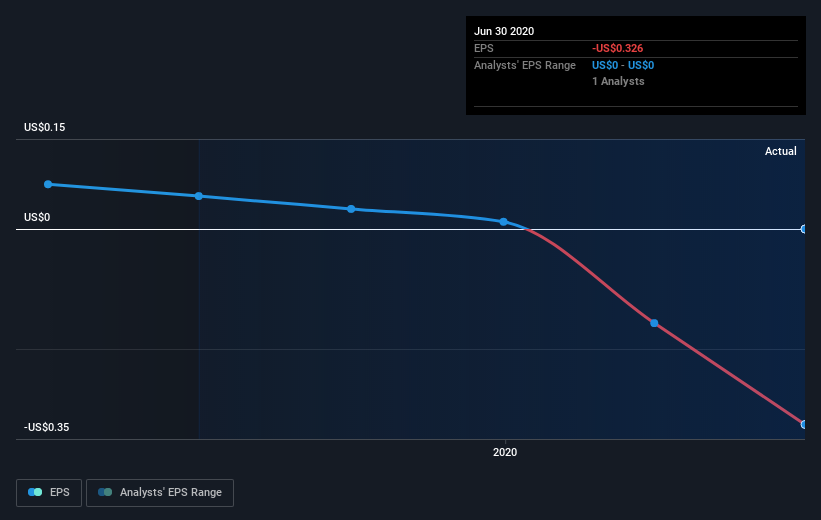

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Dogness (International) saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Dogness (International)'s key metrics by checking this interactive graph of Dogness (International)'s earnings, revenue and cash flow.

A Different Perspective

Dogness (International) shareholders are up 0.6% for the year. Unfortunately this falls short of the market return of around 39%. The silver lining is that the recent rise is far preferable to the annual loss of 17% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Dogness (International) you should be aware of, and 1 of them is a bit concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies