Is MKS Instruments Inc’s (NASDAQ:MKSI) CEO Overpaid Relative To Its Peers?

Jerry Colella took the helm as MKS Instruments Inc’s (NASDAQ:MKSI) CEO and grew market cap to US$4.93b recently. Understanding how CEOs are incentivised to run and grow their company is an important aspect of investing in a stock. Incentives can be in the form of compensation, which should always be structured in a way that promotes value-creation to shareholders. I will break down Colella’s pay and compare this to the company’s performance over the same period, as well as measure it against other US CEOs leading companies of similar size and profitability.

Check out our latest analysis for MKS Instruments

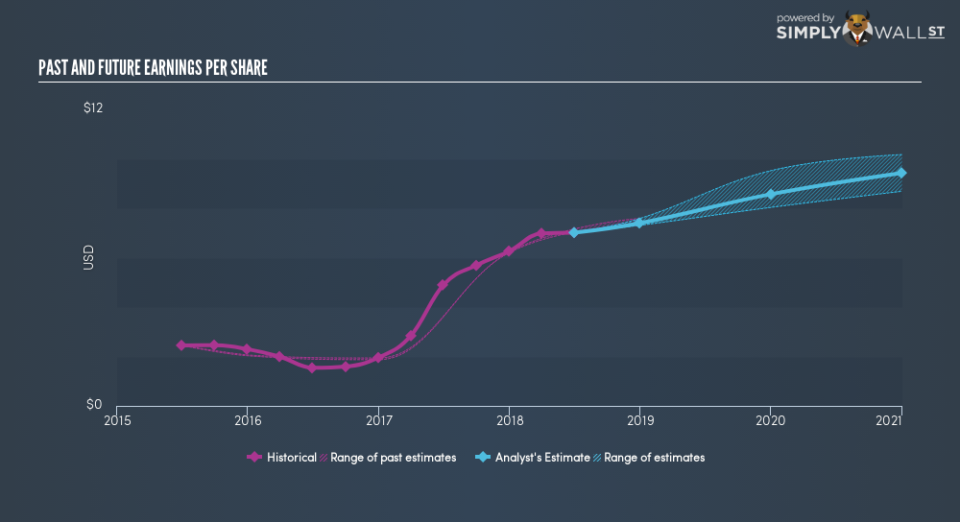

What has been the trend in MKSI’s earnings?

MKSI can create value to shareholders by increasing its profitability, which in turn is reflected into the share price and the investor’s ability to sell their shares at higher capital gains. In the past year, MKSI produced a profit of US$381.62m , which is an increase of 44.81% from its previous year’s earnings of US$263.54m. This is an encouraging signal that MKSI aims to sustain a strong track record of generating profits regardless of the challenges. As profits are moving up and up, CEO pay should mirror Colella’s hard work. During the same period, Colella’s total remuneration fell by -14.58%, to US$5.62m. In addition to this, Colella’s pay is also made up of 53.40% non-cash elements, which means that variabilities in MKSI’s share price can impact the real level of what the CEO actually receives.

Is MKSI’s CEO overpaid relative to the market?

Despite the fact that one size does not fit all, since compensation should be tailored to the specific company and market, we can gauge a high-level thresold to see if MKSI is an outlier. This exercise can help direct shareholders to ask the right question about Colella’s incentive alignment. Generally, a US mid-cap has a value of $5B, produces earnings of $290M and remunerates its CEO circa $5.3M annually. Based on the size of MKSI in terms of market cap, as well as its performance, using earnings as a proxy, it appears that Colella is paid higher than other US CEOs of mid-caps, on average. Though this is merely a high-level estimate, investors should be cognizant of this expense.

What this means for you:

In the upcoming year’s AGM, shareholders should think about whether another increase in CEO pay is justified, should the board propose another executive pay raise. Although this analysis is relatively simplified, the fact that Colella’s pay is above its peer group should raise questions as to why this may be the case. If you have not done so already, I highly recommend you to complete your research by taking a look at the following:

Governance: To find out more about MKSI’s governance, look through our infographic report of the company’s board and management.

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of MKSI? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Movies

Yahoo Movies