How Much Is TriCo Bancshares (NASDAQ:TCBK) CEO Getting Paid?

This article will reflect on the compensation paid to Rick Smith who has served as CEO of TriCo Bancshares (NASDAQ:TCBK) since 1999. This analysis will also assess whether TriCo Bancshares pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for TriCo Bancshares

How Does Total Compensation For Rick Smith Compare With Other Companies In The Industry?

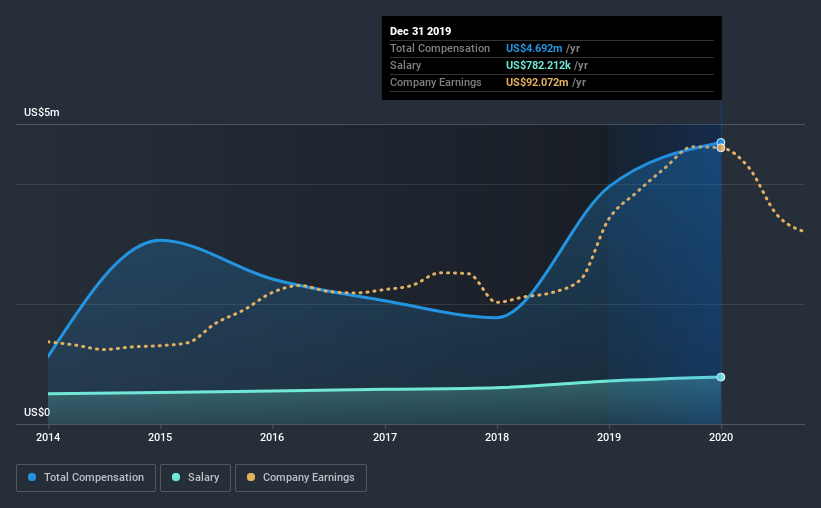

According to our data, TriCo Bancshares has a market capitalization of US$899m, and paid its CEO total annual compensation worth US$4.7m over the year to December 2019. We note that's an increase of 19% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$782k.

On examining similar-sized companies in the industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$1.9m. Hence, we can conclude that Rick Smith is remunerated higher than the industry median. Moreover, Rick Smith also holds US$7.3m worth of TriCo Bancshares stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$782k | US$715k | 17% |

Other | US$3.9m | US$3.2m | 83% |

Total Compensation | US$4.7m | US$4.0m | 100% |

Talking in terms of the industry, salary represented approximately 43% of total compensation out of all the companies we analyzed, while other remuneration made up 57% of the pie. TriCo Bancshares pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

TriCo Bancshares' Growth

Over the last three years, TriCo Bancshares has not seen its earnings per share change much, though they have deteriorated slightly. Its revenue is down 12% over the previous year.

The lack of EPS growth is certainly unimpressive. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has TriCo Bancshares Been A Good Investment?

Given the total shareholder loss of 20% over three years, many shareholders in TriCo Bancshares are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, TriCo Bancshares is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Disappointingly, share price gains over the last three years have failed to materialize. Add to that declining EPS growth, and you have the perfect recipe for shareholder irritation. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for TriCo Bancshares that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Movies

Yahoo Movies