Money scams rise in UK as fraudsters exploit COVID-19 pandemic

More than half of Brits (56%) say they haven’t done anything to ward off potential scams, despite a third (66%) saying they believe COVID-19 has led to more opportunities for fraudsters.

According to research conducted by mortgage loan company Ocean Finance, there were 1,467,962 instances of fraud reported between 2018-2020 with a 12% rise in the past year alone. These figures were taken from an FOI submitted to the National Fraud Authority.

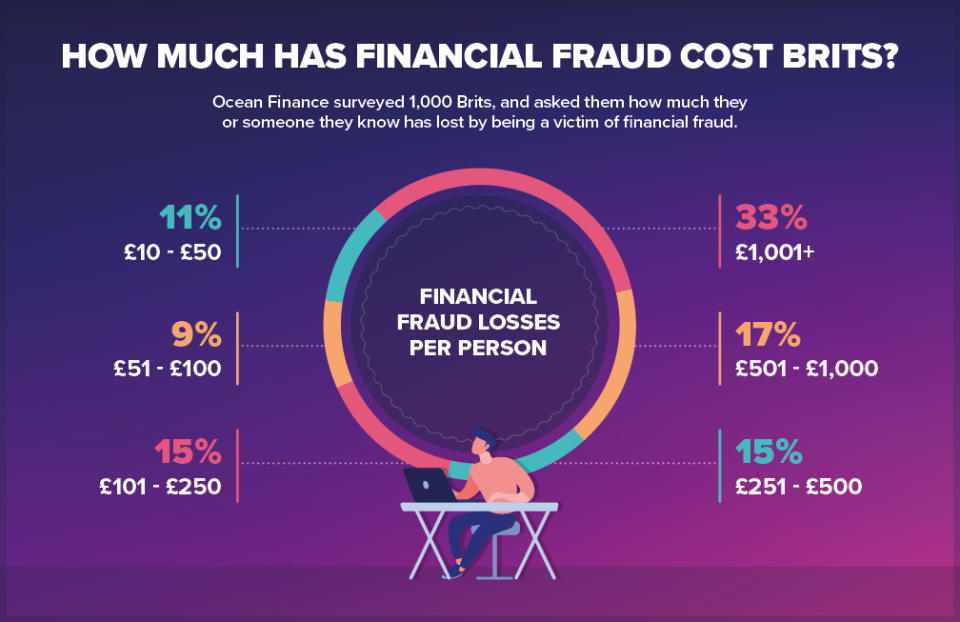

Ocean Finance also found from a poll of 1,000 people that a third of people that disclosed the amount of money that had been lost to fraudsters said it topped £1,000 ($1,335).

As evidence mounts that many of us are being targeted by scammers, less than 10% of Brits (8%) think enough is being done to stop financial Fraud.

Alongside this, 54% say they don’t even trust that a scammer would be caught if the incident were reported.

While some are able to quantify what they have lost through fraud, an eight of those surveyed weren’t even sure if they had been a victim of a scam.

READ MORE: Travel and cinema stocks leap as England lockdown and quarantine eased

Here are some commonly used scams:

Impersonation Scams: One of the more common scams, this involves a fraudster getting in touch and pretending to be from a trusted source (eg the police or your bank) to persuade you to hand over details. UK Finance has reported that, following an 84% rise from the previous year, there were 15,000 cases reported January to June 2020 with an estimated £58m lost.

Spear Phishing: A more targeted version of wider “impersonation scams,” this usually involves emails which contain a certain level of information you wouldn’t expect fraudsters to have, lowering your guard and making you more likely to share personal data.

Smishing: Like “phishing” but using SMS as opposed to emails (eg fraudulent messages from your bank asking for your logins to ‘unlock’ your account).

New Account Fraud (NAF): A scam where fraudsters use your details to open a new bank account, with the objective being to max out the credit limit as soon as possible before vanishing. This often leaves the victim caught up in legal and financial trouble whilst the case is resolved.

Boiler Room Scams: A classic "too good to be true" scam where victims are cold-called about a sure-fire way to make money quickly (e.g. stocks or investments) and are pressured into making an on the spot decision about transferring money. In 2018, an FCA investigation led to the arrest of 5 people who’d conned £2.8m from unsuspecting members of the public.

Friday Afternoon Fraud: A more specific yet widely reported form of fraud where scammers target the email addresses of solicitors (usually on a Friday due to higher rates of mortgage fee transactions on that day) to trick them into sending buyers’ money to alternative accounts. This can lead to individual losses in the tens of thousands and huge disruption in property chains.

WATCH: What is a V-shaped economic recovery?

Yahoo Movies

Yahoo Movies