Should You Be Adding Norwood Financial (NASDAQ:NWFL) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Norwood Financial (NASDAQ:NWFL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Norwood Financial

How Fast Is Norwood Financial Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Norwood Financial has grown EPS by 14% per year. That's a pretty good rate, if the company can sustain it.

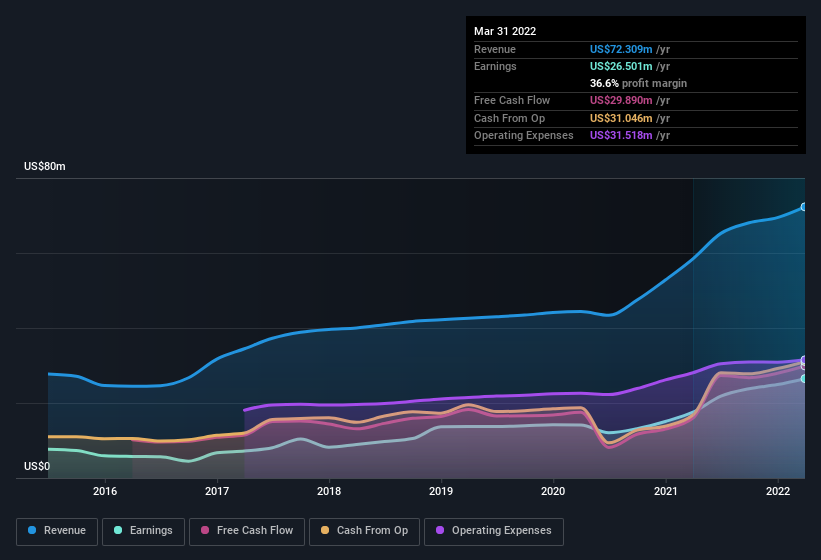

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Norwood Financial's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Norwood Financial's EBIT margins were flat over the last year, revenue grew by a solid 24% to US$72m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Norwood Financial isn't a huge company, given its market capitalization of US$210m. That makes it extra important to check on its balance sheet strength.

Are Norwood Financial Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent US$2.6m buying Norwood Financial shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Independent Director, Alexandra Nolan, who made the biggest single acquisition, paying US$1.3m for shares at about US$25.17 each.

Along with the insider buying, another encouraging sign for Norwood Financial is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$20m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 9.5% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Norwood Financial Deserve A Spot On Your Watchlist?

One positive for Norwood Financial is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Of course, just because Norwood Financial is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

As a growth investor I do like to see insider buying. But Norwood Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies