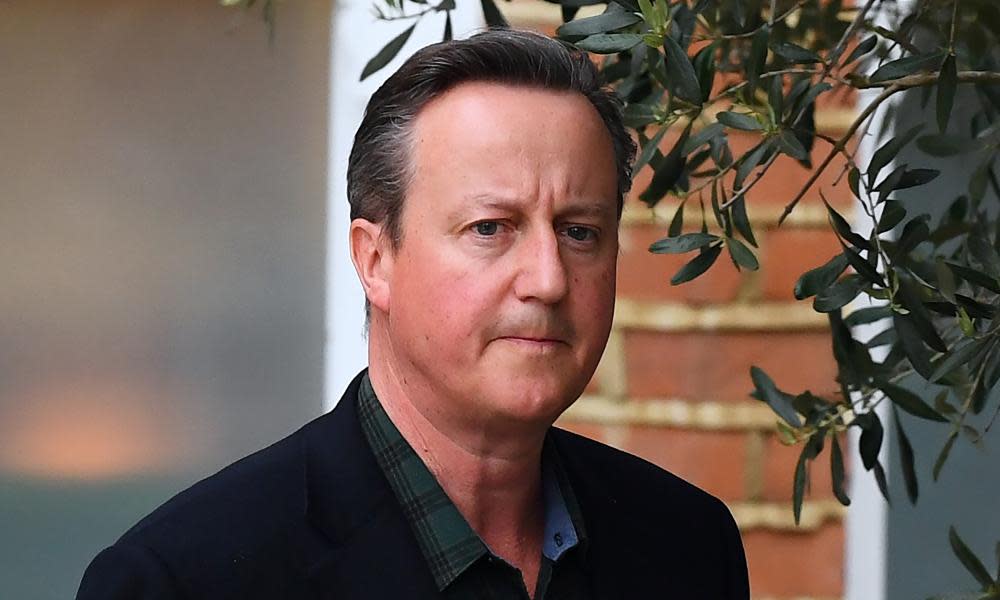

The Guardian view on David Cameron’s lobbying: a cynical defence won’t wash

Last week, David Cameron, Britain’s former Conservative prime minister, claimed rather implausibly that his frantic lobbying of ministers and officials last year on behalf of failed Australian financier Lex Greensill was motivated by public service rather than private gain. Mr Cameron could say this with a straight face because he would not reveal, in four hours of testimony to MPs, his salary or the payout he was in line for had Greensill Capital survived the pandemic.

The sums were likely to have been embarrassingly large. Mr Cameron did cash in some of his shares in 2019. His reported 1% stake in the supply-chain finance company was reckoned at one stage to be worth £60m. Was Mr Cameron only in it for the money? A windfall would have suggested he was.

Mr Cameron left office in 2016 and joined Greensill two years later, walking through the revolving door he had once promised to close. This highlights the sheer inadequacy of the regulation of lobbying by former Whitehall officials and ministers. It is a system where individuals are meant to police themselves. When they do not, the only reprimand appears to be a set of raised eyebrows. This is not good enough.

Both Gordon Brown and Theresa May have engaged in private activities after leaving high office with some sense of propriety. If prime ministers cannot follow their example, then there ought to be a real-time reporting mechanism for their post-prime-ministerial work, especially their contact with the UK government, and their related assets and earnings. It should not take a financial collapse for a former prime minister to be held accountable for their ill-advised actions.

It is startling to hear Mr Cameron suggest there was nothing wrong in using the British state as a piggybank for politically connected financial firms. He wanted the government to pump money into Greensill by buying the bonds it issued. Had it been permitted, the state bailout would have saved the company and sent Mr Cameron on his way, potentially, to pocket millions. Mr Cameron shamelessly claimed that this was in the interest of the UK “supply base”.

Such arguments evaporate upon inspection. Greensill’s business model has been compared with the sub-prime mortgage market. It paid company invoices upfront for a fee. Greensill took a cut for offering a “60- or 90-day” borrowing facility to big firms or government departments. These loans were backed by bonds bought by investors looking for returns in a low-interest world. The most damaging accusation was that Greensill ran a Ponzi-like scheme by issuing loans against invoices from nonexistent customers.

As long as invoices were settled then a profit could be made both for investors and Greensill. However, the pandemic saw cash dry up and left invoices unpaid. On 3 March, the Financial Times reported that Greensill was preparing to file for insolvency in the UK. A year earlier, Mr Cameron began his bombardment with a text to the Treasury’s top official. A cynic, quips a character in one of Oscar Wilde’s plays, is someone who knows the price of everything and the value of nothing. This witty turn of phrase hints at something very wrong today. What l’affaire Greensill shows is that, in business and government, there are too many people in positions of power whom Wilde would have described as cynics. The law needs to be updated to reflect that.

Yahoo Movies

Yahoo Movies