Is Perma-Pipe International Holdings, Inc. (NASDAQ:PPIH) A Financially Sound Company?

Investors are always looking for growth in small-cap stocks like Perma-Pipe International Holdings, Inc. (NASDAQ:PPIH), with a market cap of US$68m. However, an important fact which most ignore is: how financially healthy is the business? Given that PPIH is not presently profitable, it’s essential to understand the current state of its operations and pathway to profitability. I believe these basic checks tell most of the story you need to know. Nevertheless, since I only look at basic financial figures, I’d encourage you to dig deeper yourself into PPIH here.

How much cash does PPIH generate through its operations?

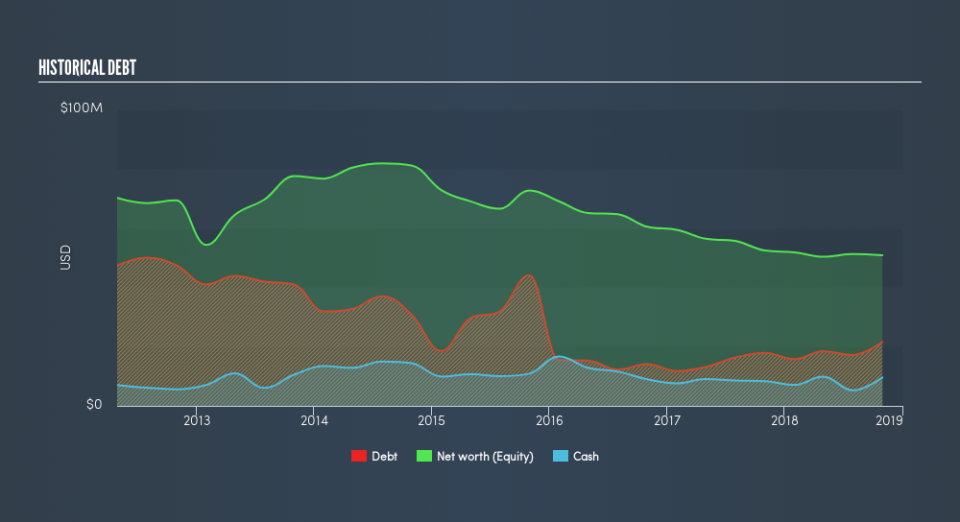

PPIH has built up its total debt levels in the last twelve months, from US$18m to US$22m – this includes long-term debt. With this increase in debt, the current cash and short-term investment levels stands at US$9.6m , ready to deploy into the business. Moreover, PPIH has generated cash from operations of US$1.7m over the same time period, resulting in an operating cash to total debt ratio of 8.0%, signalling that PPIH’s operating cash is not sufficient to cover its debt. This ratio can also be interpreted as a measure of efficiency for unprofitable businesses since metrics such as return on asset (ROA) requires a positive net income. In PPIH’s case, it is able to generate 0.08x cash from its debt capital.

Can PPIH meet its short-term obligations with the cash in hand?

Looking at PPIH’s US$41m in current liabilities, it appears that the company has been able to meet these commitments with a current assets level of US$64m, leading to a 1.58x current account ratio. Generally, for Machinery companies, this is a reasonable ratio since there’s a sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Can PPIH service its debt comfortably?

With debt reaching 43% of equity, PPIH may be thought of as relatively highly levered. This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. However, since PPIH is currently unprofitable, sustainability of its current state of operations becomes a concern. Maintaining a high level of debt, while revenues are still below costs, can be dangerous as liquidity tends to dry up in unexpected downturns.

Next Steps:

PPIH’s high cash coverage means that, although its debt levels are high, the company is able to utilise its borrowings efficiently in order to generate cash flow. This may mean this is an optimal capital structure for the business, given that it is also meeting its short-term commitment. This is only a rough assessment of financial health, and I’m sure PPIH has company-specific issues impacting its capital structure decisions. I recommend you continue to research Perma-Pipe International Holdings to get a more holistic view of the small-cap by looking at:

Historical Performance: What has PPIH’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies