Here's Why I Think Great-West Lifeco (TSE:GWO) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Great-West Lifeco (TSE:GWO). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Great-West Lifeco

How Fast Is Great-West Lifeco Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Great-West Lifeco has grown EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

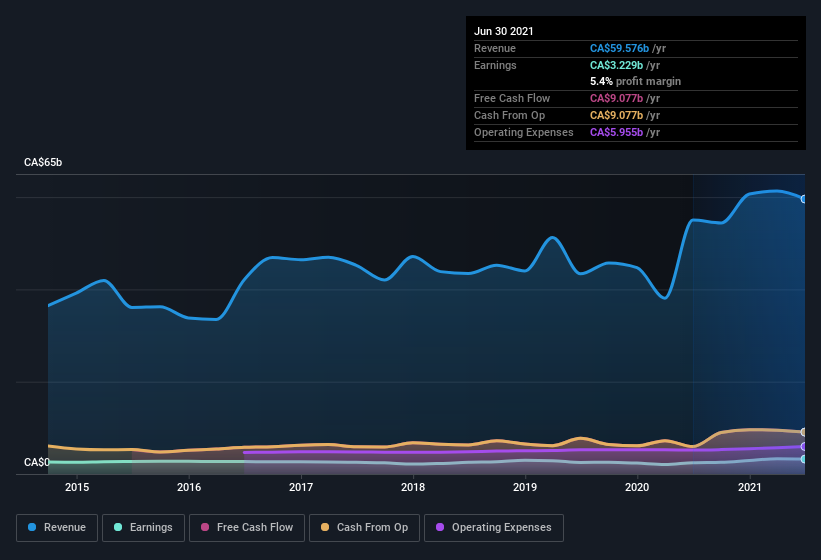

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Great-West Lifeco's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Great-West Lifeco maintained stable EBIT margins over the last year, all while growing revenue 8.3% to CA$60b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Great-West Lifeco's forecast profits?

Are Great-West Lifeco Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth -CA$2.8m) this was overshadowed by a mountain of buying, totalling CA$3.9m in just one year. This makes me even more interested in Great-West Lifeco because it suggests that those who understand the company best, are optimistic. We also note that it was the President, Paul Mahon, who made the biggest single acquisition, paying CA$1.8m for shares at about CA$27.16 each.

The good news, alongside the insider buying, for Great-West Lifeco bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold CA$32m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.09% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Great-West Lifeco To Your Watchlist?

One important encouraging feature of Great-West Lifeco is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Great-West Lifeco is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Great-West Lifeco, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies