Miami man’s securities fraud made relatives $4 million, lost others $5 million, SEC says

A Miami investment advisor used a form of securities trading fraud to channel $4.6 million to accounts under his parents’ names while sticking other clients with more than $5.5 million in losses, alleged a Securities and Exchange Commission complaint unsealed Thursday.

The SEC also announced an asset freeze against Brickell companies UCB Financial Advisers and UCB Financial Services Limited and UCB Group executive director Ramiro Sugranes. No criminal charges have been filed in Miami federal court by the Justice Department.

“I have no comment on anything,” Sugranes said when reached by phone Thursday afternoon.

When the Miami Herald called the UCB companies’ phone number, the number was disconnected.

“We allege that Sugranes used the UCB investment firms to funnel millions of dollars to two clients, while unloading over $5 million in first-day losses on their other clients,” said Joseph G. Sansone, Chief of the SEC Enforcement Division’s Market Abuse Unit.

The two clients, as named in the complaint, are Ramiro Sugranes Hernandez and Thelma Lanzas De Sugranes — whom the complaint says are Ramiro Sugranes’ parents. The complaint says both names are on both “preferred” accounts.

Also, the complaint brings up Sugranes’ history of questionable account practices regarding relatives. He resigned from a broker job in 2004, the complaint said, “after he failed to follow company procedures concerning the documentation of certain transactions in one of his relative’s accounts.”

A year later, UCB Financial Advisers registered with the state of Florida with Sugranes was president and CEO.

SEC accuses South Florida businessman of securities fraud, proposes $600,000 settlement.

Trading securities to give parents the best, others the rest?

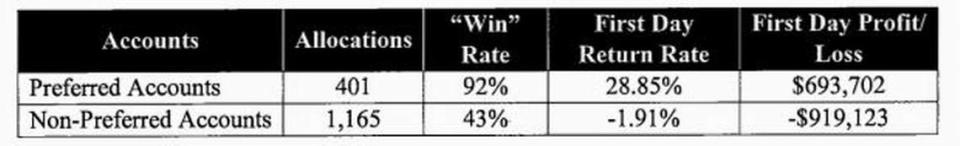

About 100 clients in several states and various countries gave the UCB companies the right to make trades for them. But, beginning in September 2015, the complaint said, the two accounts held by Sugranes parents received preferred treatment to the detriment of the other clients through “cherry-picking.”

“[Sugranes] carries out the cherry-picking scheme by first using an average price trading account used by the UCB Entities to purchase stocks and options on behalf of numerous client accounts,” the complaint said. “Sugranes then allocates those trades to specific accounts, typically later that same day.

“If the position increases in value during that day, the position is usually closed out, thereby locking in the same-day profit, and the opening and closing trades and the corresponding profits are allocated to one.of the Preferred Accounts,” the complaint continues. “If the value of the trades decrease during that day, the position (which is worth less at the time of allocation than it was at the time of purchase and, thereby, has a first day loss) is usually allocated to [the account(s) of] one or more of the UCB Entities’ other clients.”

“Conversely, the complaint alleges that if the price of the securities decreased during the trading day, the defendants usually allocated the unprofitable trades to other client accounts.”

The complaint uses examples of this being done with stocks and options, on individual days and over several years. It says of the 496 Google stock options trades between Sept. 2, 2015 and March 26, 2021, 290 went to the two preferred accounts and made $648,000 on the first day of trading. The other 206, which lost $767,000, went to the non-preferred accounts.

Between the stocks and the options, the complaint calculates that the preferred accounts racked up $4,629,814 in first day gains while the non-preferred accounts took $5,575,130 losses.

“The odds that random chance could account for this difference in first-day profits and losses between the preferred and non-preferred accounts is less than one in a billion,” the complaint said.

And, the complaint said, at least $2.24 million of those profits have been withdrawn from the preferred accounts.

Four Doral cops suspended with pay as feds probe COVID relief small business loans

Yahoo Movies

Yahoo Movies