Investors in Confluent (NASDAQ:CFLT) from a year ago are still down 63%, even after 9.5% gain this past week

Even the best stock pickers will make plenty of bad investments. Anyone who held Confluent, Inc. (NASDAQ:CFLT) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 63%. Confluent may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

While the stock has risen 9.5% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Confluent

Confluent isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Confluent grew its revenue by 59% over the last year. That's a strong result which is better than most other loss making companies. In contrast the share price is down 63% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

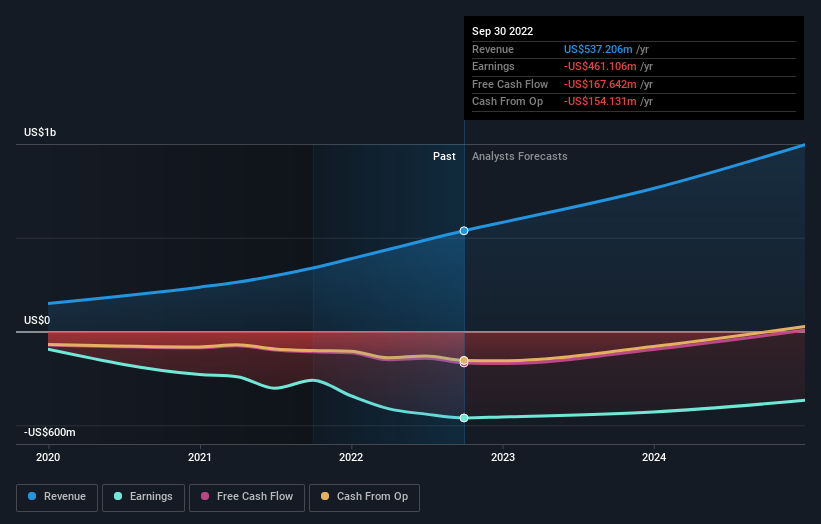

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Confluent is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Confluent will earn in the future (free analyst consensus estimates)

A Different Perspective

Confluent shareholders are down 63% for the year, even worse than the market loss of 7.7%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Confluent , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies