Got $5,000? Here Are the Best Canadian Stocks to Buy This Summer

While 2021 has understandably seen fewer opportunities for investors than 2020, there have still been various options for Canadians this year. It’s not just one industry that’s rallying or producing all the best Canadian stocks to buy either.

This is important, because it means that if you can find a high-quality business trading undervalued, sooner or later, it’s going to rally.

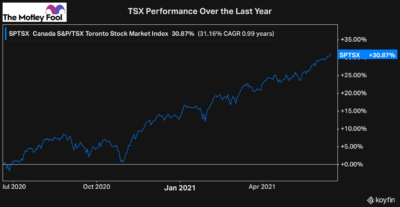

We are nearly halfway through the year, and the TSX is up more than 16% — an impressive rate. Even over the last 12 months, the progress has been impressive, up 30%.

This impressive and generally consistent growth shows what incredible opportunities there are for investors today. A stock index gaining 30% in 12 months is a pretty rare occurrence. This environment is one of the best opportunities to buy high-quality stocks that you can hold for the long term.

So, if you have cash to invest today, here are three of the top Canadian stocks I’d be looking to buy.

A top Canadian recovery stock to buy today

By now, most stocks have recovered from the coronavirus pandemic. However, a few industries continue to struggle. One stock that’s well on its way to recovery but is still trading extremely cheap is Roots (TSX:ROOT).

Roots is an iconic Canadian retailer and fashion brand that has struggled in recent years. The company’s operations were inefficient, so although it’s never really had a problem with its popularity or its sales, Roots has had to work on improving its bottom line.

Then as the stock was in turnaround mode, the pandemic hit, causing it to fall and the business to face more headwinds. Its strong brand and online presence have helped Roots to remain robust, though, and it fared well through the pandemic, especially for a retailer.

As the economy progresses, recovering from the pandemic, and restrictions are slowly being lifted across the country, Roots is offering a tonne of potential. Not only that, but it’s trading considerably cheap at a market cap of less than $150 million.

So, if you’re looking for the best Canadian stocks to buy this summer, I’d strongly consider Roots, and I’d consider it soon.

A long-term tech stock

Tech stocks are always important to own in your portfolio. There generally two types of tech stocks to consider.

The first type is large, established stocks like Shopify or Facebook. These stocks are bigger and safer than smaller, more volatile tech stocks. However, because of their size, their growth is limited. They can still grow rapidly, as they are tech stocks. However, as they get bigger, it gets inherently harder to grow.

The other type of tech stock to own are smaller companies with massive growth potential. There are a few top Canadian stocks to consider like that. One of the best to buy today, though, has to be AcuityAds Holdings.

AcuityAds is an AdTech stock with a tonne of long-term potential. It’s the perfect stock to buy and forget about. At a market cap of just $750 million, it’s extremely cheap. Plus, it’s an analyst favourite, with the average target price of $25 — a more than 100% premium from today’s trading price.

So, if you’re looking for the best Canadian stocks to buy, I’d check out AcuityAds. It has a tonne of prospects for growth, and it’s trading dirt cheap.

A cheap gold stock

Lastly, some of the cheapest stocks to buy today are gold stocks. Gold is always nice to have a small portion of your portfolio allocated to it, which is why I’d consider B2Gold (TSX:BTO)(NYSE:BTG) today.

One thing that investors don’t like about gold is that it doesn’t produce a yield. That’s why owning a top gold stock paying an impressive dividend is worth a buy today.

First off, B2Gold is leveraged to the price of gold. So, you’re buying it extremely cheap, and it has major upside potential. However, you’re also you’re earning an impressive dividend while you wait for that appreciation.

At these dirt-cheap prices, B2Gold yields an impressive 3.7%. Furthermore, it trades at a forward price-to-earnings ratio of just 8.6 times. And the average target price from analysts is roughly $9, which is more than 60% upside from today’s price.

Therefore, B2Gold is easily one of the best Canadian stocks to buy today.

The post Got $5,000? Here Are the Best Canadian Stocks to Buy This Summer appeared first on The Motley Fool Canada.

Looking for even more stocks to consider? Here are five more!

5 Canadian Growth Stocks Under $5

We are giving away a FREE copy of our "5 Small-Cap Canadian Growth Stocks Under $5" report. These are 5 Canadian stocks that we think are screaming buys today.

More reading

Fool contributor Daniel Da Costa owns shares of AcuityAds Holdings Inc and B2Gold Corp. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. The Motley Fool owns shares of and recommends AcuityAds Holdings Inc., Facebook, and Shopify. The Motley Fool recommends the following options: long January 2023 $1,140 calls on Shopify and short January 2023 $1,160 calls on Shopify.

2021

Yahoo Movies

Yahoo Movies