London politics LIVE: Treasury minister says ‘we’ll press on with tax cuts’ as Tory backlash grows amid markets turmoil

Liz Truss was standing by Chancellor Kwasi Kwarteng on Wednesday as a Treasury minister rejected calls for the government to abandon last week’s mini-Budget, despite a growing Tory revolt and turmoil in financial markets.

A Downing Street spokesman said the Prime Minister and Chancellor “are working on the supply side reforms needed to grow the economy which will be announced in the coming weeks”.

The backing for the Chancellor came as Andrew Griffiths, Financial Secretary to the Treasury, said the Government would plough ahead with its controversial growth plans, saying “we think they are...right”.

A growing number of Tory MPs have slammed tax cuts and tens of billions of pounds of extra borrowing which has sent the pound plunging.

Simon Hoare MP tweeted: “In the words of Norman Lamont on Black Wednesday: “today has been a very difficult day”.

Mr Hoare, chairman of the Commons Northern Ireland committee, added: “These are not circumstances beyond the control of Govt/Treasury . They were authored there. This inept madness cannot go on”. Another Tory MP, Robert Largan, voiced “serious reservations” about some of the Chancellor’s announcements.

“I do not believe that cutting the 45p Top Tax Rate is the right decision when the Government’s fiscal room for manoeuvre is so limited. In my view, this is a mistake,” he tweeted.

Former Chief Whip Julian Smith is among other Tory MPs who have spoken out against the cut in the 45p top rate of tax, a move which he described as “wrong”.

Many Conservative MPs are privately aghast at some of Mr Kwarteng’s plans which have send the pound falling sharply.

Amid turmoil in the markets, the Bank of England made an emergency intervention to protect Britain’s “financial stability” after the mini-Budget.

The bank said it would buy back billions of pounds of Government debt to try to drive down the interest rate on public borrowing which has soared since the fiscal statement on Friday.

It stressed that it was also seeking to protect households and businesses from the crisis, who also face spiralling mortgage and other borrowing costs.

The dramatic move came at 11am, as the Pound continued to fall and as top bankers had been meeting the Chancellor as he sought to defuse the economic crisis which he has sparked.

Decision yet to be made on whether benefits will increase in line with inflation

22:07 , Lydia Chantler-Hicks

Ministers have not decided whether benefits will be uprated in line with inflation in the autumn.

Asked about whether the uprating commitment would be carried out, Treasury minister Chris Philp told ITV’s Peston: “It is under consideration and I am obviously not going to make policy announcements here, it will be considered in the normal way in the course of the coming weeks.”

Pressed about the decision, he added: “I am not going to make policy commitments on live TV, it is going to be considered in the normal way, we will make a decision and it will be announced I am sure in the first instance to the House of Commons.”

Cabinet minister urges people to remain ‘calm’ amid mini-budget turmoil

22:03 , Lydia Chantler-Hicks

A UK cabinet minister has urged people to remain “calm” amid the turmoil sparked by the Government’s mini-budget announcement.

Welsh Secretary Robert Buckland stood by Chancellor Kwasi Kwarteng’s plans during an interview with ITV Wales on Wednesday.

He told the Wales At Six programme that aspects of the budget were “vital for the lives of every business and indeed every family”.

Questioned over the pound’s fall in value, food cost inflation and soaring interest rates which have affected the housing market, Mr Buckland said: “I do think it’s very important that we remain very steady and calm through this period.

“The issue for me is how we grow our economy in order to pay for increased public services.

“The only way that we’re going to long term sustain our important public services in Wales and elsewhere is to grow our economy, and the Government is trying to make sure that as many obstacles are removed in order to allow for that higher growth to take place.

“That will be good for all of the billions at risk.”

Government not considering reversing plan, says Treasury minister

21:46 , Lydia Chantler-Hicks

The Government will not reverse its growth plan proposals that have led to market instability, a minister has insisted.

Asked by Sky News if the Government had made any consideration of reversing the plan, Treasury minister Chris Philp said: “No, none at all, because getting Britain’s economy growing is so important. Important to raise wages and important to pay the tax bills of the future.”

He also defended the cut in the 45p rate of income tax, claiming it was less than 1/20th of the “fiscal firepower that was deployed” in the mini-budget and said 30 million workers would benefit from the broader tax cuts.

Mr Philp also claimed that global market “volatility” had led to soaring government bond yields.

He said: “I think if you just take a step back and look at the markets … over the last year or so and the last nine months in particular, globally we have seen quite a lot of volatility.”

Responding to reports that Cabinet ministers would be asked to draw up efficiency cuts to slash their departmental budgets in response to economic turmoil, Mr Phip said: “The Government always wants to operate more efficiently.

“We want to make sure that money paid by our neighbours, my constituents, is spent as well as possible and that it is prioritised towards projects that deliver growth, infrastructure for example.”

He added: “Obviously we are constantly looking at that, but I would emphasise again we are going to be sticking to the existing spending envelope which was set out a year ago, it covers a three-year period, we are in the first of those three years now. It makes sure public services are properly and responsibly funded, and we are sticking to that.”

Truss 'standing by Chancellor’

18:53 , Lydia Chantler-Hicks

Prime Minister Liz Truss is said to be standing by Chancellor Kwasi Kwarteng - as backlash grows over his budget and the turmoil into which it has thrust the UK economy.

A Downing Street spokesman has said: “The [Prime Minister] and the Chancellor are working on the supply side reforms needed to grow the economy which will be announced in the coming weeks.”

‘The world is wondering what on earth is going on in the UK’, says former Treasury minister

18:06 , Lydia Chantler-Hicks

Crossbench peer and former Treasury minister Lord O’Neill of Gatley said investors and companies “all over the world” were “wondering what on earth is going on in the UK”.

He told BBC Radio 4’s PM programme: “This is a breathing room for the Government, in my view, to seriously think what on earth is it really trying to do and … this idea that you can just magically quadruple productivity by a tiny corporate tax policy reversal is at the core of why investors and companies all over the world, never mind here at home, are wondering what on earth is going on in the UK.”

Tory MP says Government must make statement to ‘steady the nerves and steady market'

17:27 , Lydia Chantler-Hicks

The Government cannot wait until November to give clarity on its economic plans and must make a statement “in very short order”, a senior Conservative MP has said.

North Thanet MP Sir Roger Gale told BBC News: “I don’t think we can wait until November, which is the current intention as I understand it.

“I think, yes, we need a statement in very short order indeed to steady the nerves, steady the market and set out very clearly what the business plan is so that everybody understands properly where we are going.”

He added: “The failing in the statement that was made last Friday is lack of clarity and I think that, in part, is what has led to the run on the pound and the position that we find ourselves in today.”

Treasury minister: ‘Every major economy is dealing with the same issues’

17:10 , Lydia Chantler-Hicks

Financial Secretary Andrew Griffith has welcomed the “timely” intervention by the Bank of England in the markets.

Mr Griffith added that all major economies were experiencing the same volatility which the UK is seeing.

During an interview on Sky News, he said “all developed markets” are seeing “unprecedented” volatility.

“We are seeing the same impacts of Putin’s war in Ukraine cascading through things like the cost of energy, some of the supply side implications of that,” he said.

“That’s impacting every major economy. Every major economy you are seeing interest rates going up as well. Every major economy is dealing with exactly these same issues.

“The Bank of England has made this timely intervention. What the Chancellor and I are focused on is delivering that economic growth plan.”

‘Government will continue with plan despite turmoil’ says Treasury minister

16:48 , Lydia Chantler-Hicks

A Treasury minister has said the Government will press on with Chancellor Kwasi Kwarteng’s growth plan despite the turmoil in the financial markets.

Financial Secretary Andrew Griffith told Sky News: “We think they are the right plans because those plans make our economy competitive.”

He added: “Get on and deliver that plan. That’s what I, the Chancellor and my colleagues in Government are focused on is getting on and delivering that growth.

“That is what is going to allow consumers to benefit. In the meantime, we are protecting every household and every business from the biggest macro shock out there at the moment, which is the cost of energy.”

Starmer calls for Parliament to be recalled

16:05 , Lydia Chantler-Hicks

Sir Keir Starmer has called for Parliament - currently on a conference recess - to be recalled immediately to discuss the UK financial crisis.

Speaking to reporters in Liverpool, the Labour leader said: “The Government has clearly lost control of the economy.

“What the Government needs to do now is recall Parliament and abandon this budget before any more damage is done.”

Doubts if Bank of England action will ‘convince the sceptics'

15:30 , Miriam Burrell

AJ Bell’s investment director has cast doubt on whether the Bank of England’s move to buy up Government bonds will be enough to “convince the sceptics”.

Russ Mould said the Bank’s U-turn, due to end on October 14, may not be enough to put “bond vigilantes” – investors who sell off bonds in protest against fiscal policy – “firmly back in their basket”.

He told PA Media: “Having probably given the market a lesser-rate hike than it expected last week and to confirm that it was committed to quantitative tightening, to then have to come back to quantitative easing a week later … it’s not going to convince the sceptics.”

Chancellor underlined ‘clear commitment to fiscal discipline’

14:54 , Miriam Burrell

The Chancellor “underlined the government’s clear commitment to fiscal discipline” at a meeting with bank bosses on Wednesday morning.

Representatives from Bank of America, JP Morgan, Standard Chartered, Citi, UBS, Morgan Stanley and Bloomberg all attended.

According to a read-out of the meeting Kwasi Kwarteng “underlined the government’s clear commitment to fiscal discipline and reiterated that he is working closely with the Governor of the Bank of England and the OBR ahead of delivering his Medium Term Fiscal Plan on 23 November”.

It added: “The Chancellor also discussed with attendees how last Friday’s Growth Plan will expand the supply side of the economy through tax incentives and reforms, helping to deliver greater opportunities and bear down on inflation.”

Keir Starmer’s mortgage leaped by “hundreds"

14:49 , Miriam Burrell

Sir Keir Starmer said his own mortgage has leaped up by “hundreds of pounds” and that his care worker sister is among those being made very anxious by the cost-of-living crisis.

The Labour leader told ITV News: “My mortgage has gone up because we’re on a variable rate. It’s gone up by a number of hundreds of pounds.

“But I’m not pleading a special case on my behalf, I’m thinking of the millions of people who are really up against it with their mortgage, their prices going up, with their pensions, with their energy bills.

“I was speaking to my sister last night who is a care worker. Because of her rising prices, she was really, really anxious about the situation. She’s not alone.”

Chancellor may ‘freeze spending on public services’

14:35 , Miriam Burrell

Paul Johnson, director of the Institute for Fiscal Studies, has said Chancellor Kwasi Kwarteng may try to freeze spending on public services when he sets out his medium-term fiscal plan to get the public finances back on track.

“If I had to guess now what that plan might look like, I would suggest that it will be that he will look five years into the future and he’ll say ‘I’m going to freeze spending over the whole of that five-year period’,” he told BBC Radio 4’s The World at One.

“The problem with that is that, particularly after a decade of austerity and cuts in public services, there are serious questions as to whether there is any credibility associated with a freeze in public spending for such a long period of time.”

Senior Tory MP slams ‘inept madness’ of mini-Budget

14:21 , Miriam Burrell

A senior Tory MP has slammed the “inept madness” of the Chancellor’s mini-Budget which sent the pound plunging.

After an emergency intervention by the Bank of England to protect Britain’s financial stability, Simon Hoare MP tweeted: “In the words of Norman Lamont on Black Wednesday: ‘Today has been a very difficult day’.”

Mr Hoare, chairman of the Commons Northern Ireland committee, added: “These are not circumstances beyond the control of Govt/Treasury. They were authored there. This inept madness cannot go on”.

Labour: Government ‘lost control’ of economy

14:17 , Miriam Burrell

Labour leader Sir Keir Starmar said the Government has “lost control of the economy”.

“It’s going to mean higher mortgages and higher prices. And what for? Unfunded tax cuts for the one per cent.

“They must recall parliament today and abandon this act of economic self-harm.”

