Is Clarus's (NASDAQ:CLAR) 233% Share Price Increase Well Justified?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. To wit, the Clarus Corporation (NASDAQ:CLAR) share price has flown 233% in the last three years. That sort of return is as solid as granite. It's also good to see the share price up 22% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 10% in 90 days).

See our latest analysis for Clarus

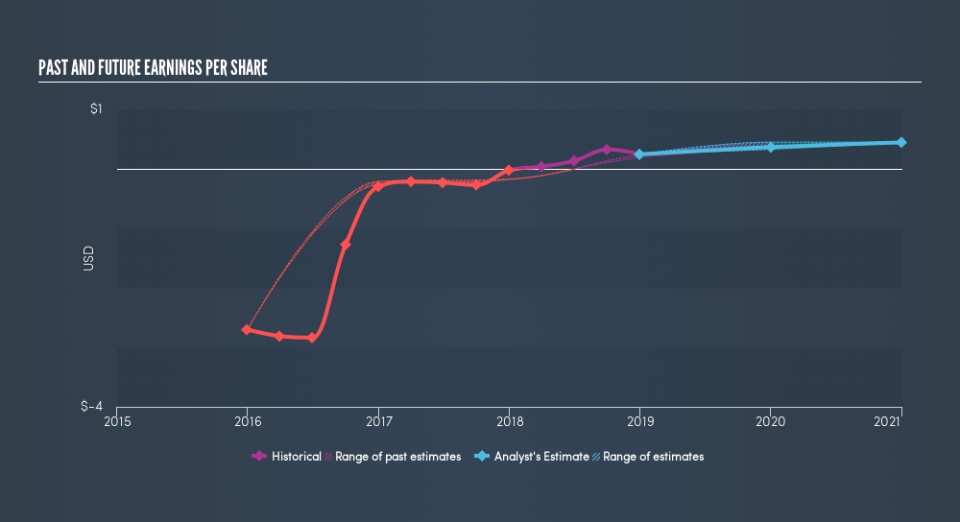

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Clarus became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Clarus has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Clarus the TSR over the last 3 years was 236%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Clarus has rewarded shareholders with a total shareholder return of 93% in the last twelve months. That's including the dividend. That's better than the annualised return of 4.9% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Movies

Yahoo Movies