Frequency Electronics' (NASDAQ:FEIM) Stock Price Has Reduced 20% In The Past Year

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Frequency Electronics, Inc. (NASDAQ:FEIM) have tasted that bitter downside in the last year, as the share price dropped 20%. That contrasts poorly with the market return of 13%. However, the longer term returns haven't been so bad, with the stock down 2.6% in the last three years. The falls have accelerated recently, with the share price down 13% in the last three months.

View our latest analysis for Frequency Electronics

Frequency Electronics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year Frequency Electronics saw its revenue fall by 18%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 20% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

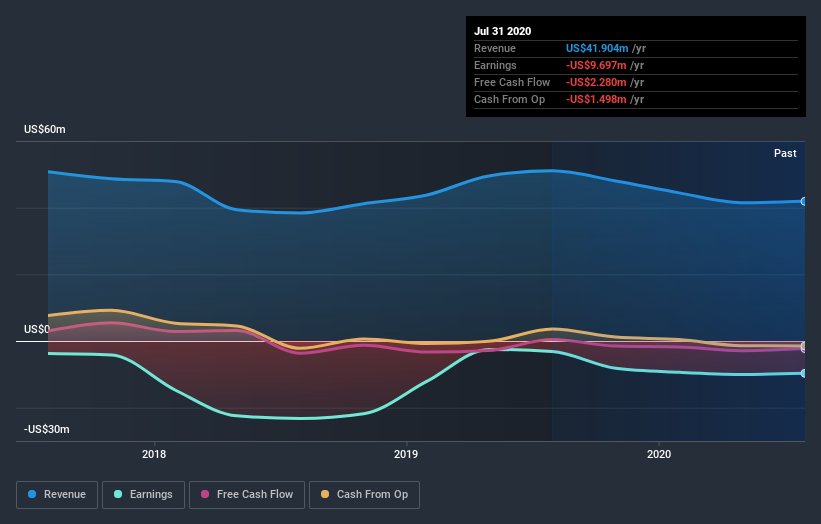

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Frequency Electronics' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 13% in the last year, Frequency Electronics shareholders lost 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Frequency Electronics is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

Of course Frequency Electronics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Movies

Yahoo Movies