Despite the Growth Prospects, the Risk of Dilution Keeps Looming over fuboTV (NYSE:FUBO)

This article first appeared on Simply Wall St News.

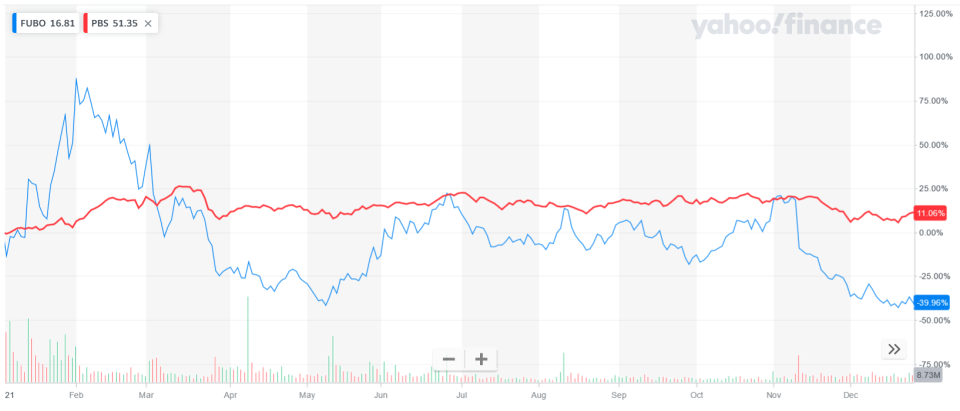

Although there were several bullish attempts through 2021,fuboTV Inc. (NYSE: FUBO) is ending the year on a low note.

Even though the media sector underperformed the broad market, FUBO dropped over 40% - remaining far from profitability and under heavy pressure from the shorts.

See our latest analysis for fuboTV

Looking back at the year, here is the visual comparison of fuboTV against the media sector (Invesco Dynamic Media ETF)

Despite the negative sentiment, there are contrarians out there. For example, J.P.Morgan recently initiated coverage with an Overweight rating and a US$28 price target. Analyst Anna Lizzul quoted the company's position to achieve double-digit revenue growth per user.

The upgrade came shortly after FuboTV closed an acquisition of a streaming company Molotov SAS faster than expected. Molotov provides Fubo with a strong foothold in France, with 4 million users across the country.

Why Does Debt Bring Risk?

Debt assists a business until it has trouble paying it off, either with new capital or with free cash flow. In the worst-case scenario, a company can go bankrupt if not paying its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth without negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

What Is fuboTV's Debt?

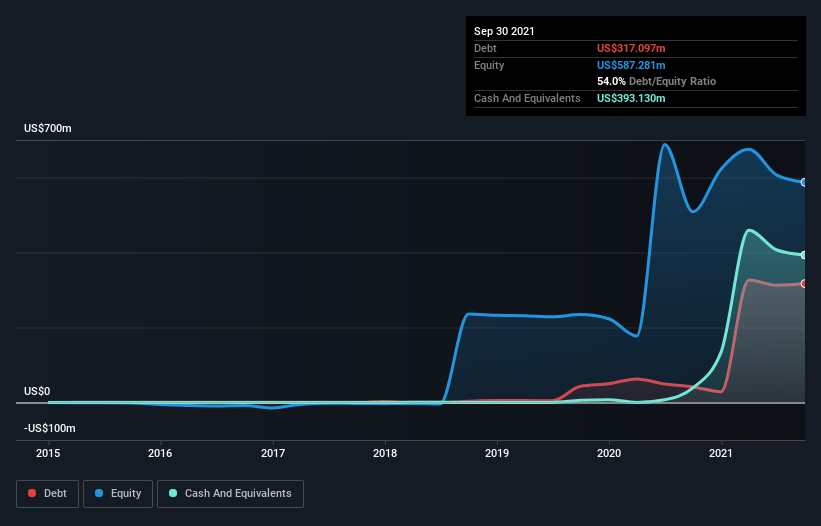

As you can see below, at the end of September 2021, fuboTV had US$317.1m of debt, up from US$41.5m a year ago. Click the image for more detail. But it also has US$393.1m in cash to offset that, meaning it has US$76.0m net cash.

How Strong Is fuboTV's Balance Sheet?

The latest balance sheet data shows that fuboTV had liabilities of US$251.4m due within a year and liabilities of US$321.5m falling due after that. Offsetting these obligations, it had cash of US$393.1m as well as receivables valued at US$26.1m due within 12 months. So it has liabilities totaling US$153.7m more than its cash and near-term receivables combined.

Of course, fuboTV has a market capitalization of US$2.44b, so these liabilities are probably manageable. Despite its noteworthy liabilities, fuboTV boasts net cash, so it's fair to say it does not have a heavy debt load.

The balance sheet is the obvious place to start when analyzing debt levels. But ultimately, the future profitability of the business will decide if fuboTV can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, fuboTV reported revenue of US$512m, which is a significant growth of 361%, although it did not report any earnings before interest and tax.

So How Risky Is fuboTV?

Statistically, companies that lose money are riskier than those that make money. And the fact is that over the last twelve months, fuboTV lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time, it burnt through US$254m of cash and made a loss of US$439m.

If this trend continues, the company will likely need more cash. Although it is not heavily indebted, the risk of dilution brings considerable risks for new investors. According to our data, the total shares outstanding grew by 127.7% in the past 12 months. This is a big deal because dilution is the fastest way to erase shareholders' value.

However, not all investment risk resides within the balance sheet - far from it. For example, fuboTV has 3 warning signs (and 1 which is significant) we think you should know about.

At the end of the day, it's often better to focus on companies free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Movies

Yahoo Movies