The government has lost control of the economy. It’s going to mean higher mortgages and higher prices.

And what for?

Unfunded tax cuts for the one per cent.

They must recall parliament today and abandon this act of economic self-harm.— Keir Starmer (@Keir_Starmer) September 28, 2022

Kwarteng facing growing Tory revolt

13:40 , Michael Howie

Chancellor Kwasi Kwarteng is facing a growing Tory backlash against parts of his mini-Budget which has plunged Britain into an economic crisis.

Robert Largan, Tory MP for High Peak, became the latest Conservative politician to criticise elements of the fiscal statement on Friday.

He tweeted: “I have serious reservations about a number of announcements made by the Chancellor. I do not believe that cutting the 45p Top Tax Rate is the right decision when the Government’s fiscal room for manoeuvre is so limited. In my view, this is a mistake.”

However, I have serious reservations about a number of announcements made by the Chancellor. I do not believe that cutting the 45p Top Tax Rate is the right decision when the Government's fiscal room for manoeuvre is so limited. In my view, this is a mistake.

— Robert Largan (@robertlargan) September 28, 2022

Former Chief Whip Julian Smith is among other Tory MPs who have spoken out against the cut in the 45p top rate of tax, a move which he described as “wrong”.

Many Conservative MPs are privately aghast at some of Mr Kwarteng’s plans which have send the pound falling sharply.

‘Last thing we want is a political crisis'

13:23 , Miriam Burrell

Mel Stride, Conservative chairman of the Commons Treasury Committee, who backed Rishi Sunak for the leadership, warned “there’s a lot of concern within the parliamentary party, there’s no doubt about that”.

Asked about the Chancellor Kwasi Kwarteng’s future, he told Sky News: “Well there’s a lot of concern within the parliamentary party, there’s no doubt about that.

“I don’t want to speculate on the future of the Chancellor other than to say that I think where the party should be at the moment is really uniting at a time of economic crisis. The last thing we want now is a political crisis to compound that, and I think really focus on this issue of growth.”

Pressure mounts for Kwarteng to front

13:13 , Miriam Burrell

MPs are not due to return to Westminster until October 11 following the break for the party conferences.

The Chancellor is due to address the Tory conference in Birmingham on Monday but faces calls to speak to the nation before that.

Kwasi Kwarteng spoke with bank bosses at the Treasury on Wednesday morning ahead of the Bank of England’s announcement.

Ryanair boss says economic plan is ‘nuts’

13:06 , Miriam Burrell

Ryanair chief executive Michael O’Leary has described the economic plan put forward by the UK Government as “nuts”.

Speaking in Dublin, Mr O’Leary said the policy could potentially bankrupt the economy in the coming years.

“I think what they have done in the UK is nuts,” Mr O’Leary said.

“You can’t have an energy guarantee that runs for two years; it’s completely uncosted.

“I think they could bankrupt the UK economy in the next two years.

Shadow chancellor calls for ‘urgent statement’ from Kwateng

12:57 , Miriam Burrell

Rachel Reeves has called for an “urgent statement” from the Chancellor to address “the crisis that he has made”.

The shadow chancellor said of the Conservatives: “Their decisions will cause higher inflation and higher interest rates – and are not a credible plan for growth.

“The Chancellor must make an urgent statement on how he is going to fix the crisis that he has made.”

People will be deeply worried about the impact of this turmoil on their mortgage, their pension, and their cost of living.

This is a crisis made in No10 and is the direct result of the Tory government's reckless actions, which include tax cuts for the richest 1%.— Rachel Reeves (@RachelReevesMP) September 28, 2022

Pound falls below 1.055 cents

12:44 , Michael Howie

The pound has fallen further in value against the US dollar - slumping by about a cent to $1.055 in a matter of minutes.

It dropped shortly after the Bank of England announced action to stave off a “material risk to UK financial stability”.

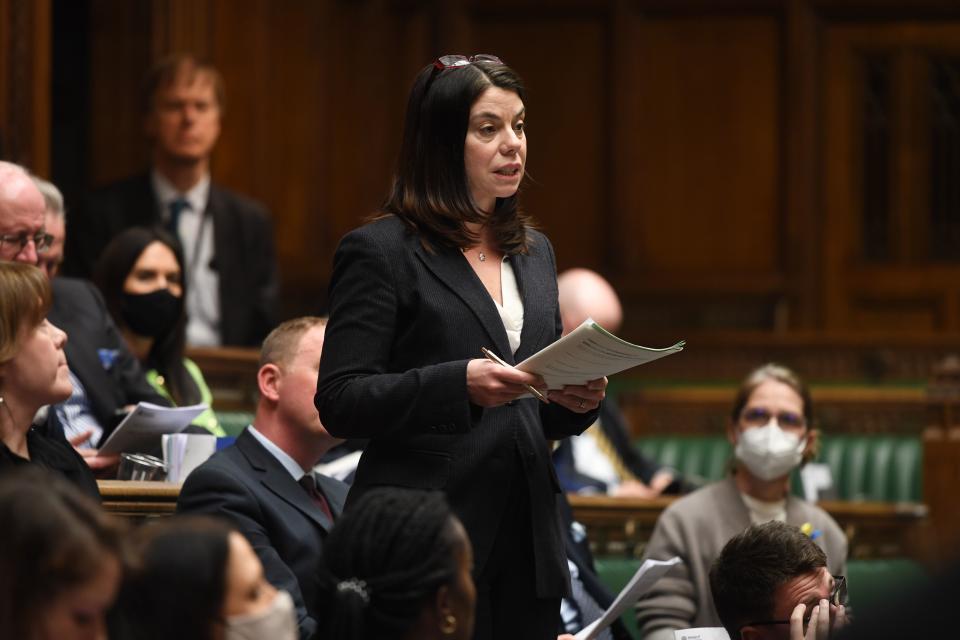

Pictured: Chancellor meets with bank bosses

12:40 , Miriam Burrell

Bank applying ‘plasters on financial wounds’

12:17 , Miriam Burrell

Joshua Raymond of XTB.com said there had been an “immediate fall” in long-dated UK gilt yields after the Bank’s action, with the 10-year and 30-year bond yields falling by around 0.4% in a “matter of minutes”.

He said: “The UK central bank first tried words, which failed. Now it tries to intervene in bond markets to bring yields back under control.

“On the one hand, this might bring some reassurance to the market that the Bank is ready to act outside of its scheduled meetings.”

He added: “The Bank of England is applying plasters on the financial wounds created by the Truss government, who have shown no hint at reversing policy.”

Interest rates ‘still likely to rise'

12:11 , Miriam Burrell

Sir Charlie Bean, a former deputy governor of the Bank of England, has said that despite Wednesday’s intervention by the Bank, interest rates will still likely need to rise.

Speaking to BBC News, Sir Charlie said: “The need for an immediate rate increase is much reduced. It is not going to go away though.

“It is likely that accompanying the fiscal expansion that was announced at the end of last week, the bank will have to significantly raise interest rates.

“The financial stability action today is not going to change the fact that mortgage interest rates will be rising in the future.”

MPs respond to Bank of England action

12:08 , Miriam Burrell

Bank of England has now stepped in to rescue British Govt from financial meltdown

The “Magic Money Tree” being given a good shake again

Please never forget that this is how money works - financing the state is not the same as managing a household budget— Chris Hazzard MP (@ChrisHazzardSF) September 28, 2022

Liz Truss and Kwasi Kwartang refuse to listen to the civil servants, the banks, the Bank of England, the IMF and the credit rating agencies. The only people they *have* to listen to is you. Remember that when you’re next at the ballot box.

— Darren Jones MP (@darrenpjones) September 28, 2022

UK in grip of rapidly deteriorating economic crisis. Emergency intervention by @bankofengland to reduce damage of UK gov own policies extraordinary.

Commons should be immediately recalled (where even is PM?) & as at least an initial symbol of sense, top tax rate abolition dumped— Nicola Sturgeon (@NicolaSturgeon) September 28, 2022

What happened this morning?

11:44 , Miriam Burrell

If you’re just joining us, the Bank of England has launched an emergency UK Government bond-buying programme to prevent borrowing costs from spiralling out of control.

The Bank announced it was stepping in to buy Government bonds – known as gilts – at an “urgent pace” over a two-week period from today until October 14.

The Bank said: “Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability.

“In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses.”

The Treasury responded by reaffirming its commitment to the Bank of England’s independence and said the Government “will continue to work closely with the Bank”.

It comes as Chancellor Kwasi Kwarteng met with bank bosses on Wednesday morning in a bid to reassure them that the Government remains in control of the situation.

The pound hit an all-time record low of 1.03 against the US dollar on Monday.

Bank bosses leave Treasury

11:32 , Miriam Burrell

The Chancellor’s meeting with business leaders appears to have broken up, with executives from major banks leaving through the front door of the Treasury.

None of them responded to questions put by reporters about what assurances had been offered by Kwasi Kwarteng in the wake of the pound’s slumping value.

Govt to ‘work closely’ with Bank of England

11:29 , Miriam Burrell

The Treasury has said the Government will continue to “work closely” with the Bank of England, after it announced it will launch a temporary UK government bond-buying programme.

A Treasury spokesperson said: “The Bank of England, in line with its financial stability objective, carefully monitors financial markets and any potential risk to the flow of credit to the real economy, and subsequent effects on UK households and businesses.

“Global financial markets have seen significant volatility in recent days. The Bank has identified a risk from recent dysfunction in gilt markets, so the Bank will temporarily carry out purchases of long-dated UK government bonds from today in order to restore orderly market conditions.

“These purchases will be strictly time-limited, and completed in the next two weeks. To enable the Bank to conduct this financial stability intervention, this operation has been fully indemnified by HM Treasury.

“The Chancellor is committed to the Bank of England’s independence. The Government will continue to work closely with the Bank in support of its financial stability and inflation objectives.”

Auctions will take place until Oct 14

11:26 , Miriam Burrell

The purchases of government bonds will be “strictly” temporary, the Bank of England said.

“They are intended to tackle a specific problem in the long-dated government bond market,” a statement on Wednesday said.

Auctions will take place from today until October 14.

The Monetary Policy Committee (MPC) has been informed of these temporary and targeted financial stability operations, the Bank said.

“As set out in the Governor’s statement on Monday, the MPC will make a full assessment of recent macroeconomic developments at its next scheduled meeting and act accordingly. The MPC will not hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

Temporary purchases of government bonds

11:22 , Miriam Burrell

The Bank of England said it “stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses”.

In a statement on Wednesday it said: “To achieve this, the Bank will carry out temporary purchases of long-dated UK government bonds from 28 September. The purpose of these purchases will be to restore orderly market conditions. The purchases will be carried out on whatever scale is necessary to effect this outcome. The operation will be fully indemnified by HM Treasury.”

Bank of England to launch temporary bond-buying programme

11:18 , Miriam Burrell

The Bank of England has said it will launch a temporary UK government bond-buying programme as an emergency move to stave off a “material risk to UK financial stability”.

Truss, Kwarteng ‘trashed the pound'

11:07 , Miriam Burrell

Lib Dems leader Ed Davey has accused Prime Minister Liz Truss and Chancellor Kwasi Kwarteng of “trashing the pound”.

He tweeted on Wednesday: “Liz Truss and Kwasi Kwarteng have trashed the pound, betrayed homeowners and now ruined Britain’s economic reputation.

“They’re playing ideology with people’s lives and don’t care about the consequences.”

Liz Truss and Kwasi Kwarteng have trashed the pound, betrayed homeowners and now ruined Britain's economic reputation.

They're playing ideology with people's lives and don't care about the consequences.— Ed Davey (@EdwardJDavey) September 28, 2022

Increase in mortgage rates will ‘dwarf’ savings

10:52 , Miriam Burrell

Scotland’s Deputy First Minister has said he is “very concerned” following the IMF’s statement overnight.

Speaking to the BBC on Wednesday, John Swinney said: “I think the warnings are very stark about the folly of the decision that have been taken by the UK Government.

“I think the IMF’s criticism of the unfunded tax cuts which will simply increase the cost of borrowing – and we’re already seeing that with punishing increases in interest rates which will affect people who have mortgages around the country and some of that increase in mortgage rates will dwarf the small savings that will be made in the unfunded tax cuts that have been made.”

The IMF issued a statement on Tuesday night saying it was “closely monitoring” the situation in the UK and urged the Chancellor to “re-evaluate the tax measures”.

Bank of England can only ‘massively increase interest rates'

10:47 , Miriam Burrell

A former external adviser to the IMF said the Bank of England can only “massively increase interest rates” in the wake of the Government’s mini-budget.

Oxford University’s Ngaire Woods told BBC News the most urgent issue for Chancellor Kwasi Kwarteng should be “how to prevent the pound from slipping away”.

To sustain the pound the Bank of England will have to increase interest rates with a “very painful consequence”, Ms Woods said, and use foreign exchange reserves.

Ms Woods said: “The Government has put us in an extremely difficult corner and that’s why the IMF is so worried.”

Bank bosses start arriving at Treasury

10:03 , Miriam Burrell

JP Morgan’s chief executive in Europe, the Middle East and Africa has arrived at the Treasury for a meeting with Chancellor Kwasi Kwarteng.

Investment banker Viswas Raghavan did not respond to questions as he walked into the building.

Bank of America’s president of international Bernard Mensah has also arrived.

‘A new Chancellor can’t expect the world to trust him'

10:01 , Miriam Burrell

A former external adviser to the IMF has said the new Chancellor Kwasi Kwarteng “can’t expect the world to trust him”.

Oxford University’s Ngaire Woods told BBC News: “He’s come out too quickly to say ‘Trust me, I’ve got this’.”

Ms Woods said investors in Britain and abroad will be asking “Why should we trust you yet?”

She said Britain needs to show that the Government and Bank of England are working together to build confidence in the economy.

Ms Woods said the bolder the economic policy, the more the Government needs to consult and prepare people for it.

Worries grow for UK economy

09:30 , Miriam Burrell

With the pound taking another hammering, Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “The IMF’s move has added to worries that the UK is fast taking on the characteristics of an emerging market economy, and risks ditching its developed country status.

“It’s now not only wracked with trade disruptions, an energy crisis and soaring inflation, but it’s also being closely monitored by the international body known as the world’s lender of last resort.”

Sterling fell back to 1.06 US dollars at one stage, having recovered to 1.08 US dollars on Tuesday after Monday saw it reach an all-time low against the greenback.

The FTSE 100 Index also fell sharply after opening on Wednesday, falling more than 2% at one stage – down nearly 140 points at 6846.4 – and appearing to head for its lowest level for more than a year.

The stock sell-off followed market losses in the US overnight.

Tory MP: Main threat is recession not inflation

09:05 , Miriam Burrell

Tory MP Sir John Redwood said the main threat for the year ahead is recession not inflation, while defending the Government’s fiscal plan.

He told Sky News: “My message today is that the Government are right to see the main threat for the year ahead is recession not inflation because the good news is that all forecasters say inflation will come down a lot next year, and the sooner the better.”

On the Bank of England, he said: “I think they should be very cautious about taking more action because they have lurched from a monetary policy that was flagrantly too permissive and very inflationary to one which is now very tight.

“And I think it’s quite tight enough to do the job we need to do which is to get inflation down.”

Kwasi Kwarteng to meet Wall Street bosses

08:58 , Miriam Burrell

Kwasi Kwarteng is scheduled to meet with Wall Street firms on Wednesday morning in a bid to reassure banking bosses that the Government is in control of the economy.

The meeting will be with firms including Bank of America, JP Morgan, Standard Chartered, Citi, UBS, Morgan Stanley and Bloomberg, the Telegraph reports.

The Chancellor spoke to City chiefs yesterday.

Lib Dems: Truss, Kwarteng ‘blinded by ideology’

08:29 , Miriam Burrell

Liberal Democrat Treasury spokesperson Sarah Olney called the Government “totally blinded by ideology” after the IMF intervened to criticise its tax-cutting plan.

The Lib Dems said Parliament, which is currently in conference recess, should be recalled to discuss the market turmoil.

“Truss and Kwarteng have been in Government for three weeks and the IMF has already been forced to issue a statement on their reckless economic policy,” Ms Olney said.

“Both are totally blinded by ideology, which is making millions across the UK suffer. We need to recall Parliament to fix this mess.”

The pound suffers further falls

08:06 , Miriam Burrell

The pound suffered further falls on Wednesday after the Government was heavily criticised by the IMF over its handling of economic policy.

Sterling fell back to 1.06 US dollars after reaching 1.08 US dollars on Tuesday.

The pound plunged to its all-time low against the dollar on Monday – at 1.03 – and there are fears it could head towards parity with the greenback unless the UK Government can ease financial market fears over its plans to slash taxes.

Tory MP: ‘IMF were very wrong'

07:55 , Miriam Burrell

A prominent Liz Truss supporter has said the IMF and Bank of England were “very wrong” about inflation.

Tory MP Sir John Redwood told Sky News: “They didn’t warn us or the other central banks in the run up to the big inflation, that the monetary policies of 2021 were far too loose, interest rates far too low, and the money printing was getting out of control.

“Now they should be looking forward”, he said.

“We should be fighting recession. Of course, we must be prudent with finances. But the truth is that if the austerity policies have their way and we have a big recession, the borrowing won’t go down, the borrowings will soar.”

A recap of Kwarteng’s mini-budget

07:44 , Miriam Burrell

Chancellor Kwasi Kwarteng slashed taxes by £45 billion on Friday in a huge gamble to ramp-up growth before the next general election.

The top 45p rate of income tax has been scrapped, as well as lopping 1p off the basic rate from next April to reduce it to 19p in the pound, one year earlier than planned, with 31 million people set to benefit from the change.

Mr Kwarteng reversed April’s National Insurance hike of 1.25 percentage point from November 6 and binned his predecessor Rishi Sunak’s planned increase in corporation tax from 19 per cent to 25 per cent next year.

The threshold for paying no Stamp Duty on home purchases has doubled from £125,000 to £250,000.

A cap on bankers’ bonuses has been axed also.

The Chancellor unveiled the biggest tax cuts since 1972.

Labour: IMF rebuke shows Govt made ‘a mess’

07:35 , Miriam Burrell

Labour leader Sir Keir Starmer said the IMF rebuke should not be ignored and Kwasi Kwarteng should change course.

He told LBC Radio: “I think the IMF statement is very serious, and it shows just what a mess the Government have made of the economy and it’s self-inflicted.

“This was a step they didn’t have to take. Quite often when the markets are jittery, when the pound falls, it’s because of some international event – conflict in Ukraine, a cost-of-living crisis, energy crisis. This is self-inflicted by the Government.

“We all look at the graph and we see the pound falling, but it’s not an abstract graph. This is reflected in people’s mortgages.

“And people are very, very worried this morning.”

Bank of England responds

07:30 , Miriam Burrell

Bank of England chief economist Huw Pill has warned they “cannot be indifferent” to the developments of the past days – seen as a signal the cost of borrowing will have to go up to protect the pound and keep a lid on inflation.

“It is hard not to draw the conclusion that all this will require significant monetary policy response,” Mr Pill said in a speech to the Barclays-CEPR International Monetary Policy Forum.

“We must be confident in the stability of the UK’s economic framework.”

What the IMF says

07:26 , Miriam Burrell

Good morning.

In case you missed it, the International Monetary Fund (IMF) has urged Chancellor Kwasi Kwarteng to change course with the economic plan.

It said in a statement: “We understand that the sizeable fiscal package announced aims at helping families and businesses deal with the energy shock and at boosting growth via tax cuts and supply measures.

“However, given elevated inflation pressures in many countries, including the UK, we do not recommend large and untargeted fiscal packages at this juncture, as it is important that fiscal policy does not work at cross purposes to monetary policy.

“Furthermore, the nature of the UK measures will likely increase inequality.”

Yahoo Movies

Yahoo Movies