Mirion Technologies, Inc.'s (NYSE:MIR) Popularity With Investors Is Under Threat From Overpricing

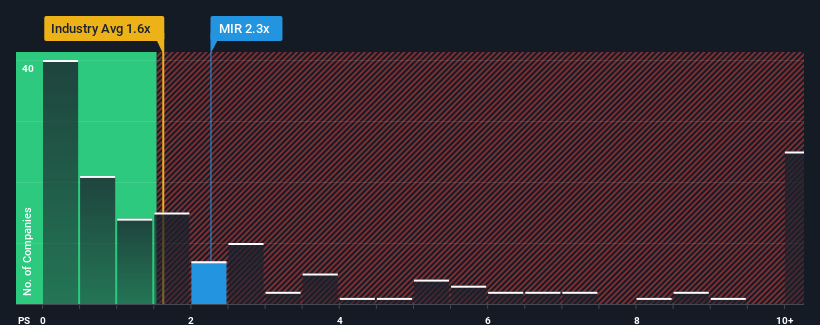

When close to half the companies in the Electronic industry in the United States have price-to-sales ratios (or "P/S") below 1.6x, you may consider Mirion Technologies, Inc. (NYSE:MIR) as a stock to potentially avoid with its 2.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Mirion Technologies

How Mirion Technologies Has Been Performing

Recent revenue growth for Mirion Technologies has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mirion Technologies.

How Is Mirion Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, Mirion Technologies would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. This was backed up an excellent period prior to see revenue up by 54% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.4% during the coming year according to the three analysts following the company. With the industry predicted to deliver 16% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Mirion Technologies' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Mirion Technologies, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Mirion Technologies with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies