Blow for Germany as Rhine falls below critical water level

Western sanctions have ‘limited impact’ on Putin regime, warns International Energy Agency

GDP fell by 0.1pc in second quarter, first decline since early 2021

FTSE 100 adds 0.5pc

Ambrose Evans-Pritchard: The next PM should not be bounced into stupid energy policies by this mood of near hysteria

Germany has been dealt a fresh economic blow after the Rhine River dropped below a critical level, halting the transit of large amounts of river traffic.

The Rhine River fell to a new low on Friday, further hindering the supply of vital commodities to parts of inland Europe as the continent battles with its worst energy crisis in decades. 400,000 barrels a day of oil products are transported down the river, which stretches from the Amsterdam-Rotterdam-Antwerp region through Germany to Switzerland.

The water level at Kaub – a key waypoint west of Frankfurt – dropped below the critical 40 centimetres and is expected to continue dwindling over the coming days, according to German government data.

The 40-centimetre marker means it is not economical for many barges to transit the river.

Shallow water prevents barges from loading their full volumes. Low water occasionally affects traffic on the Rhine, but this year it has reached a level not seen since 1993.

By early Tuesday, the marker at the waypoint is expected to fall to 34 centimetres. The level is a measure of navigability, not the actual depth of the river.

The Rhine is a key shipping route for Europe, which is currently struggling to secure energy supplies following Russia’s war in Ukraine.

In Germany, companies have been taking steps to prepare. Chemical maker BASF is using more rail to transport goods and has ordered shallow-water barges. While there is no impact currently, the company has said it cannot rule out a reduction in production rates for some plants in the coming weeks.

Utility Uniper said on Thursday it will not be able to bring enough coal by train to run its plants at full capacity for a longer period of time. It previously warned of production cuts at its Staudinger-5 plant until September due to a lack of coal.

Steelmaker Thyssenkrupp has said its crisis team is meeting daily, and it is using ships with lower drafts to keep its mill in the town of Duisburg supplied.

06:21 PM

Wrapping up

That's all from us this week, we shall see you on Monday! Before you go, check out the latest stories from our reporters:

Tory leadership battle threatens broadband upgrades with £1bn tax bill

Salt Bae’s London restaurant makes £4.6m profit in three months

Britain cuts out Putin as Russian energy imports drop to zero

Meditation app Calm cuts 20pc of staff as Covid mental health boom cools

British EDF customers pay twice as much as French for energy

06:08 PM

Peloton to cut nearly 800 jobs as part of turnaround plans

Peloton has announced turnaround plans that involve cutting hundreds of jobs and raising prices for its equipment as it battles to stay relevant after the pandemic.

The luxury fitness company is cutting 784 roles across its distribution and customer service teams, as well as shuttering 16 warehouses across North America.

It plans to stop using in-house workers and vans to deliver equipment but instead rely on third-party logistics providers.

The customer support team, which is mainly located in Arizona and Texas, will be halved and replaced with outsourced staff too.

05:42 PM

FTSE 100 ends fourth consecutive week of gains

The FTSE 100 has logged its fourth consecutive week of gains, as global sentiment got a boost from signs of waning US inflation even as domestic data showed Britain's economy contracted in the second quarter.

The blue-chip index ended 0.5pc higher at a two-month high. The index has outperformed its global peers this year, aided by weakness in sterling and its large exposure to energy and defensive companies.

James Smith, economist at ING, said: "The fall in UK GDP during the second quarter was largely down to noise.

"But the risk of recession is rising quickly, with gas futures hitting new highs for next winter and our latest estimates suggesting the household energy price cap could come close to £5,000 in the second quarter of next year. Much now depends on fiscal policy announcements in the autumn."

05:22 PM

Europe in talks to replace Russian rockets with Elon Musk's SpaceX

The European Space Agency (ESA) is in talks with Elon Musk’s SpaceX to take on launches for Brussels after the West was blocked from using Russia’s Soyuz rockets. Matthew Field has the story:

The US rival to France’s Arianespace is in technical discussions with the bloc’s space authority to provide capacity for upcoming missions.

The EU had been planning to use French-built Ariane 6 rockets for future space flights, but these have been repeatedly delayed, prompting talks with rivals to provide a stopgap.

Josef Aschbacher, ESA director general, told Reuters that SpaceX, India and Japan were in the frame to provide launch services.

He said: “One is SpaceX, that is clear, another one is possibly Japan. Japan is waiting for the inaugural flight of its next generation rocket. Another option could be India.”

05:00 PM

Five Chinese state-owned companies to delist from NYSE amid tensions

Five Chinese state-owned companies, including oil giant Sinopec and China Life Insurance, have announced plans to delist from the New York Stock Exchange, amid economic and diplomatic tensions with the US.

The companies, which also include Aluminium Corporation of China (Chalco), PetroChina and Sinopec Shanghai Petrochemical Co, each said that they would apply to delist their American Depository Shares this month.

The five, which in May were flagged by the US securities regulator as failing to meet its auditing standards, will keep their listings in Hong Kong and mainland Chinese markets.

Beijing and Washington are in talks to resolve a long-running audit dispute that could see Chinese companies banned from US exchanges if they do not comply with US rules.

04:37 PM

Spain, Portugal welcome Germany's call for Europe gas link

Spain and Portugal backed Germany's call for a gas pipeline linking the Iberian peninsula with central Europe today, with Madrid saying its part of the connection could be "operational" within months.

The proposal came as Europe struggles to find ways to rapidly reduce its energy dependence on Russia following its invasion of Ukraine, which has upended the power market, sending prices soaring and nations scrambling for supplies.

On Thursday, German Chancellor Olaf Scholz said a pipeline running through Portugal, Spain and France to central Europe was "conspicuously absent" and if it existed, it could make "a massive contribution" to easing the supply crisis.

Spain currently has six liquefied natural gas (LNG) terminals for processing gas that arrives by sea which could help the EU boost imports, but only has two, low-capacity links to France's gas network, which has connections to the rest of Europe.

04:01 PM

Meditation app Calm cuts 20pc of staff as Covid mental health boom cools

A meditation app founded by a British entrepreneur has slashed 20pc of jobs as the Covid-fuelled boom for mental health technologies cools. Matthew Field writes:

Mindfulness app Calm, founded by Michael Acton Smith, will cut 90 jobs amid a wider tech downturn.

San Francisco-headquartered Calm developed an app that claims to reduce stress and improve sleep through meditation exercises. It has signed up celebrities including Matthew McConaughey, Cillian Murphy and LeBron James to voice its audio guides. Users pay £28.99 per year to use its tools.

03:42 PM

London-listed HydrogenOne invests in Dutch pipeline company

Investment fund HydrogenOne has invested £8.4m in a Dutch hydrogen company, alongside some of the world's biggest companies.

The investment is part of a £12m funding round which means it will join Shell Ventures and Chevron Technology Ventures as investors in Strohm.

The business focuses on building pipelines that can pump hydrogen from offshore wind farms, where it has been made using clean energy, to the shore. Hydrogen is touted by many as a clean-burning fuel. However, critics say that burning it still releases harmful emissions - just not carbon - and when it leaks into the atmosphere the gas can contribute to climate change.

03:21 PM

Post Office workers to take industrial action too

In more news from the CWU, workers at the Post Office will take their fourth round of industrial action on August 26, to coincide with a walkout by some staff at Royal Mail on the same day.

It said around 2,000 workers including those in supply chain and administrative grades would strike in an "everyone-out" day on August 26 in a dispute over pay, after workers were given no pay rise for 2021/22 and a 3pc offer for 2022/23.

Members in different Post Office functions will then hold further separate 24-hour walkouts, on August 27 and August 30, the union said.

CWU assistant secretary Andy Furey said: “At a time when inflation is almost 12pc, a pay deal worth just 3pc over two years is incredibly insulting – it’s actually a huge pay cut in real terms."

02:59 PM

BT Group and Openreach staff announce more strikes

The Communication Workers Union (CWU) has served notice on BT Group and Openreach that its members would take further strike action on August 30 and 31 in a dispute over pay.

More than 40,000 of BT's staff walked out on July 29 and August 1, the first strike action in 35 years at the telecoms group. The company awarded a £1,500 pound-a-year rise in April, a 5pc increase on average, and has said it won't be reopening its 2022 pay review.

A spokesman for BT said: "We have made the best pay award we could and we are in constant discussions with the CWU to find a way forward from here. In the meantime, we will continue to work to minimise any disruption and keep our customers and the country connected."

02:59 PM

BT Group and Openreach staff announce more strikes

The Communication Workers Union (CWU) has served notice on BT Group and Openreach that its members would take further strike action on August 30 and 31 in a dispute over pay.

More than 40,000 of BT's staff walked out on July 29 and August 1, the first strike action in 35 years at the telecoms group. The company awarded a £1,500 pound-a-year rise in April, a 5pc increase on average, and has said it won't be reopening its 2022 pay review.

A spokesman for BT said: "We have made the best pay award we could and we are in constant discussions with the CWU to find a way forward from here. In the meantime, we will continue to work to minimise any disruption and keep our customers and the country connected."

CWU assistant secretary Andy Furey said: “At a time when inflation is almost 12pc, a pay deal worth just 3pc over two years is incredibly insulting – it’s actually a huge pay cut in real terms."

02:54 PM

Handover

It’s for me to hand over to the one and only Giulia Bottaro, who will steer the blog bravely unto the weekend. Thanks for following along today!

02:38 PM

Rhine hits 40cm

Just in: water levels at Kaub, the crucial waypoint in the Rhine, have fallen to the critical level of 40cm. That will leave the river impassable for many barges, a major blow of businesses that use it for supplies.

02:27 PM

Warning over energy bill stealth charge

Households cutting back on gas and electricity use to save money are being stung by “standing charges” that are applied no matter how much energy they use.

My colleague Tom Haynes reports:

Standing charges – also known as ‘daily unit rates’ – are set by energy companies, and are added to customers’ bills at a flat rate.

Speaking on BBC’s Today programme, Emely Seymour, an energy expert at Which?, said high standing charges were frustrating to households who were being charged despite their attempt to save money through reduced usage.

Standing charges are incorporated into the price cap, set by the energy watchdog Ofgem, which limits the amount providers can charge customers on variable tariffs.

But rates can vary across the country, meaning those living in areas such as the South West, where transporting electricity is more costly, pay more than those who live in areas like London.

Read more: Warning over stealth charge that drives up your energy bill even if you don't use any power

01:50 PM

Schroeder sues to reclaim Bundestag office

Gerhard Schroeder, Germany’s former chancellor, is suing the Bundestag to reclaim he government-funded office and staff – which were taken away after he refused to cut ties with Vladimir Putin.

Bloomberg reports:

Michael Nagel, Schroeder’s lawyer, claimed the decision by lawmakers in the Bundestag to suspend the right to his office lacked any legal basis.

“These kind of decisions, which are reminiscent of a absolutist principality, can’t prevail under the rule of law,” Nagel said in a statement. “The decision is arbitrary.”

Schroeder, a Social Democrat like current Chancellor Olaf Scholz, led a ruling coalition in Berlin from 1998 to 2005. Once out of office, Schroeder’s close ties to Putin and refusal to give up lucrative posts with Russian state-owned energy companies became an embarrassment for his party.

01:31 PM

Wall Street set to open higher

Just about an hour until the US open, and it’s feeling a lot like a Friday in mid-August around here.

Wall Street stocks are set to rise – futures are pointing to gains of about 0.4pc on the benchmark S&P 500.

The gauge is still roughly 12.3pc below its January peak, although UK investors who own US shares will be feeling the pain of that fall somewhat less thanks to the slump in the value of the pound since then.

01:10 PM

European gas set for fourth weekly gain as crisis grows

European natural gas prices – which are at the heart of the energy omnicrisis facing the continent – are set to notch up a fourth week of consecutive gains.

Dutch front-month futures, the European benchmark, have dipped slightly today but are still up on the week.

Countries are scrambling to build gas reserves amid fears Vladimir Putin will turn off the taps this winter.

12:09 PM

Half of England to be moved into drought status

More than half of England are to be moved into drought status, the Department for Environment, Food and Rural Affairs said.

My colleague Emma Gatten reports:

Eight of 14 areas in England will be declared in drought status: Devon and Cornwall, Solent and South Downs, Kent and South London, Herts and North London, East Anglia, Thames, Lincolnshire and Northamptonshire, East Midlands.

Yorkshire and the West Midlands are expected to move into drought later in August.

Read more: Drought declared across half of England

11:24 AM

EU president Czechia floats ban on Russia visas

Czechia, which holds the European Union presidency, has reportedly floated the idea of a blanket ban of visas for Russian citizens as a new escalation in the sanctions war with Moscow.

