Some Duluth Holdings (NASDAQ:DLTH) Shareholders Have Copped A Big 64% Share Price Drop

Duluth Holdings Inc. (NASDAQ:DLTH) shareholders are doubtless heartened to see the share price bounce 30% in just one week. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 64% in that time. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for Duluth Holdings

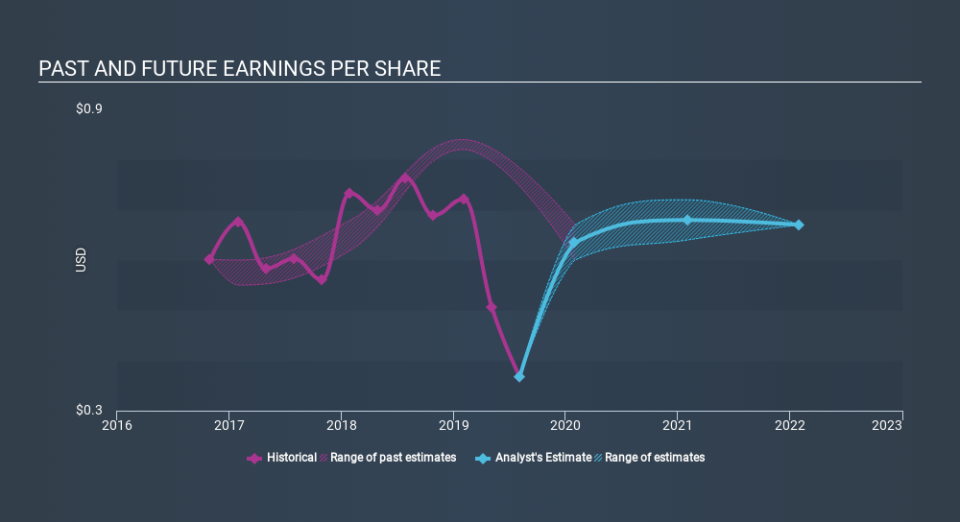

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years that the share price fell, Duluth Holdings's earnings per share (EPS) dropped by 18% each year. This reduction in EPS is slower than the 29% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Duluth Holdings's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Duluth Holdings shares, which cost holders 60%, while the market was up about 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 29% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Movies

Yahoo Movies