If You Like EPS Growth Then Check Out Greenland Technologies Holding (NASDAQ:GTEC) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Greenland Technologies Holding (NASDAQ:GTEC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Greenland Technologies Holding

Greenland Technologies Holding's Improving Profits

Over the last three years, Greenland Technologies Holding has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Greenland Technologies Holding boosted its trailing twelve month EPS from US$0.56 to US$0.67, in the last year. I doubt many would complain about that 20% gain.

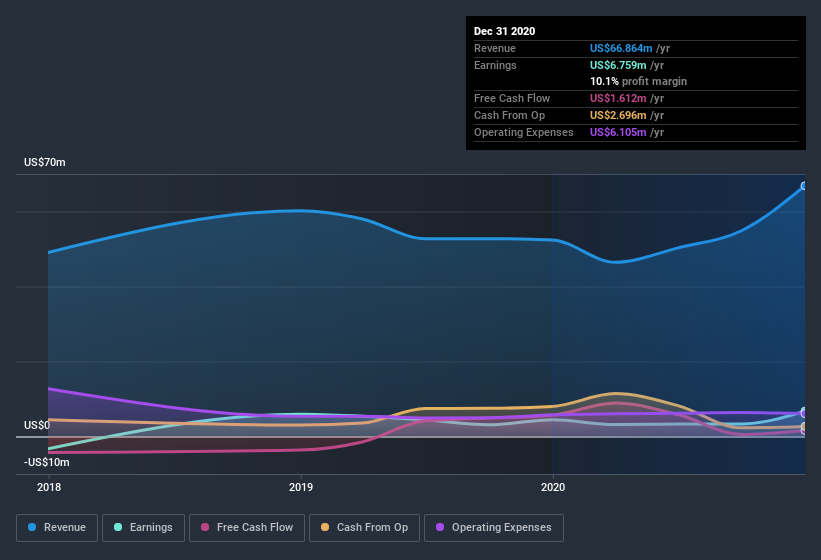

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Greenland Technologies Holding did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since Greenland Technologies Holding is no giant, with a market capitalization of US$88m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Greenland Technologies Holding Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Greenland Technologies Holding insiders own a meaningful share of the business. In fact, they own 71% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have US$63m invested in the business, using the current share price. That's nothing to sneeze at!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations under US$200m, like Greenland Technologies Holding, the median CEO pay is around US$514k.

The Greenland Technologies Holding CEO received total compensation of just US$214k in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Greenland Technologies Holding Deserve A Spot On Your Watchlist?

One important encouraging feature of Greenland Technologies Holding is that it is growing profits. The fact that EPS is growing is a genuine positive for Greenland Technologies Holding, but the pretty picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Still, you should learn about the 5 warning signs we've spotted with Greenland Technologies Holding (including 1 which is a bit unpleasant) .

Although Greenland Technologies Holding certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies