Why Intel Is a Great Buy

The market has treated Intel like it's a failing company over the past few years. But there's a lot of value in Intel's shares when you look at its balance sheet and upside in mobile and wearable devices.

The balance sheet matters

Intel is sitting on $17.4 billion in cash and short-term investments, compared to a $115 billion market cap. It's also paying a hefty 3.8% dividend yield to investors. Despite what some view as a disappointing year, over the past four quarters Intel has also generated $20.2 billion in operating cash flow.

Those aren't bad values for an investment to start from.

The next generation of mobile

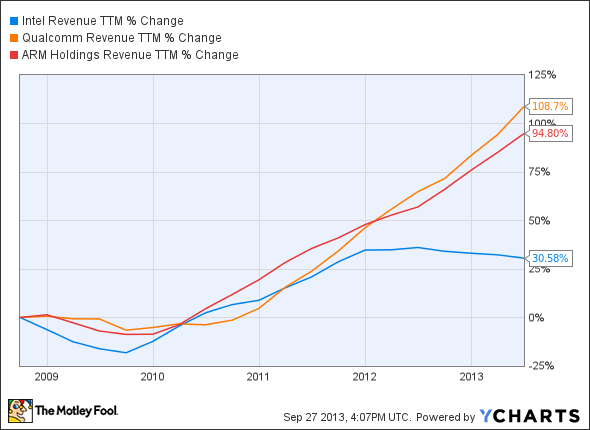

There's no doubt that Intel has missed out on much of the mobile boom so far, leaving the revenue gains to Qualcomm and ARM Holdings .

INTC Revenue TTM data by YCharts.

ARM Holdings won share in mobile because of a more energy-efficient architecture, and when Apple decided to design chips in-house, ARM locked up a huge part of the market for the company. Qualcomm has been a dominant player in processors and baseband LTE modems and Qualcomm's Snapdragon is in the market-favorite Samsung Galaxy S4. Along with the iPhone, those are the two most popular smartphones on the market and the profits have gone to ARM Holdings and Qualcomm, not Intel.

Where the game could change is with Intel's next-generation chips, particularly the 14 nanometer system on a chip code-named Broadwell. Earlier this month, Intel demonstrated 30% lower power consumption than the 22 nanometer Haswell ULT chip at the same performance level. This is important because it's power consumption that has held back Intel in mobile, and these improvements make it a viable alternative to competitors. Broadwell will initially be targeted at ultrabooks and tablets, but 14 nanometer is coming to mobile as well.

Intel's 22 nanometer Merrifield chip will launch later this year, targeting the smartphone market and is something of a test run for Intel. The real fireworks will happen sometime in early 2015 when a 14 nanometer chip, code-named Morganfield, is due out. This will help Intel lower power consumption and could be a leap ahead of ARM Holdings in mobile. By early 2015, Intel could be a big player in mobile chips, flipping its current position.

Intel is being tested in mobile devices, winning the Samsung Galaxy Tab 3 earlier this year and already designed into many Windows 8 tablets and convertibles, as well as Chromebook devices. These are steps toward mobile, particularly on the Android and Windows side, which aren't designed internally, like Apple's chips are.

The wearable future

With a head start on the next generation of chips, Intel has eyes on dominance in wearable devices as well. The company previewed a line called Quark earlier this month and intends to use the chips in wearable devices, as well as industrial and medical applications.

Of course, this isn't a wide-open market. Qualcomm has its sights set on wearable devices as well and revealed chips this month that interact with the Internet of Things. AMD and others also have their eyes on the market, but Intel won't be left behind this time.

Intel is a great buy with growth opportunities

It's unknown just how big smartphone, tablet, and wearable markets will be for Intel, but they're all pure upside. The other good thing for investors is that revenue deterioration appears to have slowed, with the company reporting a 2% sequential rise in revenue last quarter. Intel's data center business will help stem revenue lost in PCs and give time for new markets to take off.

With shares trading at 12.4 times trailing earnings, a 3.8% dividend yield, and $17.4 billion in cash, I think this is one of the best buys on the market. The company will continue to generate cash from existing businesses, and growth in new markets could be tremendous if Intel gets them right.

Another big winner in smartphones

Intel is trying to make a big move in smartphones, but there one company that already sits at the crossroads of smartphone technology as we know it. It's not your typical household name, either. In fact, you've probably never even heard of it! But it stands to reap massive profits NO MATTER WHO ultimately wins the smartphone war. To find out what it is, click here to access The Motley Fool's latest free report: "One Stock You Must Buy Before the iPhone-Android War Escalates Any Further..."

The article Why Intel Is a Great Buy originally appeared on Fool.com.

Fool contributor Travis Hoium manages an account that owns shares of Intel. The Motley Fool recommends Intel. The Motley Fool owns shares of Intel and Qualcomm. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Yahoo Movies

Yahoo Movies