Magna Trims 2023 Ad Spending Forecast as US Economy Weakens

The weakening U.S. economy has led Magna to reduce its advertising spending forecast for the rest of this year and all of 2023.

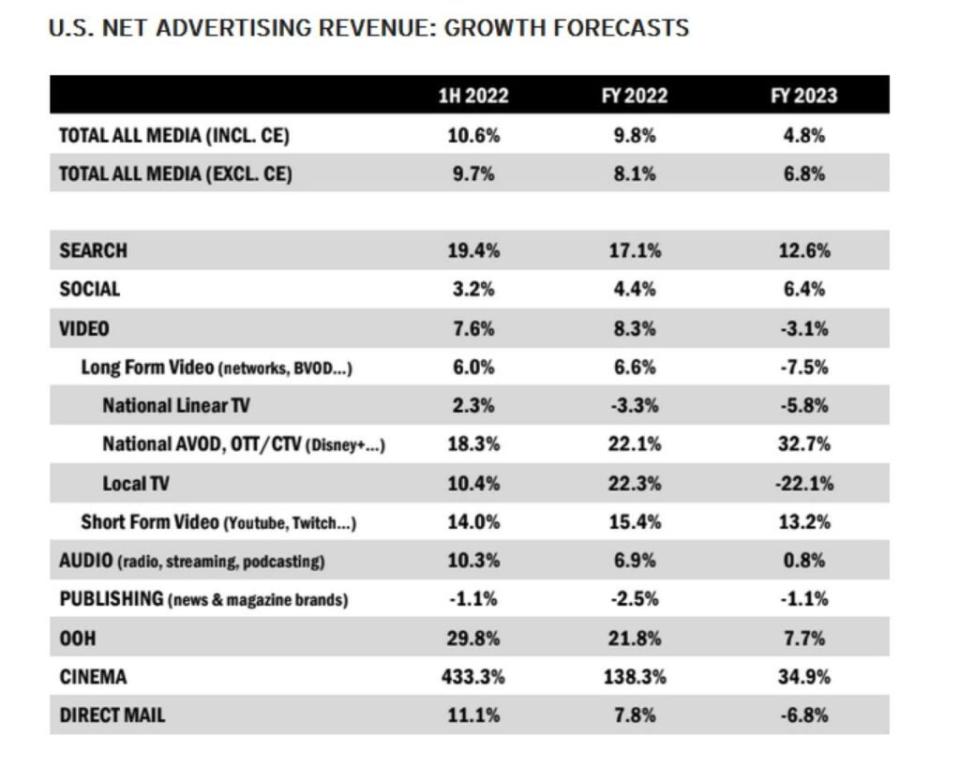

The media investment and research firm, a unit of Interpublic Group, said it now expects U.S. ad growth of 4.8% next year, down from the 5.8% it predicted in June.

The second half of 2022 will be boosted by billions of ad dollars spent by political campaigns for the midterm elections, said the author of the report, Vincent Letang, Magna EVP of global market intelligence. Spending on November’s World Cup tournament in Qatar will also contribute to gains.

And technological innovations will drive “multiple organic growth factors” next year, Letang said.

Among those factors: “Retail media networks bringing below-the-line marketing budgets into digital media, programmatic spending in digital audio and digital OOH formats, and the expansion of AVOD and CTV advertising with new ad-supported tiers from Disney+ and Netflix,” Letang said in a statement.

Magna estimated that total advertising sales in the first half of the year grew 11% from last year to $151 billion, based on media owners financial reports. Ad sales grew by 14% year-over-year in the first quarter, and by 7% in the second quarter, or 4% sequentially.

The fastest-growing format was out-of-home advertising, reflecting the return to mobility for most Americans following the pandemic, the report said.

Also in the first half:

Cinema advertising grew by 430%, as blockbusters and audiences returned to theaters

Search advertising rose 19%

Digital audio advertising, including streaming and podcasting, gained 7.5%

Advertising-based Video on Demand and CTV streaming placements jumped 18%

Short-form digital video formats like YouTube and Twitch advertising rose 14%

Social media ad sales growth slowed dramatically, up 3% in the first half to $30 billion, compared with a leap of 38% in the first half of 2021

National television sales increased 2% to $20 billion, in part boosted by the Winter Olympics; local TV sales got a 10% lift to $9 billion, thanks to political spending

The numbers are not likely to be as rosy for the second half of the year, though Magna still expects full-year, all-media advertising revenues to reach a record $323 billion, topping $300 billion for the first time, and 9.8% higher than 2021, buoyed by the elections and the World Cup.

“Economic uncertainty and rising inflation are affecting several industries and driving brands and local businesses to moderate their marketing expenses in the second half,” the report said. It pointed to consumer product companies, restaurants and retail as all facing business challenges amid rising inflation, while other industries, like mortgage lenders, “see their businesses suffer from the rise of interest rates.”

As a result, the firm predicted non-cyclical ad spending growth will slow to 8.1%, down from the 9.5% forecast.

Magna also still expects growth for 2023, but with consumer product companies, finance and retail all coming in below average, and a lack of cyclical events weighing down growth.

One factor that will be in play is that more states are likely to legalize online gambling, with Ohio likely and the large states of Texas, California and Florida lining up as possibilities.

“Finally, there’s hope that the automotive vertical may start to recover in 2023 after two years of decline in car sales and advertising activity,” the report said. “Car sales have stabilized since August, mostly due to a comparison effect (they had started to fall a year before), and, as soon as the supply-chain conditions and production capacities improve, manufacturers and car dealers will compete again to meet the pent-up demand.”

Also Read:

Roku, Nielsen Team Up for Four-Screen Audience Measurement

Yahoo Movies

Yahoo Movies