A statement by Prague’s foreign minister Jan Lipavsky, obtained by AFP, says:

The flat halting of Russian visas by all EU member states could be another very effective sanction.

In a time of Russian aggression, which the Kremlin keeps on escalating, there cannot be talks about common tourism for Russian citizens.

Such a move has also been supported by Finland and Estonia, whose prime minister tweeted earlier this week:

Stop issuing tourist visas to Russians. Visiting #Europe is a privilege, not a human right. Air travel from RU is shut down. It means while Schengen countries issue visas, neighbours to Russia carry the burden (FI, EE, LV – sole access points). Time to end tourism from Russia now

— Kaja Kallas (@kajakallas) August 9, 2022

11:06 AM

Magic truffles face Dutch tax blow

Bit of an offbeat summer tax story: the ‘magic truffles’ sold in some Amsterdam shops, face being slapped with a 21pc value added tax after judges ruled they don’t count as food.

Per Dutch News:

The case was taken to court by a truffle seller who said his products should fall under the 9pc btw rate which covers food. Truffles had fallen under the low rate since they first went on sale in 1997, but in 2019, the tax office said they should be charged at the normal, higher rate.

In the new court ruling, published last week, judges say that the truffles are a stimulant and should therefore fall under the same btw rating as alcohol and tobacco products.

10:57 AM

Pound stumbles despite GDP beat

Sterling’s having a fairly poor day today, despite UK growth coming in stronger than expected.

As ever, it’s probably worth looking to the US side for a reason – this might well be an unwinding of some of the losses the dollars suffered earlier this week as investors pared back bets on Federal Reserve rate increases following softer-than-expected inflation.

10:36 AM

Flutter mulling up to 200 job cuts in UK and Ireland, boss warns

Flutter shares are continuing to soar today following its upbeat earnings, but there is a sting in the tail for employees: boss Peter Jackson says as many as 200 jobs in the UK and Ireland may be cut as it reviews operations.

Some staff could be relocated to more profitable parts of the business, he added, saying the review is expected to conclude by the end of the next month.

10:11 AM

Government plots new relief for energy-intense industries

The Government has launched a consultation looking at way of supporting energy-intensive industries such as steel, paper and cement.

In a statement, the Department for Business, Energy and Industrial Strategy said:

The UK Government is consulting on the option to increase the level of exemption for certain environmental and policy costs from 85pc of costs up to 100pc.

This reflects higher UK industrial electricity prices than those of other countries including in Europe, which could hamper investment, competition and commercial viability for hundreds of businesses in industries including steel, paper, glass, ceramics, and cement, and risk them relocating from the UK.

BEIS said this would help “around 300 businesses supporting 60,000 jobs in the UK’s industrial heartlands”.

Business secretary Kwasi Kwarteng said:

With global energy prices at record highs, it is essential we explore what more we can do to deliver a competitive future for those strategic industries so we can cut production costs and protect jobs across the UK.

10:04 AM

Eurozone factories stronger than expected

Just in: industrial production in the eurozone rose 0.7pc in June, and was stronger than previously thought in May (revised to +2.1pc, versus +0.8pc on an earlier estimate).

It’s an upbeat sign that defies wider worries about a slowdown driven by the energy crisis gripping the continent.

09:57 AM

ICYMI: Truss rules out windfall tax increase

In case you missed our splash today: Liz Truss on Thursday night rejected calls to increase the windfall tax on energy companies to fund cost of living handouts for households, saying profit is not a “dirty word”.

Our lobby team reports:

The Foreign Secretary said she was “absolutely” against such taxes, arguing that such a policy approach would be taken by Labour.

The remarks are her clearest yet on the subject and come despite the Treasury devising an expansion of the windfall tax as an option for the next prime minister.

As a new forecast predicted that annual energy bills could soar to more than £5,000 next April, Ms Truss also said she would lift the ban on fracking.

09:47 AM

Money round-up

Here are some of the day’s top stories from the Telegraph Money team:

Loophole that beats the ‘seven-year rule’ on inheritance tax: Families are using an unusual insurance policy to save thousand.

Smart meter users could be moved to ‘prepayment plans’ if they don’t pay bills:

Campaign to cancel direct debits from October has gathered more than 100,000 supporters.

Where we think inflation will go from here – and what it means for investors: Questor Wealth Preserver: a look at what caused this bout of price rises will help you maintain the real value of your money.

09:21 AM

Flutter flies on upbeat US assessment

Gambling giant Flutter Entertainment is leading FTSE 100 risers today, popping 9pc higher after saying there had been “no discernable” slowdown from customers.

The group – which operates PaddyPower and others – said its US business is also performing better than expected.

That has been welcomed by markets, because America is seen as a key growth area.

Chief executive Peter Jackson said:

We are particularly pleased with momentum in the US where we extended our leadership in online sports betting with FanDuel claiming a 51pc share of the market and number one position in 13 of 15 states, helping contribute to positive earnings

09:05 AM

Rhine likely to fall below critical point today

The Rhine – Germany’s key waterway – is expected to become impassable at a key chokepoint today as a heatwave devastates Europe.

Water levels at Kaub, a particularly shallow point of the river, are likely to fall below 40cm today according to Government data. At that point, many of the barges that use the river will be unable to pass.

As Bloomberg neatly sums it up:

The Rhine is used to ship everything from fuels to chemicals, paper products to grains. The climate crisis on the river couldn’t happen at a worse time, with Europe already in the grips of an energy supply crunch in the wake of Russia’s war in Ukraine. The twin crises have sent costs soaring for businesses, undermining efforts to tame inflation.

08:51 AM

GSK rises after pushback over Zantac claims

Pharma giant GlaxoSmithKline is on the rise today after saying it will vigorously defend claims of a link between Zantac, a heartburn treatment it formerly developed, and cancer.

The FTSE 100 company – which suffered its biggest share price drop since 1998 yesterday amid worries over legal challenges – is up about 2.5pc.

It said the litigation against itself and several others was “inconsistent with the scientific consensus”.

08:34 AM

Russian fuel imports hit zero

One interesting nugget from the ONS, which found overall UK imports from Russia were the lowest on record (back to 1997) – Britain seems to have gone completely cold turkey on Russian fuel:

Imports of fuels, a historically important commodity for trade with Russia, reached £0.0 billion in June 2022.

08:29 AM

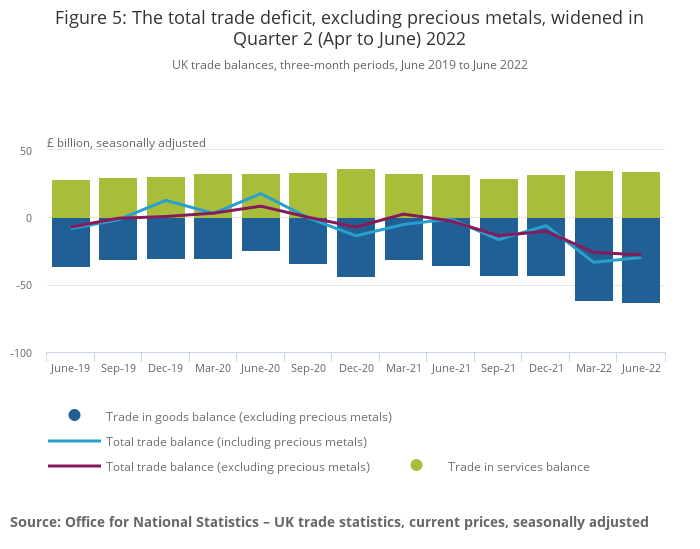

Trade deficit widens to new record amid scramble for fuel

The UK’s trade deficit widened to a record £27.9bn across the second quarter amid a boom in demand for fuel, according to the ONS.

It says:

Total imports increased by £14.3 billion to £206.6 billion, and total exports increased by £12.3 billion to £178.6 billion.

Part of this was due to inflation, statisticians said: adjusted for price risest, the deficit narrowed by £2.4bn to £22.6bn.

Total trade fell 2.1pc, amid a decline in exports:

.@ONS June trade data shows total trade (exports + imports) fell by 2.1% this month, driven by a fall in exports of 8%, largely to outside the EU. Services trade grew, although import growth outpaced exports in June. pic.twitter.com/i4kYcJMg8k

— Sophie Hale (@hale_shale) August 12, 2022

08:12 AM

FTSE 100 rises

It’s been a slightly stronger-than-expected open for the FTSE 100 after those expectation-beating growth figures. The blue-chip index is up about 0.25pc at the moment.

07:58 AM

Niesr: Economy already in recession

The venerable National Institute of Economic and Social Research reckons the UK is already in a recession – standing out somewhat by predicting another fall in output this quarter.

As a reminder, two consecutive quarters of negative growth is the typical definition of a recession.

Stephen Millard, its deputy director for macroeconomic modelling and forecasting, says:

It now looks like the UK economy entered a recession in the second quarter of this year as GDP fell by 0.1 per cent, and we expect output to continue falling over the next three quarters.

07:52 AM

Reaction: Economy holding up ‘better than expected’

Here’s some of the reaction to this morning’s GDP numbers

Ruth Gregory from Capital Economics:

The better-than-expected GDP figures for June suggests that the economy is holding up a little better than we had thought in the face of sky-high inflation. Even so, the GDP figures confirmed that the economy contracted by 0.1pc q/q in Q2 and we have not altered our view that a recession is on the way later this year.

Thomas Pugh from auditor RSM :

The huge rise in energy bills in Q4 is likely to tip the economy into a recession that will last roughly a year and see a peak-to-trough fall in GDP of around 1pc-2pc. The big picture is that the economy could be no larger in 2025 than it was in 2019, before the pandemic.

James Smith from the Resolution Foundation:

While the contraction in June partly reflects the timing of Platinum Jubilee bank holidays, the economy has started a difficult period on a weak footing… The first priority for the new Prime Minister will be to provide further targeted support to low-and-middle income households who will be worst affected by the stagflation that already seems to be taking hold.

07:41 AM

More on that recession…

The Bank of England has predicted that the economy will fall into a recession at the end of 2022, lasting well over a year.

Here’s how its prediction looked – although it already appears to have been too downbeat about the second quarter.

Both Tory leadership candidates have pledged more support for households struggling to pay their bills.

Liz Truss, the frontrunner to take over from Boris Johnson as Prime Minister, has rejected the idea that a recession is inevitable. The foreign secretary has promised immediate tax cuts to boost incomes.

“We can change the outcome and make it more likely the economy grows,” she said last week.

Her rival Rishi Sunak has claimed Ms Truss's "unfunded" tax cuts would pour "fuel on the fire" of inflation, which is expected to hit 13.3pc in October, when the energy price cap is expected to surge.

07:38 AM

Tourism and hotels benefit from fall in cases

The ONS said tourist attractions and hotels benefitted after Covid-19 travel restrictions were lifted at the end of March.

Days out increased, helping to boost the leisure industry, while the Queen’s Platinum Jubilee celebrations drove a surge in sales at mobile food stands and takeaway food shops, even as the extra bank holiday in June dragged down monthly output.

Most analysts expect the economy to bounce back over the summer (July to September), before a surge in energy bills this October drags the economy back into decline.

07:36 AM

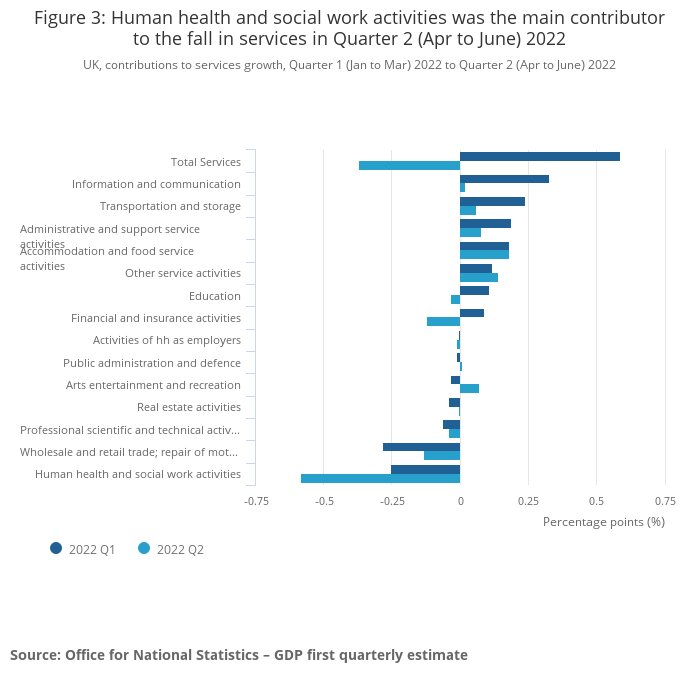

Wind-down of pandemic-era schemes was biggest drag on services

Britain may have been returning to ‘normal’ for much of the second quarter, but cut both ways for growth thanks to the winding up of the Government’s massive pandemic-era health schemes.

Across services, the ONS says “the largest negative contribution from human health and social work activities, reflecting a reduction in coronavirus (COVID-19) activities”.

Overall:

There was a 5.4pc fall in human health and social work activities, reflecting a large reduction in coronavirus activities, such as NHS Test and Trace, COVID-19 vaccination programme and lateral flow orders over the second quarter.

Here’s how that looks in the context of service contributions to growth more widely:

07:32 AM

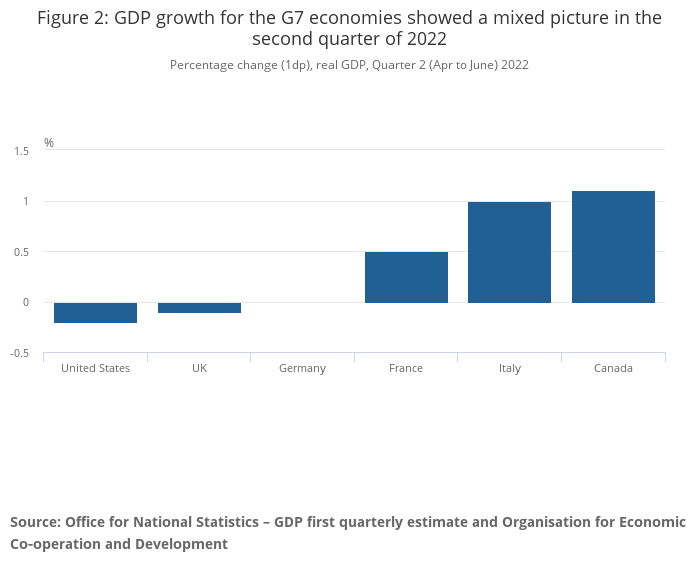

British growth second-worst in G7

Here’s that 0.1pc decline in the context of other G7 countries. As you can see, the UK has found itself near the bottom of the pack, with only the US (which has entered a technical recession) performing worse.

07:28 AM

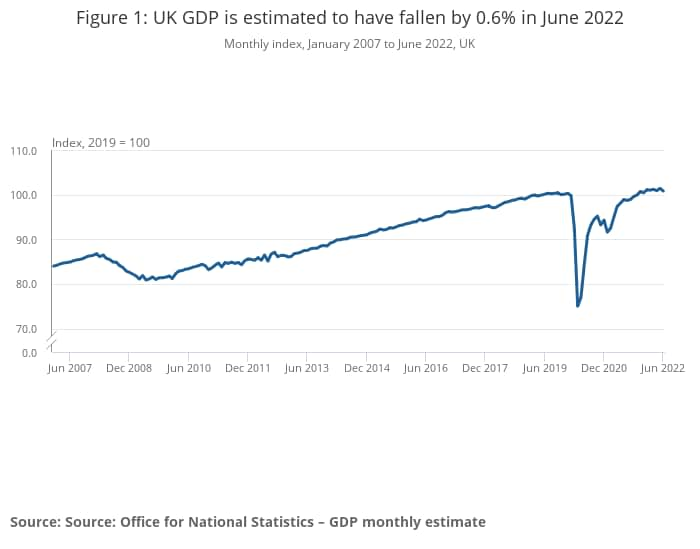

Economy still bigger than before pandemic

Despite the overall quarterly fall, and the 0.6pc June decline, the UK economy is still 0.9pc bigger than before the pandemic (i.e. February 2020) on a monthly basis, per the ONS:

07:23 AM

Hard to price in Jubilee impact

The Queen’s Platinum Jubilee celebration certainly had an impact on growth in June, says the ONS, although on first read it seems statisticians struggled to put an exact number on it.

They say:

The Platinum Jubilee, and the move of the May bank holiday, led to an additional working day in May 2022 and two fewer working days in June 2022. This should be considered when interpreting the seasonally adjusted movements involving May and June 2022.

One area where the festivities appear to have caused a clear boost is eating out: estimates from booking service OpenTable show a 23pc increase in seated restaurant diners during the week containing the Jubilee bank holidays.

In the broad though, it was pretty muted. The ONS says “there was little impact on the quarterly estimates” from the celebration.

07:16 AM

‘Too early’ to call recession

Yael Selfin, chief economist at KPMG UK, says it is “too early” to call a recession. She adds:

Temporary factors such as an extra bank holiday and the phasing out of the Test & Trace scheme were behind the fall in GDP in Q2. While we see increasing signs of underlying weakness in the economy, we expect a more severe downturn to take place only from towards the end of this year.

07:15 AM

Zahawi: We can pull through

Here’s Chancellor Nadhim Zahawi’s response to those figures:

Our economy showed incredible resilience following the pandemic and I am confident we can pull through these global challenges again.

I know that times are tough and people will be concerned about rising prices and slowing growth, and that’s why I’m determined to work with the Bank of England to get inflation under control and grow the economy.

07:14 AM

Snap take: First quarterly contraction since early 2021

Britain’s economy shrank by 0.1pc between April and June amid the worst inflationary crisis in decades.

GDP fell on a quarterly basis for the first time since the start of last year, amid a 0.6pc output fall in June alone.

That marked the worst monthly drop since January 2021, when the country was in a stringent winter lockdown.

The economy is expected to grow during the current quarter, before slumping into a recession later this year as rocketing prices crush activity and demand.

Darren Morgan, the ONS’s director of economic statistics, said:

Health was the biggest reason the economy contracted as both the test and trace and vaccine programs were wound down, while many retailers also had a tough quarter. These were partially offset by growth in hotels, bars, hairdressers and outdoor events.

07:05 AM

Decline across all major sectors

All sectors suffered a decline in output during June, although manufacturing came out of the quarter looking unscathed despite soaring prices.

In June, GDP fell 0.6%:

▪ services fell 0.5%

▪ manufacturing fell 1.6%

▪ construction fell 1.4%https://t.co/1Dkgjajjnl pic.twitter.com/kmc15JAeE0— Office for National Statistics (ONS) (@ONS) August 12, 2022

07:03 AM

Slowdown less sharp than feared

Both today’s headline numbers came in softer than economists had feared:

Q2 GDP: -0.1 (expectation: -0.2pc)

June GDP: -0.6 (exp.: -1.2pc)

07:02 AM

Breaking: Economy suffers quarterly contraction

Just in: The UK economy shrank by the slimmest of margins during the second quarter, with GDP falling by 0.1pc after a 0.6pc decline in June.

06:57 AM

Agenda: Britain braced for contraction

Good morning. It’s all about growth this morning, as we get June figures for GDP that will complete numbers for the second quarter.

National output is expected to have taken a 1.2pc knock in June, down in part to the Platinum Jubilee celebrations. Across the quarter, that’s expected to result in a 0.2pc fall.

Elsewhere, the FTSE 100 is on course for a flat day, after falling yesterday despite wider optimism about calming inflation.

5 things to start your day

1) British EDF customers pay twice as much as French for energy Macron's price cap on state-owned supplier shields households from soaring costs

2) Hong Kong suffers record fall in population as people flee zero-Covid curbs The city lost 113,200 residents in the year to June

3) Breaking up HSBC would unlock up to £29bn payday, says Chinese shareholder Insurer accuses lender of ‘exaggerating’ challenge of spinning off its Asian business

4) Heathrow sale revives hopes of a third runway under new Prime Minister But whoever enters Number 10 still faces environmental hurdles and a sector in flux

5) Mark Zuckerberg branded 'creepy' by Facebook's own chatbot Social media company 'exploits people for money', artificial intelligence program warns

What happened overnight

Asian markets mostly fell on Friday, winding back some of the previous day's rally, as traders come to terms with the likelihood that central banks will continue to raise interest rates to battle runaway inflation.

Asia struggled to maintain momentum, with Hong Kong, Shanghai, Sydney, Seoul, Singapore, Manila, Jakarta and Wellington all slightly lower.

Tokyo, however, jumped more than 2pc and investors there returned from a one-day break to play catch-up with Thursday's bounce. Taipei also rose.

Coming up today

Corporate: 888 Holdings, Flutter Entertainment, TBC Bank Group (interims)

Economics: GDP (UK), industrial production (UK, EU), manufacturing production (UK), Michigan consumer sentiment index (US)

Yahoo Movies

Yahoo Movies