Here's Why Citius Pharmaceuticals (NASDAQ:CTXR) Must Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Citius Pharmaceuticals (NASDAQ:CTXR) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Citius Pharmaceuticals

Does Citius Pharmaceuticals Have A Long Cash Runway?

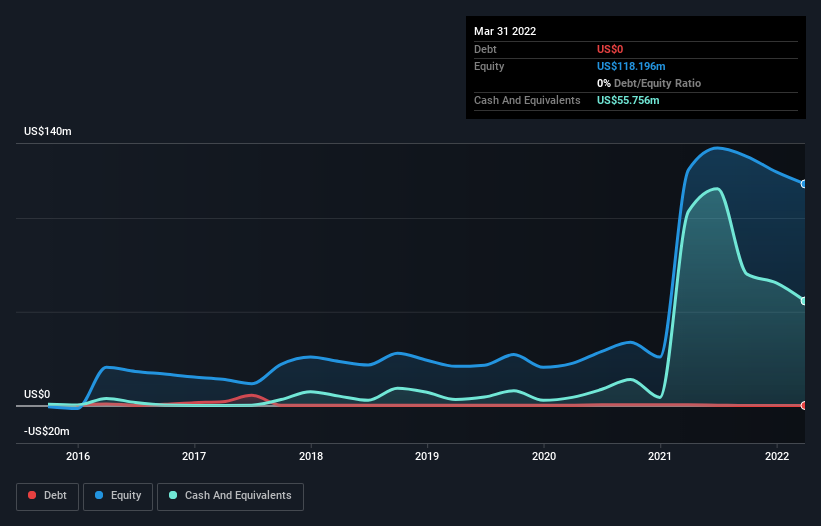

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2022, Citius Pharmaceuticals had cash of US$56m and no debt. In the last year, its cash burn was US$65m. Therefore, from March 2022 it had roughly 10 months of cash runway. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. However, if we extrapolate the company's recent cash burn trend, then it would have a longer cash run way. The image below shows how its cash balance has been changing over the last few years.

How Is Citius Pharmaceuticals' Cash Burn Changing Over Time?

Citius Pharmaceuticals didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Its cash burn positively exploded in the last year, up 206%. With that kind of spending growth its cash runway will shorten quickly, as it simultaneously uses its cash while increasing the burn rate. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Citius Pharmaceuticals Raise More Cash Easily?

Given its cash burn trajectory, Citius Pharmaceuticals shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$151m, Citius Pharmaceuticals' US$65m in cash burn equates to about 43% of its market value. That's high expenditure relative to the value of the entire company, so if it does have to issue shares to fund more growth, that could end up really hurting shareholders returns (through significant dilution).

Is Citius Pharmaceuticals' Cash Burn A Worry?

Citius Pharmaceuticals is not in a great position when it comes to its cash burn situation. While its cash runway wasn't too bad, its increasing cash burn does leave us rather nervous. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for Citius Pharmaceuticals (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies