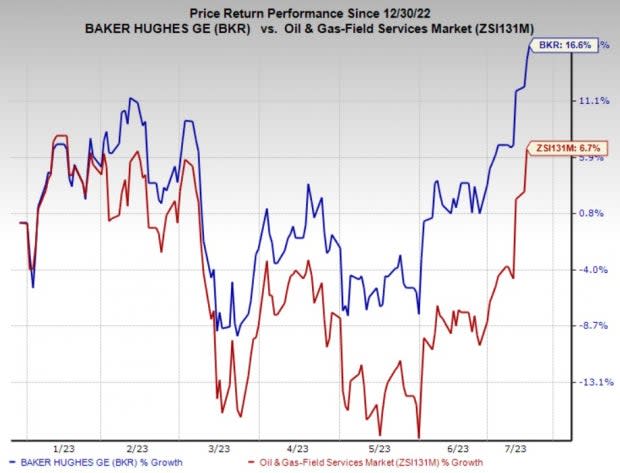

Baker Hughes (BKR) Shares Gain 16.6% YTD: What to Expect?

Baker Hughes Company BKR has gained 16.6% in the year-to-date period compared with 6.7% growth of the composite stocks belonging to the industry.

The company, currently carrying a Zacks Rank #3 (Hold), has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days.

Image Source: Zacks Investment Research

What’s Favoring the Stock?

The West Texas Intermediate crude price is trading at the $75-per-barrel mark, which is highly favorable for exploration and production activities.

Despite a slowdown in drilling activities, strong oil prices will likely make way for further rig additions, as upstream energy players mainly focus on stockholder returns than boosting production.

Higher exploration and production activities will improve demand for Baker Hughes’ oilfield services. For 2023, BKR expects revenues of $14.5-$15.5 billion from the Oilfield Services and Equipment unit, indicating an increase from the $13.2 billion reported in 2022.

Baker Hughes predicts significant growth from a series of profitable international liquefied natural gas (LNG) contracts. With the growing demand for clean energy, countries worldwide are actively investing in LNG terminals. BKR expects to receive massive orders for LNG equipment this year.

Baker Hughes is strongly committed to returning capital to shareholders and has been a reliable dividend payer in the past two years. Compared with the composite stocks belonging to the industry, the company has been consistently paying higher dividend yields over the past two years.

Baker Hughes has a strong balance sheet. The company’s cash balance of $2,415 million can easily clear the short-term debt of $684 million, reflecting a strong liquidity profile. BKR’s debt-to-capitalization has consistently been lower than the composite stocks belonging to the industry over the past two years.

Given these tailwinds, Baker Hughes is poised for an upside in the coming days.

Risks

In 2022, Baker Hughes generated a free cash flow of $1.1 billion, indicating a decline from the $1.8 billion reported a year ago. This reflects weakness in the company’s operations. The recessionary pressures in some of the world’s largest economies may impact the company’s ability to generate consistent positive cash flows.

Stocks to Consider

Some better-ranked players in the energy space are Oceaneering International, Inc. OII, Seadrill Limited SDRL and Evolution Petroleum Corporation EPM, currently sporting a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

One of the leading suppliers of integrated technology solutions, Oceaneering boasts an impressive portfolio of diversified products and services. OII has a Zacks Style Score of A for Momentum.

Oceaneering has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for OII’s 2023 and 2024 earnings per share is pegged at $1.12 and $1.29, respectively.

Seadrill is a market-leading international driller with strong exposure in key strategic basins like the U.S. Gulf of Mexico, Brazil and Angola. SDRL reported first-quarter 2023 earnings of 83 cents per share, beating the Zacks Consensus Estimate of earnings of 55 cents per share.

Seadrill has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for SDRL’s 2023 and 2024 earnings per share is pegged at $2.93 and $4.01, respectively.

Evolution Petroleum is an independent energy company. EPM reported first-quarter 2023 earnings of 42 cents per share, beating the Zacks Consensus Estimate of earnings of 17 cents.

Evolution Petroleum has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for EPM’s 2023 and 2024 earnings is pegged at $1.11 per share and $1.05 per share, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Seadrill Limited (SDRL) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

Yahoo Movies

Yahoo Movies