Here's Why We Think LaserBond (ASX:LBL) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like LaserBond (ASX:LBL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for LaserBond

LaserBond's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. It's good to see that LaserBond's EPS has grown from AU$0.03 to AU$0.033 over twelve months. This amounts to a 12% gain; a figure that shareholders will be pleased to see.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of LaserBond shareholders is that EBIT margins have grown from 11% to 17% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

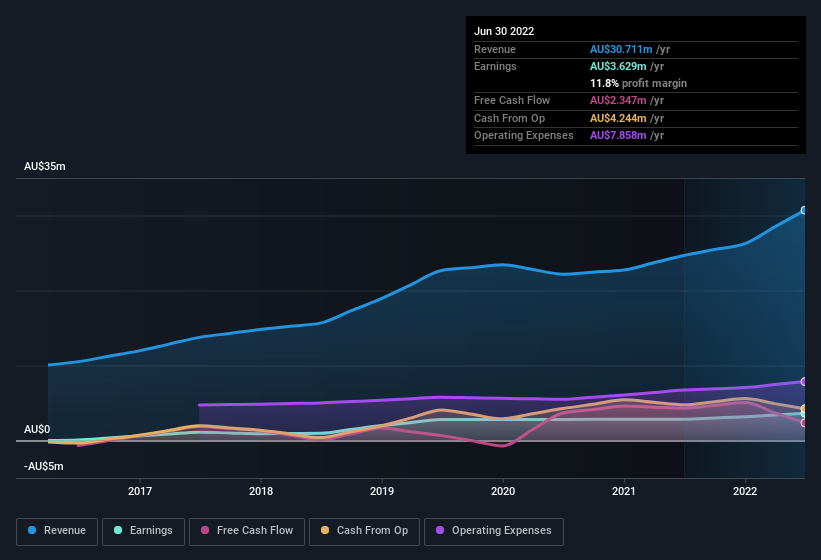

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

LaserBond isn't a huge company, given its market capitalisation of AU$92m. That makes it extra important to check on its balance sheet strength.

Are LaserBond Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in LaserBond in the previous 12 months. So it's definitely nice that Non-Executive Director Ian Neal bought AU$20k worth of shares at an average price of around AU$0.80. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for LaserBond will reveal that insiders own a significant piece of the pie. Actually, with 39% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at AU$36m at the current share price. So there's plenty there to keep them focused!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Wayne Hooper is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations under AU$289m, like LaserBond, the median CEO pay is around AU$422k.

LaserBond's CEO took home a total compensation package worth AU$343k in the year leading up to June 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does LaserBond Deserve A Spot On Your Watchlist?

One important encouraging feature of LaserBond is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Still, you should learn about the 1 warning sign we've spotted with LaserBond.

The good news is that LaserBond is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies