Further weakness as Domo (NASDAQ:DOMO) drops 9.9% this week, taking one-year losses to 65%

Even the best stock pickers will make plenty of bad investments. And unfortunately for Domo, Inc. (NASDAQ:DOMO) shareholders, the stock is a lot lower today than it was a year ago. To wit the share price is down 65% in that time. At least the damage isn't so bad if you look at the last three years, since the stock is down 1.8% in that time. The falls have accelerated recently, with the share price down 47% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

With the stock having lost 9.9% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Domo

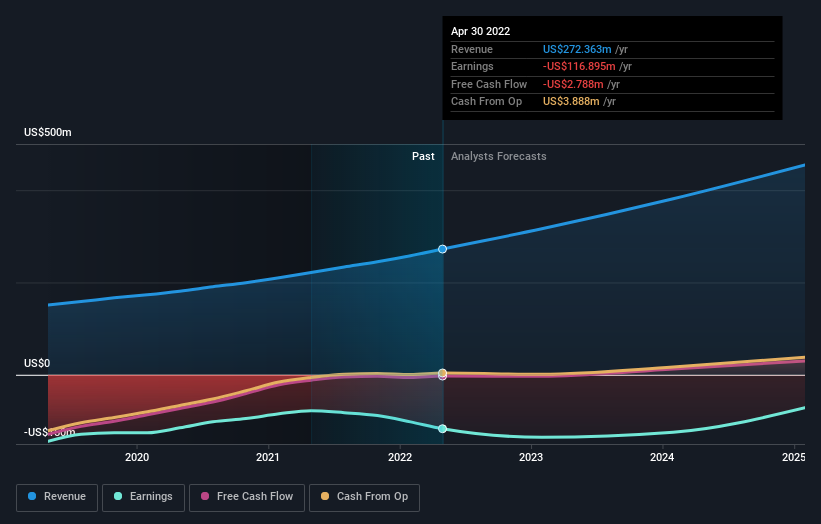

Because Domo made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Domo increased its revenue by 23%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 65% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Domo's financial health with this free report on its balance sheet.

A Different Perspective

Domo shareholders are down 65% for the year, falling short of the market return. The market shed around 21%, no doubt weighing on the stock price. Shareholders have lost 0.6% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for Domo (1 is potentially serious!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies