Here's Why We Think Magyar Bancorp (NASDAQ:MGYR) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Magyar Bancorp (NASDAQ:MGYR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Magyar Bancorp

Magyar Bancorp's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Magyar Bancorp has managed to grow EPS by 34% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

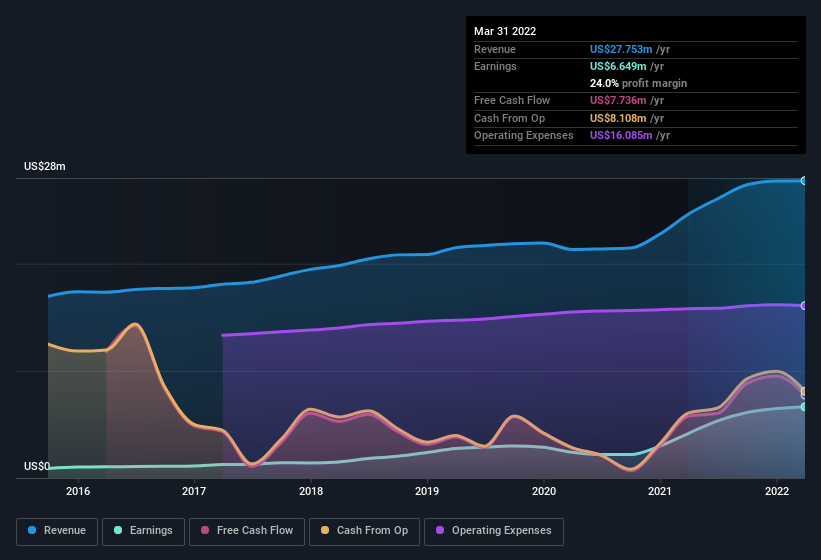

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Magyar Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Magyar Bancorp maintained stable EBIT margins over the last year, all while growing revenue 13% to US$28m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Magyar Bancorp is no giant, with a market capitalisation of US$84m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Magyar Bancorp Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in Magyar Bancorp in the previous 12 months. Add in the fact that Peter Brown, the Senior VP & Chief Lending Officer of the company, paid US$21k for shares at around US$10.00 each. It seems that at least one insider is prepared to show the market there is potential within Magyar Bancorp.

Is Magyar Bancorp Worth Keeping An Eye On?

You can't deny that Magyar Bancorp has grown its earnings per share at a very impressive rate. That's attractive. Not only is that growth rate rather juicy, but the insider buying adds fuel to the fire. So on this analysis, Magyar Bancorp is probably worth spending some time on. We should say that we've discovered 1 warning sign for Magyar Bancorp that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Magyar Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies