Marketmind: China + policy hawks = drag on markets

By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

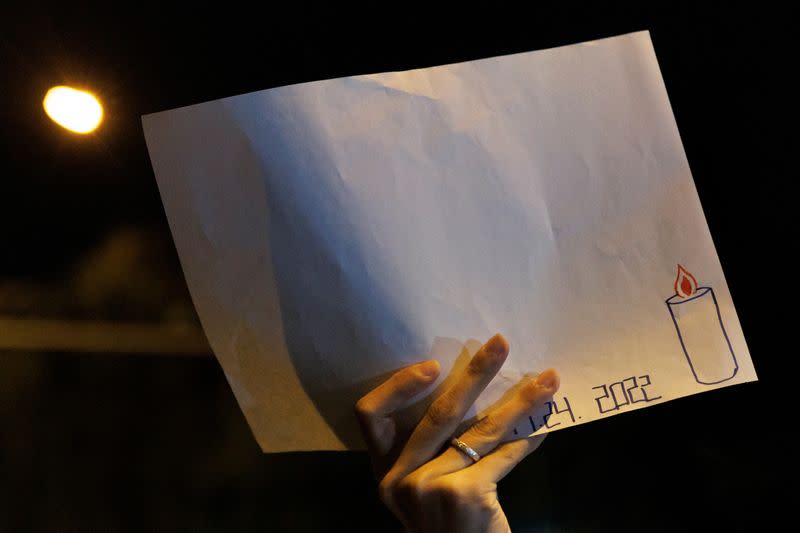

The social unrest flaring up across China - and how Beijing responds to it - remains front and center for Asian markets, suggesting the sentiment driving trading on Tuesday will again be negative.

Just to compound investors' caution, two U.S. Federal Reserve officials on Monday reiterated their conviction that monetary policy must be tightened further and kept at restrictive levels for some time yet in order to get inflation under control.

Let's start with China, where the protests against strict zero-COVID policy and restrictions on freedoms are spreading. Chinese assets are, unsurprisingly, under pressure - the offshore yuan fell on Monday for a fifth straight day and Chinese stocks had their biggest decline in a month.

A little more surprising, however, given the scale of the unrest, is that the declines have been contained and orderly. There is no obvious sense of forced selling. Yet.

It's a hard one to trade. Does the unrest accelerate a re-opening of the economy, or does it prompt President Xi Jingping to double down? Either way, volatility and lack of visibility should prevail in the near term.

One consequence overseas was the slide in Apple Inc shares on Monday, down 2.7% as worker unrest at the world's biggest iPhone factory in China stoked fears of a deeper hit to the already constrained production of higher-end phones.

Apple is now underperforming the broader market this year.

St. Louis Fed President James Bullard and New York Fed President John Williams dealt another blow to markets on Monday, signaling that rates will reach at least 5% and might not be cut at all next year. Traders are on board with the first bit, but certainly not the second - 40 basis points of easing is still implied in next year's rates curve.

ECB President Christine Lagarde also struck a hawkish tone on Monday, saying inflation has not peaked and may yet surprise on the upside. If anyone was in any doubt, the hawks at the big central banks are not backing down.

Risk assets are under pressure - Wall Street closed deeply in the red on Monday - while volatility and the dollar both rose. That's the backdrop to the Asian session on Tuesday, so it looks like being another cautious open.

Three key developments that could provide more direction to markets on Tuesday:

- Japan unemployment (October)

- Japan retail sales (October)

- Germany inflation (November, prelim)

(Reporting by Jamie McGeever in Orlando, Fla.; Editing by Marguerita Choy)

Yahoo Movies

Yahoo Movies