What is the future of privacy blockchain Oasis? | Footprint Analytics

Oasis, a protocol that aims to secure user privacy information, has seen volatile price action in the past month, rising and falling by 183% in just four days.

Aiming to be the first decentralised network with both privacy protection and scalability, the project, which launched in November 2020 has already partnered with Binance and built out a $100 million TVL DEX.

Despite the seemingly promising future, what about all the volatility for the projects’ token, ROSE, and where does Oasis go from here?

Oasis is backed by multiple funds

By dividing smart contracts into a cConsensus Layer and a ParaTime Layer, Oasis allows many compute environments to exist in parallel, which ParaTimes on the Oasis Network can protect the confidentiality of data using confidential computing technologies such as secure enclaves. Oasis also has high scalability and throughput, making it a decent ecosystem for dApps.

The first increase in ROSE’s price (to $0.40) was caused by the launch of a $160 million ecosystem fund by Oasis in conjunction with its partners on November 17. The fund aims to help founders and existing projects build on Oasis and DeFi, NFT, metaverse and privacy apps.

ROSE’s price once again surpassed $0.60 thanks to its $40 million backing from Binance Labs and the launch of the first DEX, YuzuSwap, on the mainnet.

Footprint Analytics – ROSE Token Price

Due to the high incidence of theft or attacks in cryptocurrency, exchanges needed a platform to identify and ban bad actors. Binance partnered with Oasis to develop CryptoSafe, which allows exchanges to share threat intelligence data and keep it confidential even while exchanging data.

Oasis’ first DEX goes live, TVL tops $100 million in one day

According to Footprint Analytics, Oasis’ TVL comes primarily from YuzuSwap, which accounts for 93%.

YuzuSwap surpassed $100 million in TVL a day after it went live, making ROSE skyrocket.

Footprint Analytics – Oasis Market Share of Protocol TVL

YuzuSwap is built using Oasis’ Emerald, an ecosystem that is fully compatible with EVM. Emerald is a Layer 1 decentralised blockchain network that is uniquely scalable and versatile with a privacy-centric core.

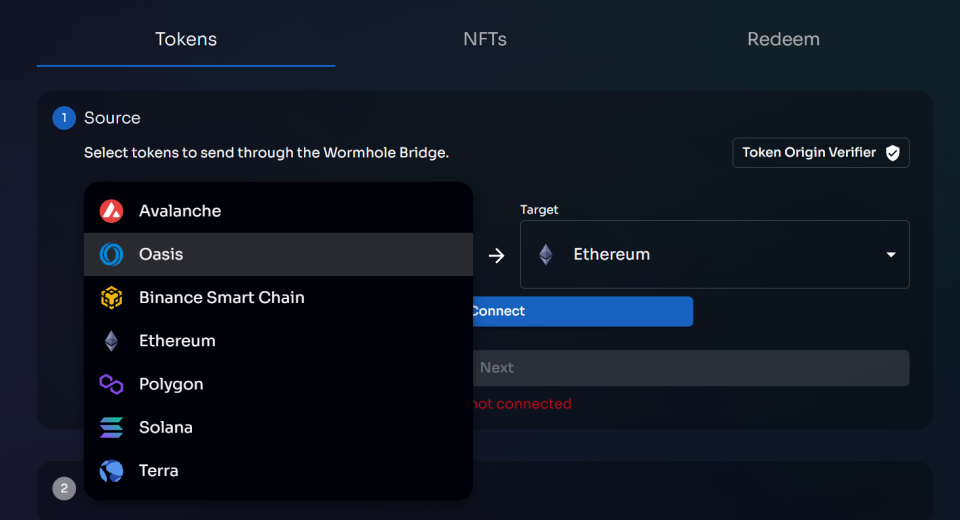

YuzuSwap uses a peer-to-peer automated-market-maker model to provide users with low-cost trading (99%+ lower fees than Ethereum) within the Ethereum and Oasis ecosystems. It also supports trading of token and NFTs assets through Oasis and other blockchains.

Screenshot Source – wormholebridge

Currently in beta, YuzuSwap’s rapid growth in value can be attributed to the high annual returns that users can earn by mining, which can earn high returns ranging from about 800% on four incentive token pairs.

However, YuzuSwap’s TVL growth has not lasted long, falling back down since January 17 to $67.53 million.

Oasis launches first NFT project

The increase in the price of ROSE is also linked to the launch of Oasis’ AI Rose NFT. On November 9, Oasis’ project to create a Web 3.0 privacy identity, MetaMirror, was announced, enabling secure data management and privacy protection through integration with Oasis Parcel ParaTime.

The Oasis AI Rose NFT series consists of 999 AI-generated rose images, and to further engage with the community and demonstrate the network’s NFT capabilities, NFTs are officially being given away for free to users.

Screenshot Source – metamirror (AI ROSE NFT)

The AI Rose NFT has a total quantity of only 999 pieces, with a low of $7,700 and a high of $99,999,999. According to official statistics, the current volume has reached $1,852,000.

Summary

The momentum that has driven Oasis in the short term has been influenced by three main factors.

Oasis’ ecosystem fund has received support from multiple sources, totalling up to $200 million in the past six months

YuzuSwap, the first decentralized exchange on the Oasis mainnet, launched successfully

Oasis introduced its first NFT collection

At the same time, Oasis is growing rapidly because of its privacy protection, high capabilities technology and gas fees that are more than 99% lower than Ethereum’s.

With so much positivity, what caused the swings in ROSE’s price?

Oasis has been online for more than a year yet has failed to scale up development. Compared with Terra and Solana, it has introduced many head protocols and is currently one of the top 10 blockchains on the whole network.

YuzuSwap is still in beta and its features are not yet stable. Its development is one of the most important things for Oasis’ growth.

Oasis has been online for more than a year, but the ecosystem has not grown very fast, and the recent growth of YuzuSwap TVL and Oasis Token ROSE has only attracted attention.

Therefore, in order for more projects and users to gain trust, Oasis needs to introduce some head protocols to enrich the ecosystem, and YuzuSwap, which accounts for the largest share, to be truly stable before Oasis can maximise its innovative technical features.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

Youtube: https://www.youtube.com/channel/UCKwZbKyuhWveetGhZcNtSTg

Yahoo Movies

Yahoo Movies