Investor Alert: Canadians Can Buy Amazon Stock for Under $25 Today

Canadian investors who have always wanted to own a stake in billionaire Jeff Bezos’s Amazon.com (NASDAQ:AMZN) but were worried about the hefty US$3,700 (CA$4,655) stock price on the Nasdaq can now buy the American internet retail giant’s shares on a local exchange for under $25.

Investors can buy Amazon stock in Canadian dollars

The NEO Exchange introduced one new and very interesting ticker on Tuesday morning. That ticker is labeled AMZN (Amazon.com CDR (CAD Hedged)). Over 8,000 units had changed hands by midday with settlement within the $22.80-$23.28 price range.

Canadian Imperial Bank of Commerce (CIBC) has introduced more trading convenience to Canadian investors through a currency-hedged Canadian Depository Receipt (CDR) series on Amazon.com common shares.

Canadian Depository Receipts are certificates issued by domestic banks representing shares in foreign-listed companies. The CDR affords investors the opportunity to hold shares in the equity of foreign companies and to trade such shares on local exchanges.

Amazon hasn’t directly listed its common stock in Canada yet, but local investors have the opportunity to buy AMZN stock in Canadian dollars thanks to the NEO Exchange and CIBC’s latest innovation.

Local investors who are concerned about associated foreign currency risks, and those who don’t like incurring foreign currency conversion costs when buying the U.S-listed company’s shares now have a local alternative.

Most noteworthy, the new CDRs allow for fractional share ownership on AMZN. You don’t have to raise over $4,600 to buy just one share in Jeff Bezos’s online retail business anymore. Just $25 can get you into the game, and you can participate in Amazon’s future growth story with a much lower cash outlay.

An e-commerce giant: A growth investor’s dream

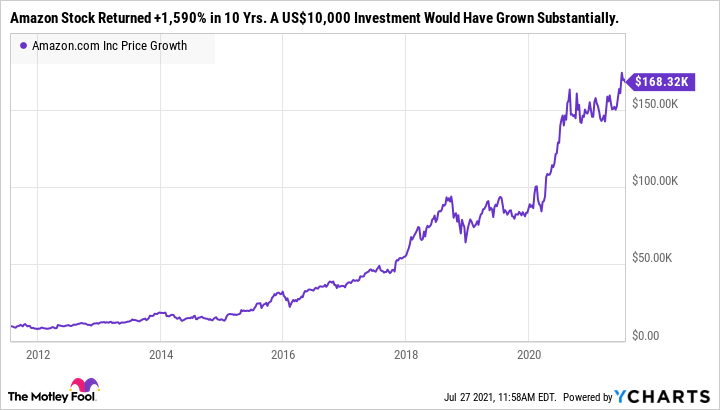

The internet giant has generated over 1,590% in capital gains over the past 10 years. An amount of US$10,000 invested in Amazon stock 10 years ago could have grown into US$169,000 today.

Buy-and-hold investors in Amazon.com stock have made fortunes over the past decade. Source: YCharts

Long-term-focused, buy-and-hold investors who worry about exchange rate risks could like this detail. CIBC edges AMZN CDRs against exchange rate risks. Currency risks arise due to unpredictable fluctuations between the USD and the CAD exchange rate.

That said, currency exposures add a layer of returns when the exchange rate moves in one’s favour. A Canadian needed under $0.95 to buy US$1 in mid-2011. And they needed under $9,500 to buy US$10,000 worth of Amazon stock. Fast forward to July 2021, that US$10,000 investment is worth over $212,900, thanks to foreign currency gains.

If the Canadian dollar were to weaken against the United States dollar over the next 10 years, investors who buy Amazon stock CDRs in Canada today will miss an added layer of returns from foreign exchange exposure.

Foolish bottom line

The NEO Exchange has brought a welcome innovation to the Canadian stock market. CIBC’s introduction of a foreign currency-hedged CDR on a much-loved U.S.-listed global e-commerce giant brings trading convenience and added investment options to Canadian retail investors. Fellow Fools will like that.

If you wished to avoid currency risks while buying Amazon stock, you have added convenience today. That said, currency exposure could add a layer of potential returns in the long term.

The post Investor Alert: Canadians Can Buy Amazon Stock for Under $25 Today appeared first on The Motley Fool Canada.

The Motley Fool’s First-Ever Cryptocurrency Buy Alert

For the first time ever, The Motley Fool has issued an official BUY alert on a cryptocurrency.

We’ve taken the exact same detailed analysis that we’ve used to find world-beating stocks like Amazon, Netflix, and Shopify to find what we believe will be the ONE cryptocurrency to rise above more than 4,000 cryptocurrencies.

Don’t miss out on what could be a once-in-a-generation investing opportunity.

Click here to get the full story!

More reading

Fool contributor Brian Paradza has no positions in any stocks mentioned. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. The Motley Fool owns shares of and recommends Amazon. The Motley Fool recommends the following options: long January 2022 $1,920 calls on Amazon and short January 2022 $1,940 calls on Amazon.

2021

Yahoo Movies

Yahoo Movies