The Levi Strauss (NYSE:LEVI) Share Price Is Up 10% And Shareholders Are Holding On

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. Over the last year the Levi Strauss & Co. (NYSE:LEVI) share price is up 10%, but that's less than the broader market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for Levi Strauss

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months Levi Strauss went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Unfortunately Levi Strauss' fell 20% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

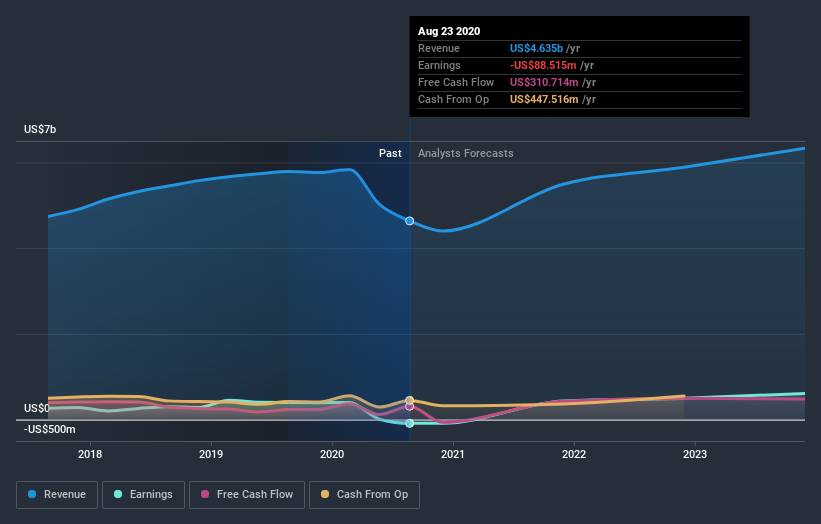

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Levi Strauss' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're happy to report that Levi Strauss are up 12% over the year. The bad news is that's no better than the average market return, which was roughly 22%. Shareholders are doubtless excited that the stock price has been doing even better lately, with a gain of 53% in just ninety days. The very recent increase in the share price could be evidence that the narrative is changing for the better due to fundamental improvements. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Levi Strauss has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Movies

Yahoo Movies