Can You Imagine How Chuffed GSI Technology's (NASDAQ:GSIT) Shareholders Feel About Its 109% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the GSI Technology, Inc. (NASDAQ:GSIT) share price has flown 109% in the last three years. That sort of return is as solid as granite.

View our latest analysis for GSI Technology

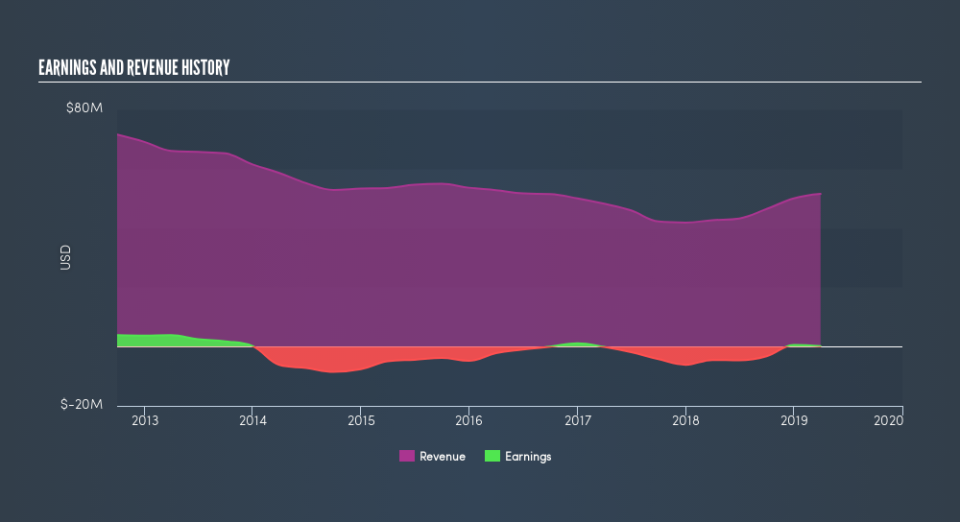

While GSI Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years GSI Technology saw its revenue shrink by 3.3% per year. So the share price gain of 28% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that GSI Technology has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on GSI Technology

A Different Perspective

We're pleased to report that GSI Technology shareholders have received a total shareholder return of 19% over one year. That's better than the annualised return of 6.0% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies