Better Buy: Procter & Gamble vs. Coca-Cola

There may be no better example of a classic defensive stock than Procter & Gamble (NYSE: PG) or Coca-Cola (NYSE: KO). Both are giants of the consumer products industry, each with more than 20 billion-dollar brands, including Coke, Sprite, and Fanta for Coca-Cola, and Gillette, Tide, and Crest for P&G, that are among the most ubiquitous in the world.

As stocks, both offer similar benefits. The two companies are not just Dividend Aristocrats but Dividend Kings, meaning that they've raised their dividend every year for 50 years or more. Coca-Cola has hiked its dividend for 55 years straight, while Procter & Gamble's payout has increased for 62 years in a row. The two also offer similar dividend yields; P&G pays investors 3.1%, and Coke offers a 3.3% dividend yield.

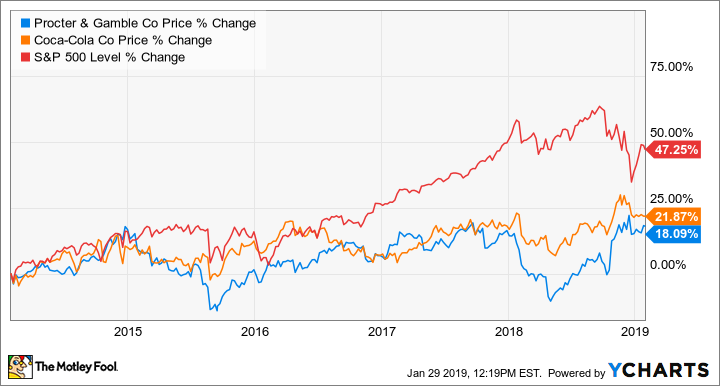

Both stocks are also known for their defensive positioning, meaning they pay reliable dividends and have businesses that prosper regardless of the overall economic climate. Even in a recession, consumers will still buy things like soap, soda, and razors. As the chart below shows, both have performed similarly over the last five years, but the two have also lagged the S&P 500.

Against that backdrop, let's take a closer look at each stock to see which is the better buy today.

Image source: Getty Images.

The drugstore fixture

After years of disappointing results as the company struggled with upstart challengers at home and saturated markets abroad, Procter & Gamble finally seems to be gaining some traction. The Pampers maker has topped expectations in its last two earnings reports, and organic sales, which strip out the effects of acquisitions, divestitures, and foreign exchange, are up 4% through the first half of its fiscal year, with the company seeing growth in all five of its business segments.

Its beauty segment has been particularly strong, with organic sales up 8% in the last two quarters as innovation in premium brands like SK-II and Olay have driven skin and personal care organic sales up double digits. Management also lifted its full-year guidance on organic sales growth from 2%-3% to 2%-4%.

The company is still facing some of the same challenges as before, including steep competition in grooming against its Gillette brand from the likes of Dollar Shave Club, now owned by rival Unilever, and Harry's. Yet it has made up for it in other areas like beauty, and fabric and home care. P&G has also cut costs and shed secondary brands like Cover Girl and a number of other cosmetics brands in a deal with Coty and shipped Duracell off to Warren Buffett's Berkshire Hathaway. That's allowed to company to focus on its biggest brands -- and the moves finally seem to be paying off as selling, general, and administrative expenses are coming down, which along with the organic sales growth is lifting currency-neutral operating margins.

The beverage king

Faced with a backlash against sugary drinks, Coca-Cola has been pivoting away from its classic stable of sodas, including the many varieties of Coke, Sprite, and Fanta. The company has diversified by acquiring brands like Vitamin Water, Zico coconut water, and Honest Tea; it also took a stake in energy-drink maker Monster Beverage. However, Coke's most ambitious acquisition came last summer when it acquired Costa Coffee, the U.K.'s biggest coffee chain with nearly 4,000 stores globally, for $5.1 billion, effectively putting it in direct competition with Starbucks as it aims to expand the brand globally. Costa gives Coca-Cola significant exposure to the coffee market, one of the fastest growing segments of the beverage industry.

Through the first three quarters of 2018, Coca-Coca saw organic revenue increase 5%, buoyed by strength outside North America. Asia-Pacific was its strongest segment, where concentrate sales and unit case volume increased 5%. Coca-Cola has also divested lower-margin bottling operations, helping to lift profitability, and the company has seen comparable, currency-neutral earnings per share increase 8% through the first three quarters of 2018 to $1.65. Coke has also found success with Coke Zero, which saw double-digit volume growth across all groups, and brands like Fuze tea and Smartwater. The beverage leader is making new acquisitions and partnerships with brands like BODYARMOR, Mojo, and Tropico.

Who's the winner?

Coca-Cola and Procter & Gamble have similar growth expectations, dividend yields, and business profiles, and check the same boxes as stocks. Investors who are attracted to one are very likely interested in the other. They also have similar P/E valuations, as P&G trades at a ratio of 21.7, compared to 23.1 for Coca-Cola.

While both stocks have been laggards in recent years, performance has improved under new management at each company, and both look well positioned for investors in a volatile market. It's a close call between the two, but I think Coca-Cola has a slight edge because the company has been more aggressive about reinventing itself with the Costa acquisition, a new line of flavored Diet Coke, and by taking over smaller brands.

Still, both stocks could be worth owning if the market returns to the shakiness it saw at the end of 2018.

More From The Motley Fool

Jeremy Bowman owns shares of Starbucks. The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares), Monster Beverage, and Starbucks. The Motley Fool is short shares of Procter & Gamble. The Motley Fool has a disclosure policy.

Yahoo Movies

Yahoo Movies